Since Myanmar’s military seized power on Monday, detaining the country’s de facto leader Aung San Suu Kyi and numerous other top government figures, there are now concerns regarding the state of trade between China and the South-east Asian state.

Earlier this month, China’s Foreign Minister Wang Yi visited Myanmar, and was welcomed by Aung San Suu Kyi. The two countries agreed to push ahead with a major transportation project and a five-year trade and economic pact.

Beijing is currently taking a neutral stance regarding the current crisis. “We hope that all parties will properly handle their differences under the constitution and legal framework to maintain political and social stability,” Chinese ministry spokesman Wang Wenbin said.

Read more: Yuan expected to climb to 6.51 in 2021

China, the second largest investor in Myanmar, has strategic financial stakes in its natural resources such as oil, gas, and metals. And Myanmar has been one of China’s most important rare earth importers in recent years by supplying it ion-adsorption clays, the primary source for mid and heavy rare earth elements.

Mid and heavy rare earths are especially crucial to modern defence technologies such as radar, sonar systems, and precision-guided weapons. China currently dominates the global supply of mid and heavy rare earth elements.

Other than having high mid and heavy rare earth content, the ion-adsorption clays are relatively inexpensive to process. The rare earth elements are attached to the clay surface as ions, and can be easily extracted by ammonium sulphate through a process called “ion-exchange” without using harsh acids.

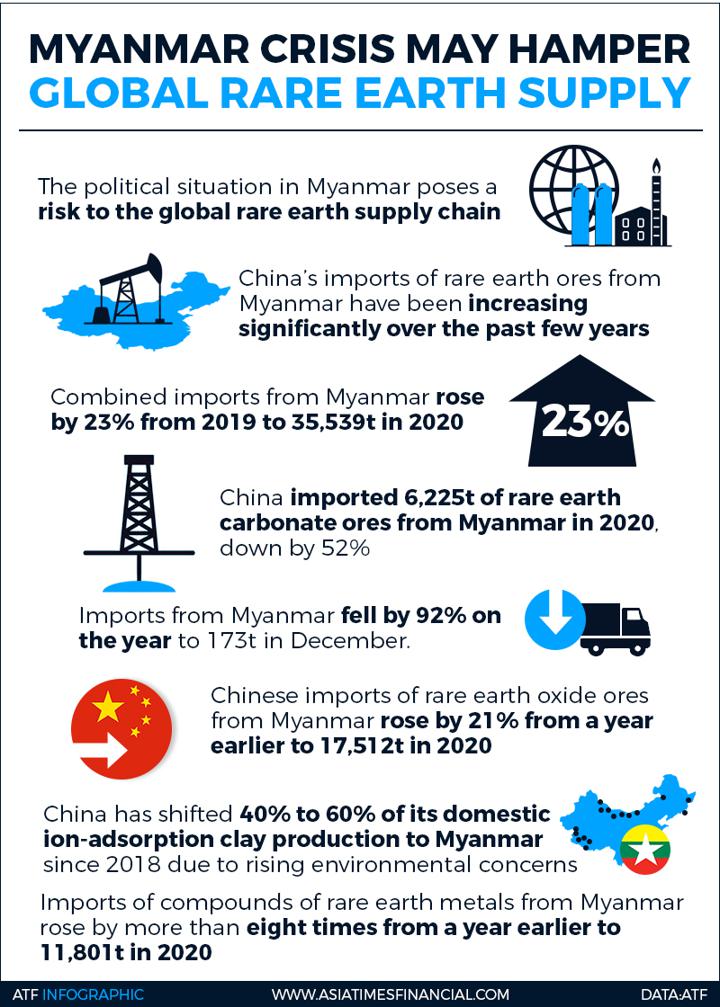

However, this process leaves large quantities of ammonium in the water systems near the production sites causing environmental damage. China has shifted an equivalent of 40% to 60% of its domestic ion-adsorption clay production to Myanmar since 2018 due to those rising environmental concerns.

SAFETY CONCERNS

Local conflicts have interfered with rare earth mining activities in Myanmar in the past. China’s rare earth imports from Myanmar in 2019 were halted twice over the safety concerns of Chinese labourers, according to Sohu.

The rare earth mines are concentrated in the northern regions controlled predominantly by the local militia groups, and there are disputes over mine profits with the Myanmar Armed Forces.

However, neither previous suspensions nor the disturbance caused by the Covid-19 pandemic have stopped the imports entirely. China imports three derivatives of the ion-adsorption clays from Myanmar – mixed rare earth carbonates (RE-carbonates), rare earth oxides (RE-oxides) and compounds of rare earth metals.

In 2020, China’s total RE carbonate imports from all sources fell by 44% year-over-year. While the annual mixed RE-carbonate imports from Myanmar decreased to 6,225 tons in 2020, a 52% reduction year-over-year, it still accounted for 71% of total China’s RE carbonate in 2020.

INCREASED IMPORTS

Although the monthly imported RE-oxides have yet to be resumed to the pre-pandemic level, Myanmar’s RE-oxides still rose by 21% year-over-year to 17512.6 tons in 2020, 99% of China’s total REO imports, according to mymetals.net. Imports of compounds of rare earth metals from Myanmar also increased more than eightfold to 11,801 tons in 2020.

According to Argus, China’s imports of rare earth materials are currently unaffected by the on-going political crisis. Reports from China backed this statement by affirming the mines are under stable control by local militia groups and are not in conflict with the Myanmar Armed Forces at present.

However, there are alerts over potential future disturbances as events unfold. Many also pointed out that if political destabilisation worsens, it would erode Chinese investors’ sentiment to lean on the rare earth production in Myanmar over the long run.

- Xiaojing Yang is a PhD candidate from Penn State University in Energy and Mineral engineering. She specialises in rare earth processing from major and secondary resources.