The United States has discussed limiting semiconductor exports to China with its allies, including Japan and the Netherlands, White House national security adviser Jake Sullivan said on Monday.

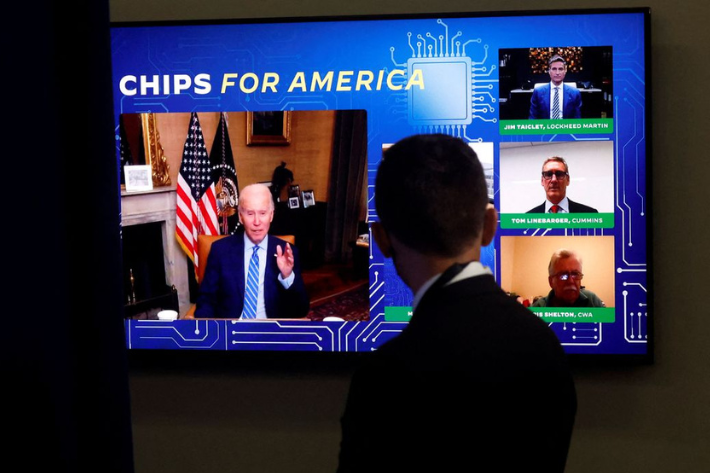

The Biden administration aims to cut China off from certain semiconductor chips made anywhere in the world using US equipment. It issued a series of curbs in October in a bid to slow Beijing’s technological and military advances.

Sullivan’s comments followed reports that the two countries had agreed in principle to join the US-led technology export control.

Also on AF: China Gambles on Graphene to Win the Global Microchip War

Apart from some US gear suppliers, Japan’s Tokyo Electron and Dutch lithography specialist ASML Holding, were the two critical players needed to make the sanctions effective, making their governments’ adoption of the curbs a key milestone, reports said. The new curbs may be announced in coming weeks.

Asked about the reports, Japanese Trade Minister Yasutoshi Nishimura said co-operation in export control figured in a telephone conversation he had with US Commerce Secretary Gina Raimondo, but declined to elaborate.

“I cannot go into details as they are diplomatic exchanges, but Japan has been implementing its export control strictly, based on the foreign exchange and foreign trade law in the spirit of international co-operation,” he told reporters.

A spokesperson for Tokyo Electron said the company was in no position to respond, since the matter had to do with each country’s regulations. “We intend to keep a close eye on the situation constantly and deal with it appropriately,” the spokesperson added.

China is Tokyo Electron’s largest market, accounting for 26% of its sales of 1.94 trillion yen ($14.1 billion) in chip-making equipment for the year that ended in March.

IBM partners with Japan on advanced chips

In another development underlining ties between Tokyo and Washington, IBM Corp and Rapidus, a newly formed chip maker backed by Japan, unveiled a partnership on Tuesday.

The two aim to make the world’s most advanced chips in Japan by the second half of the decade.

Dario Gil, the US firm’s research director, said the two companies would work together to make IBM’s 2-nanometre chips, unveiled last year.

Japan, which long ago lost its lead on chip manufacturing, particularly advanced semiconductors, is rushing to catch up and ensure its carmakers and information technology companies do not run short of the key component.

“It will take several trillions of yen,” to get pilot production up and running, Rapidus president Atsuyoshi Koike said at a news conference in Tokyo. He didn’t say where the money would come from, or where in Japan it would build a foundry.

As part of their agreement, Rapidus scientists and engineers will work alongside IBM Japan and IBM researchers at the Albany NanoTech Complex in New York state.

- Reuters, with additional editing by Vishakha Saxena

Read more:

US ‘Desperate’ For Better Ties, Says China on Delegation Visit

US Eases Planned Curbs Against China Chips Over Cost Fears

Apple to Use TSMC’s US-Made Microchips, Says Tim Cook – CNBC

Nvidia Offers New Chip to China That Meets US Limits