News that two online brokerages will remove apps in mainland China sparked a heavy selloff in their shares in New York.

Futu Holdings and UP Fintech Holding made the move because of Beijing’s intense focus on data security and capital outflows.

Chinese regulators had warned the two firms as early as 2021 that online brokerages not licensed in China were acting illegally if they served Chinese clients via the internet.

Futu’s Nasdaq-listed shares slumped 7.5% in early market trading on Tuesday, while UP Fintech dropped nearly 9% after the announcements, recouping some premarket losses.

Both stocks have been under pressure in the last couple of years over regulatory concerns.

ALSO SEE:

China’s Top Financial Data Provider, Wind, Cuts Foreign Access

China focus on data security

The removal of the apps is the latest in a series of actions Beijing has taken in the last couple of years to crack down on a wide range of sectors, and data or information security has emerged as a key concern for authorities.

In the last two months, China clamped down on consultancy and due diligence firms that thrived by providing investors access to industry experts and investigators who could obtain valuable corporate information.

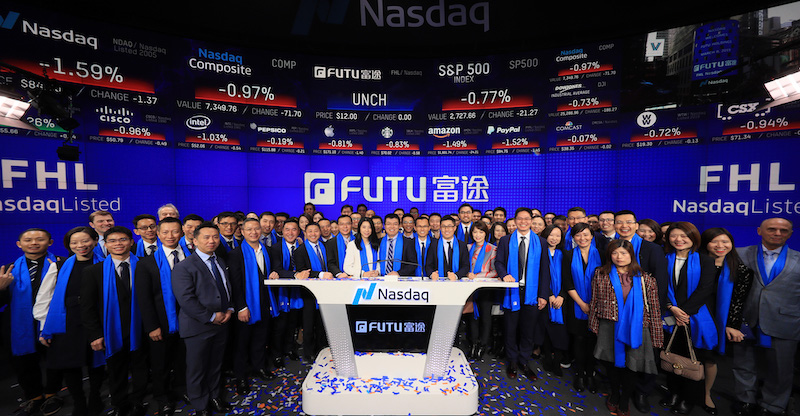

Futu, backed by Chinese internet giant Tencent Holdings, said on Tuesday its apps would be removed from app stores in China from Friday May 19, while UP Fintech, also known as Tiger Brokers, would do the same with effect from Thursday May 18.

Both firms said their existing clients in mainland China would not be affected by the removal of apps.

The removal of Futu and UP Fintech apps would bar a large number of potential retail investors in mainland China from trading securities easily in markets such as the US and Hong Kong.

News that Chinese officials were planning to ban online brokerages such as Futu and UP Fintech from offering offshore trading services to mainland clients was first reported in December 2021.

Ban aimed to stop illegal money outflows

Last December, the China Securities Regulatory Commission (CSRC) said Futu and UP Fintech had conducted unlawful securities business and banned them from soliciting new business from mainland investors.

Both Futu and UP Fintech stressed that app downloads in other markets were not affected.

“The removal is out of expectation but will not materially impact current business operations as the two companies have ceased acquiring users in mainland China since December 31, 2022,” Hanyang Wang, an analyst with 86Research, said.

Some Hong Kong units of Chinese brokerages stopped opening accounts for mainland clients following unwritten guidance from the CSRC, aimed at discouraging illegal money outflows, state media reported in February.

Futu, which has delayed its Hong Kong listing plan, holds a licence in Hong Kong, Singapore and the United States.

In a separate announcement on Tuesday, the brokerage said it was expanding into Malaysia with an investment platform.

In its 2020 annual report, Futu said that it primarily serves the emerging affluent Chinese population and a large number of its clients were mainland Chinese citizens.

UP Fintech said in its Tuesday announcement that “moving forward, the company will abide by all applicable rules and regulations in mainland China, and serve its existing clients well”.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Raids Capvision Amid Crackdown on Due Diligence Firms

China Raids Office of US Due Diligence Firm, Detains Staff

China Data Laws Make Disputes More Challenging, Says Forensic Firm

China Set to Ban Offshore Online Brokerages as Crackdown Widens

China Warns Unlicensed Online Brokerages They Are Illegal

Chinese Online Brokers Face Data Risk: People’s Daily