(ATF) Economic events

Investor sentiment will remain upbeat driven by US stimulus hopes after US non-farm payrolls increased by a less-than-forecast 245,000 in November from the previous month, as the unemployment rate dipped to 6.7%.

But risk appetite could also be crimped by the growing friction between the world’s two biggest economies as US President steps steps up his attacks on China before leaving office.

Trump restricted travel to the United States by members of China’s ruling Communist Party and their families and China warned the US about abuse in the name of national security, after the Trump administration added China’s SMIC and CNOOC to a defense blacklist. At the weekend, index provider FTSE Russell said it will drop eight Chinese companies from its indexes after a US order issued last month restricted purchase of their shares.

In the week ahead Asia’s three largest economies will be in focus with China unveiling inflation data, Japan announcing GDP performance and India reporting its October industrial production data.

Morgan Stanley economists said China’s November PMI readings showed Q4 GDP growth was on track to meet the ~6% potential growth path as both manufacturing and services were strong.

“Both domestic and external demand have been lending support to manufacturing activities, while transportation, telecommunications and financial services led the uptick in services PMI,” they said in a note.

They added high frequency indicators like auto sales had shown buoyancy in November reflecting the consumption strength.

Japanese recovery

Japan releases a revised third-quarter GDP estimated and investor will also pay attention to growth indicators in the current quarter, including October labour earnings, household spending, machinery orders and the current account.

“Final third quarter GDP data for Japan should confirm the strong rebound in national output from the heavy losses in the second quarter, although – as with many economies around the world – GDP remains well below pre-pandemic levels,” Paul Smith, economics director at IHS Markit, said.

“Moreover, recent PMI data have suggested the Japanese recovery, whilst being maintained, remains rather tepid. Social distancing and weak household income remain a challenge and continue to suppress domestic demand gains. Next week’s household spending data will therefore provide clues on any momentum (or lack of) in this crucial ingredient for the country’s economic recovery.”

India’s industrial numbers will be closely watched as globally these recoveries have been quicker than consumption, especially after last month’s PMI data showed rapid expansion of output.

Fund flows

Fund flows in the week to December 2 reflected improved risk appetite as investors piled into equities as the optimism of a wave of vaccine candidates convinced markets the worst of the coronavirus pandemic was over. Growing hopes of a US stimulus package to offset the economic impact of the coronavirus pandemic also hastened the flows.

In Asia, there were strong inflows into Chinese, Indian and Japanese equities. In the bond markets, steady global bond fund purchases (+US$10.3 billion) continued alongside a 5-month high injection into US TIPS, according to Jefferies & Co analysts.

Net flows into all Equity Funds during November totalled $127 billion, beating the previous monthly record set in January 2018 by some $17 billion, according to fund flow data provider EPFR.

But bond funds benefited too, especially emerging market funds with local currency fixed income exposure as the dollar weakness emboldened bets. Overall, Emerging Markets Bond Funds recorded their 21st inflow in the past 22 weeks with sovereign debt attracting three times the amount of fresh money that went to their corporate counterparts.

The flows were driven by the growing appetite for exposure to Chinese debt which offers positive yields in an appreciating currency.

According to EPFR data China Bond Funds have now recorded inflows for 31 straight weeks and absorbed a net $11.6 billion since the beginning of June.

“Looking ahead, there is plenty of fuel to drive asset markets and fund AUM’s higher in the months ahead. Personal savings rates in the US remain elevated, and much of the more than $1 trillion that flowed into US Money Market Funds during the second quarter remains in these liquidity management vehicles,” said Cameron Brandt, Director Research at EPFR.

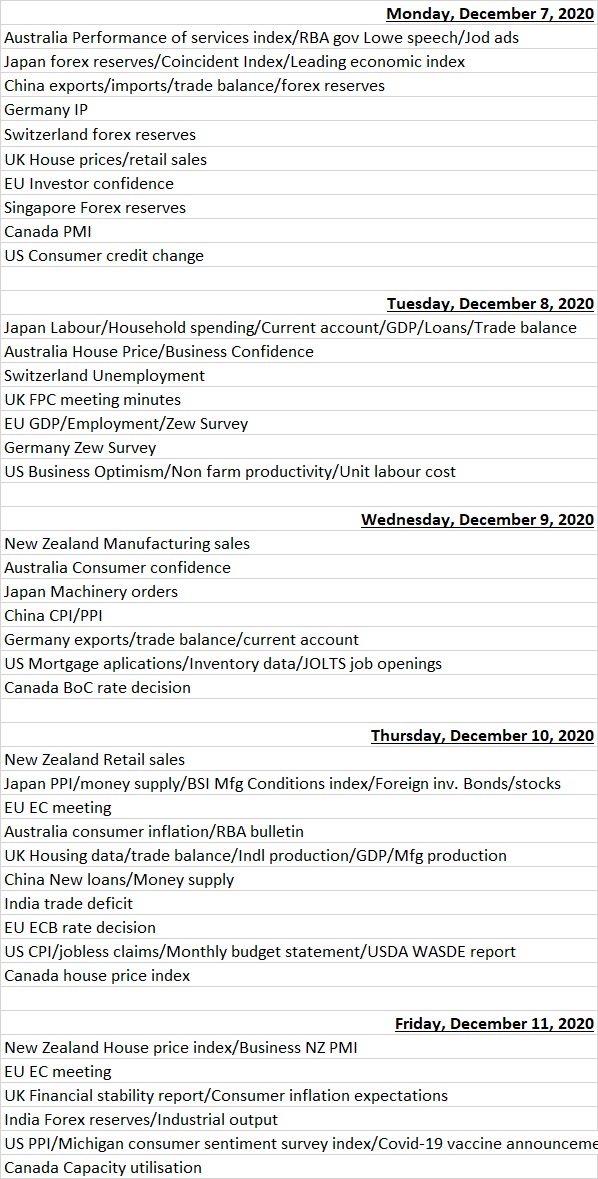

Economic data calendar

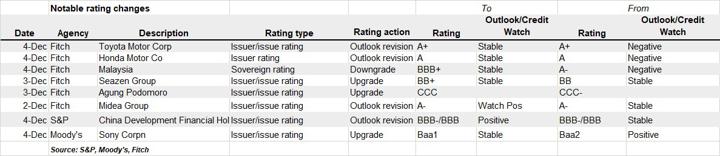

LAST WEEK’S RATING CHANGES