(ATF) Energy giant Royal Dutch Shell said on Thursday it will invest up to $6 billion a year in green energy with more funding for biofuels and electric car charging.

The Anglo-Dutch conglomerate – the world’s largest oil and gas trader and the fifth biggest company in the world, according to 2020 revenues – said its oil output peaked in 2019 and is slowly declining.

Most of the world’s energy giants are shifting to greener sources.

BP and Total are investing heavily in renewables, and while Shell is expected to boost its investment in offshore wind power eventually, experts say it will focus on its current trading and LNG operations, plus fast growth in hydrogen and biofuel businesses.

The company said it will also speed up targets to eliminate net carbon emissions by 2050. Shell chief executive Ben van Beurden said: “We must give our customers the products and services they want and need – products that have the lowest environmental impact.”

Shell’s ‘strategy update’ came a week after it posted a huge annual loss after the coronavirus slashed energy demand and oil prices in 2020. Shell recorded a net loss of $21.7 billion (18.1 billion euros) last year as global travel was hammered and economies across the world slumped as the pandemic spread. It was a dramatic come-down for a company that enjoyed a net profit of $15.8 billion in 2019.

Shell’s results and large job cuts mirror the situation across the sector. British rival BP, which is cutting around 10,000 positions, reported a 2020 net loss of $20.3 billion, while US giant Exxon Mobil suffered an annual loss of $22.4 billion.

France’s Total, which posted a $7.2 billion loss last year, said on Tuesday it will change its name to TotalEnergies to reflect a move away from fossil fuels.

Shell’s change looks far less drastic by comparison. It said it will continue to rely on its retail business – the world’s largest – in a bid to increase the number of sites to 55,000 by 2025 from 46,000 currently.

It also plans to increase the number of electric vehicle charging points to 500,000 from 60,000 now.

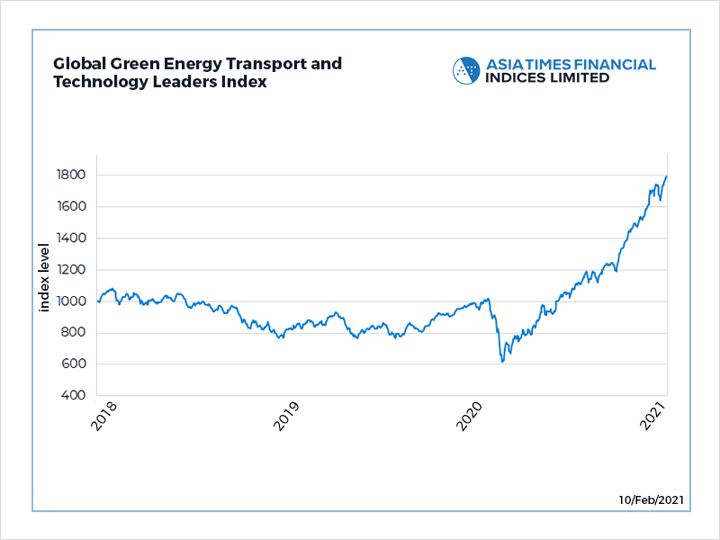

The Global Green Energy Transport and Technology Leaders’ Index, created by Asia Times Financial in collaboration with ALLINDEX, is a benchmark that tracks leaders in electric vehicle and renewable energy production and storage businesses.

Mixed reaction to rejig, compared to BP and Total

Unlike BP and Total, which both aim to increase their ownership of wind and solar farms, Shell did not outline an immediate plan to boost solar and wind power.

BP has said it will slash its fossil fuel output by 40% by 2030, but Shell will keep its oil and gas production largely stable for the next decade to help fund its transition, sources told Reuters, which noted that Shell’s strategy had received a mixed reaction from investors.

In the near-term, it will invest $5 billion a year in its trading and retail business and renewables units. It previously aimed to spend up to $3 billion on renewables and marketing combined.

Its upstream oil and gas business will get greater funding – $8 billion. It will also spend $4 billion on its liquefied natural gas (LNG) and up to $5 billion on chemicals and refining. Total spending is expected to remain within a range of $19 to $22 billion per year.

Shell said its greenhouse gas emissions peaked in 2018 and it aims to reduce its net intensity by between 6% and 8% from 2016 levels by 2023. The target rises to 20% by 2030, 45% by 2035 and 100% by the middle of the century.

With reporting by AFP and Reuters.