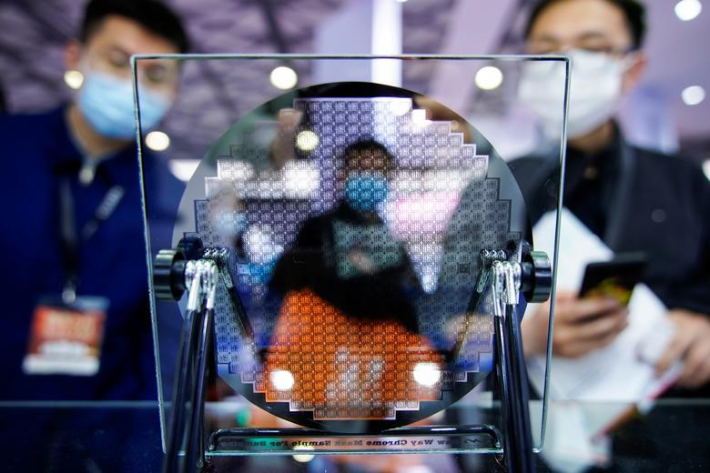

In fresh efforts to build China’s semiconductor self-sufficiency, multiple provinces in the country are ramping up chip-related subsidies, and chipmaker SMIC and Huawei have emerged as some of the biggest winners.

Local governments in Shanghai and Anhui will fund a variety of semiconductor-related projects this year — ranging from the development of DRAM chips to building facilities for chipmaking and its tools, according to a report by the South China Morning Post.

The state subsidies follow billions of dollars worth of funds already assigned by Beijing to its semiconductor industry, as a means to tackle chip export controls imposed by the US and its allies.

Also on AF: Curbs on ASML ‘to Stop Use of Advanced Chips by China Military’

In Shanghai, the local government is set to subsidise 191 major projects, of which 16 will be tied to the chip industry, the SCMP report said, citing published government documents.

The subsidised projects will include SMIC’s two 300mm production lines, which are currently under construction, the SCMP said.

300mm production lines can be used to process 5nm and 7nm chips, both of which the state-backed chipmaker is looking to mass produce. The Financial Times reported last month that SMIC is putting together production lines in Shanghai to mass produce 5nm chips for use in smartphones manufactured by Huawei.

If successful, the process will also be used to produce Huawei’s Ascend chips in 5nm, the report said.

The Ascend chipsets are currently seen as China’s only competitor to US chipmaker Nvidia’s cutting edge artificial intelligence (AI) chips. They are quickly gaining market share in China as Washington increasingly restricts Nvidia’s ability to sell to the country.

Nvidia had so far held a 90% share of China’s AI chip market.

An ability to mass produce 5nm chips will also be seen as a major win for China, and both SMIC and Huawei — after US sanctions cut both firms off of most international markets.

Separately, the Shanghai government will also back a Huawei R&D facility focused on chips, wireless networks and the Internet of Things, SCMP said.

Huawei is among the world’s biggest spenders on research and development. In 2022, the firm invested $22.5 billion on R&D — the fifth largest such spending in the world.

View this post on Instagram

Chipmaking tools, DRAM chips

In keeping with the Xi Jinping government’s call to achieve self-sufficiency in the entirety of the chip supply chain, the Shanghai government will also back a production facility for etching equipment-maker Advanced Micro-Fabrication Equipment.

Similarly, China’s Eastern province of Anhui, on Sunday, pledged more support for the development of DRAM chips, SCMP said.

In October, China’s state-backed Big Fund said it would invest nearly $2 billion in Changxin Xinqiao, the country’s first chipmaker to work on mass production of DRAM design and manufacturing. Changxin is based in Anhui.

Also on AF: China’s Top Chipmaker SMIC Predicts Modest 2024 Recovery

Beijing is aiming to develop 70% semiconductor self-sufficiency by 2025 as part of the Xi Jinping government’s Made in China 2025 campaign.

A key step towards its aim has been to boost state funding for Chinese chipmakers. In 2022, Beijing handed out $1.75 billion in subsidies to domestic semiconductor companies, of which SMIC received the highest funding of over $270 million, SCMP reported.

Those subsidies have allowed SMIC to use older generation chipmaking tools to keep producing new generation chips. Using old technology typically results in higher costs of fabrication and lower chip yields, challenges that can get easier to manage with additional funding.

Meanwhile, in 2022, Huawei also received subsidies worth $948m. That was double the amount it received in the previous year, according to the FT.

That commitment from China to pour billions into its semiconductor industry has been a major cause of concern for global chip making leaders.

Firms such as Nvidia and ASML have consistently warned against the expansion of export curbs targeting China, citing Beijing’s drive to develop its own chip industry.

Nvidia Chief Jensen Huang has previously said that US export curbs will lead to permanent loss of opportunities for US businesses. Similarly, former ASML chief Peter Wennink also warned that China’s ability to innovate could create competitors for his firm which is the world’s leading manufacturer of chip-making equipment.

In its latest annual report, ASML cited competitors with goals of self-sufficiency as a risk to its business. Last year, SoftBank-backed chip designer Arm also cited the same risk to its business, in a filing for its blockbuster US IPO.

View this post on Instagram

- Vishakha Saxena

Also read:

Huawei, SMIC Set to Defy US Sanctions With 5nm Chips

China’s Military, AI Bodies Still Buying Nvidia Chips Despite US Ban

Nvidia’s New AI Chip for China Priced Close to Huawei Alternative

Slower Nvidia Chip Out in Q2 But China Firms ‘Don’t Want It’

China Firms Rush to Poach Nvidia Clients With AI Chip Offerings

New Huawei Laptop Fuels Talk of Sanctions-Beating 5nm Chip

Access to China ‘Essential’ as it Develops Chips: ASML CEO

US Curbs Set Off Sales, Tech Boom for China Chip Equipment Firms

China to Lead 2024 Chip Expansion with 18 New Fabs – SEMI

China Way Ahead of US in Chip Startup Funding – PitchBook