The Trump Administration faces a big test on Wednesday when the US Supreme Court will consider the legal basis for tariffs imposed by the US President on many of its trading partners this year.

Groups such as the US Chamber of Commerce – the country’s biggest business association – plus think tanks, political rivals and a range of other bodies opposing Trump’s use of emergency tariff powers will argue their case with the country’s highest court.

Trump’s tariffs have been a nightmare for a range of American companies, as well as many of its trading partners. But some analysts say the legal case that will be presented this week and considered by the court may not matter in the long run, as they expect the White House to use other legal measures to achieve the same goal.

ALSO SEE: Hong Kong Bids to be Digital Asset Hub, to Ease Some Rules

Trump has described the case as one of the most important in the country’s history and claimed the US would be defenceless if the US was not able to quickly use tariffs. His lawyers say an adverse ruling could thrust the US back to the brink of economic catastrophe.

For some companies, the tariffs have already been disastrous. US factory equipment maker OTC Industrial Technologies has long used low-cost countries to supply components – first China and later India – but President Trump’s tariff blitz on numerous trade partners has upended the supply chain maths for CEO Bill Canady.

“We moved things out of China and went to some of those other countries, and now the tariffs on those are as bad or worse,” Canady told Reuters. “We just have to hang on and navigate our way through this so we don’t all go broke in the short run.”

Lower courts vote against Trump

The Supreme Court, whose 6-3 conservative majority has backed Trump in a series of major decisions this year, is hearing his administration’s appeal after lower courts ruled that the Republican president overstepped his authority in imposing sweeping tariffs under a federal law meant for emergencies.

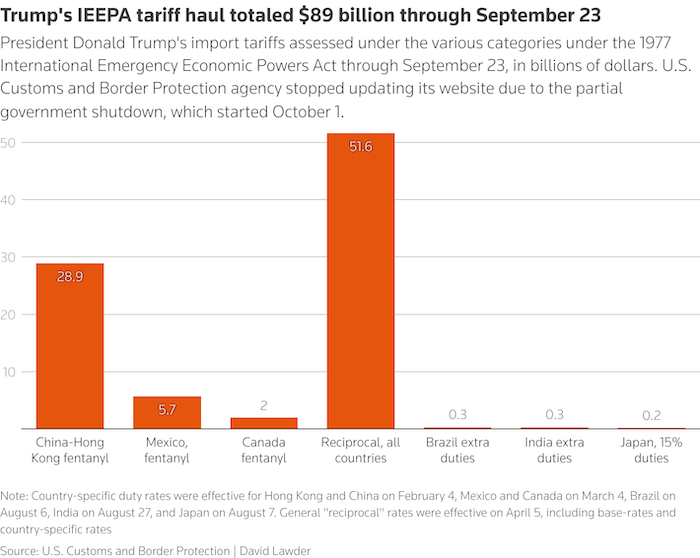

A ruling striking down Trump’s use of the 1977 International Emergency Economic Powers Act, or IEEPA, to quickly impose broad global tariffs also would eliminate a favourite cudgel to punish countries that draw his ire on non-trade political matters. These have ranged from Brazil’s prosecution of former president Jair Bolsonaro to India’s purchases of Russian oil that help fund Russia’s war in Ukraine.

“For decades, our country has been looted, pillaged, raped and plundered by nations near and far, both friend and foe alike,” Trump said in announcing sweeping reciprocal tariffs in April under this law.

“Reciprocal – that means they do to us and we do it to them,” Trump added.

Trump is the first president to invoke this statute – often has been used to apply punitive economic sanctions to adversaries – to impose tariffs. The law provides a president with broad authority to regulate a variety of economic transactions when a national emergency is declared.

In this case, Trump deemed a $1.2 trillion US goods trade deficit in 2024 a national emergency – even though the United States has run trade deficits every year since 1975 – and also cited overdoses of the often-abused painkiller fentanyl.

US Treasury Secretary Scott Bessent said he expects the Supreme Court to uphold the IEEPA-based tariffs. But if it strikes down the tariffs, Bessent said in an interview, the administration will simply switch to other tariff authorities, including Section 122 of the Trade Act of 1974, which allows broad 15% tariffs for 150 days to calm trade imbalances.

Bessent said Trump also can invoke Section 338 of the Tariff Act of 1930, a statute that allows tariffs up to 50% on countries that discriminate against US commerce.

“You should assume that they’re here to stay,” Bessent said of Trump’s tariffs. For countries that have negotiated tariff-lowering trade deals with Trump, “you should honor your agreement,” Bessent added. “Those of you who got a good deal should stick with it.”

Trump, however, is already using other authorities for certain tariffs. He is busy piling up tariffs under Section 232 of the Trade Expansion Act of 1962 involving national security concerns to protect strategic sectors such as autos, copper, semiconductors, pharmaceuticals, robotics and aircraft, as well as tariffs under Section 301 of the Trade Act of 1974 involving unfair trade practices investigations.

“This administration is committed to tariffs as a cornerstone of economic policy, and companies and industries should plan accordingly,” said Tim Brightbill, co-chair of law firm Wiley Rein’s trade law practice in Washington.

Trade deals locked in

Trump administration officials have touted his tariffs as pushing major trading partners such as Japan and the European Union to negotiate major concessions that will help to reduce the US trade deficit, arguing those concessions will survive any Supreme Court ruling.

US trade partners are not waiting for a Supreme Court ruling in deciding how to proceed. The US Trade Representative’s office has announced finalized framework trade deals with Vietnam, Malaysia, Thailand and Cambodia, locking in tariff rates of 19% to 20%. South Korea agreed to terms on a $350 billion investment plan, unlocking a 15% tariff for its cars and other goods.

Negotiations with China have proven more difficult due to its willingness to retaliate against the United States and cut off its supplies of rare earth minerals and magnets essential for US high-tech manufacturing from autos to semiconductors.

Instead of major concessions, Trump’s administration has had to settle for extensions of a delicate truce under which American and Chinese tariffs were reduced to keep the rare earths flowing.

In South Korea last Thursday, Trump agreed in talks with Chinese President Xi Jinping to halve the US tariff rate on Chinese goods related to fentanyl to 10% and to delay tighter technology export controls for a year in exchange for China’s year-long pause on its tough licensing requirements for global rare-earth exports.

Xi agreed to resume purchases of American soybeans that China had halted for months, while Trump paused new US port fees for China-linked ships for a year.

Refund risk, messy process

Some investors have said financial markets, which have grown accustomed to the Trump tariff status quo, could be thrown into turmoil if the Supreme Court strikes down the IEEPA tariffs.

A major reason for concern, particularly in the Treasury debt market, is the risk of having to refund more than $100 billion in IEEPA tariff collections and forgoing hundreds of billions of dollars of revenue annually.

The IEEPA tariffs collected so far this year make up the biggest portion of a $118 billion increase in net customs receipts in the 2025 fiscal year that ended on September 30. That helped offset rising healthcare, Social Security, interest and military outlays, helping shrink the US deficit slightly to $1.715 trillion.

“It’s a significant political economy risk that we get addicted to tariff revenue,” said Ernie Tedeschi, a senior fellow at the Yale University Budget Lab, adding that makes it harder for any future presidential administration to lower the duties.

Getting the money back also would be difficult, as a tariff reversal would be “unprecedented at this scale” for US Customs and Border Protection, said Angela Lewis, global head of customs at freight forwarder and customs broker Flexport.

The onus could be on individual importers to apply for “post-summary corrections” with the agency, a messy process that could take years and not be worthwhile for some smaller firms, Lewis said. For those getting refunds, US taxpayers also would be on the hook for 6% annual interest costs compounded daily.

Impact on inflation, global companies

The biggest dilemma is managing costs. Importers, for the most part, have eaten the tariffs, according to academic studies and comments from executives, reducing profit margins but limiting higher consumer prices and protecting market share.

While this has dampened the inflationary impact so far, cost pass-throughs are broadening through clothing and other goods prices, according to Oxford Economics, which estimated that tariffs added 0.4 percentage point to September’s Consumer Price Index annual rate of 3.0%, keeping inflation well above the Federal Reserve target.

Corporate earnings have taken the biggest hit, with global companies flagging more than $35 billion in tariff-related costs so far heading into third-quarter earnings season.

Ohio-based OTC designs and builds factory production lines and automation systems. Soon, CEO Canady said, companies like his will have to “place their bets” on where to shift production for a more sustainable cost base. That may mean back to US shores for high-end products, and to Mexico for lower-value parts.

“I think the new normal is going to be 15%,” Canady said of Trump’s tariffs, regardless of the legal authority he invokes. “They’re going call it whatever they need to call it so that it is not challengeable.”

- Reuters with additional input and editing by Jim Pollard

ALSO SEE:

Trump Cuts US Tariffs to 47%, Xi Vows to Ease Rare Earth Curbs

Trump Edges Closer to Tariff Deal With Seoul, Ignores NK Missile

Trump Will Ask Supreme Court to Allow Tariffs After Legal Setback

Foreign Firms Struggling Amid China’s Economic Slump, Trade War

Trump’s Tariffs Spurring a Rush for New Trade Agreements

Tariffs Spur Big Tesla Deals With LGES Batteries, Samsung Chips

EU Strikes a Pricey Deal With Trump to Avert a Trade War

US Court Ruling Against Trump Tariffs Seen as Temporary Setback