Hong Kong is moving to establish itself as a major hub of fintech and digital assets.

Government officials said on Monday the city plans to ease rules and introduce a tokenisation pilot scheme to promote digital asset trading and investment.

Hong Kong’s Securities and Futures Commission (SFC) will relax rules to allow locally licensed virtual asset trading platforms (VATP) to share global order books with affiliates overseas, Julia Leung, CEO of the securities watchdog, told the Hong Kong Fintech Week conference.

ALSO SEE: Nvidia’s Top AI Chips Won’t Be Sold to China, Other States: Trump

The move eases current rules that require VATP’s order book – a list of buy and sell orders for virtual assets – to be ring-fenced in Hong Kong. The changes are designed to allow operations to tap global liquidity.

Locally regulated stablecoins

Additionally, VATPs will now be allowed to distribute virtual assets and Hong Kong-regulated stablecoins with less than a 12-month track record to professional investors, easing previous requirements for a minimum one-year track record.

The regulatory adjustments come as Hong Kong intensifies efforts to compete with Singapore and the US amid surging appetite for digital investments, solidifying its status as a fintech hub.

Meanwhile, Hong Kong’s wider financial sector is poised to benefit from rising investment in digital transformation and tokenisation, according to the city’s de-facto central bank.

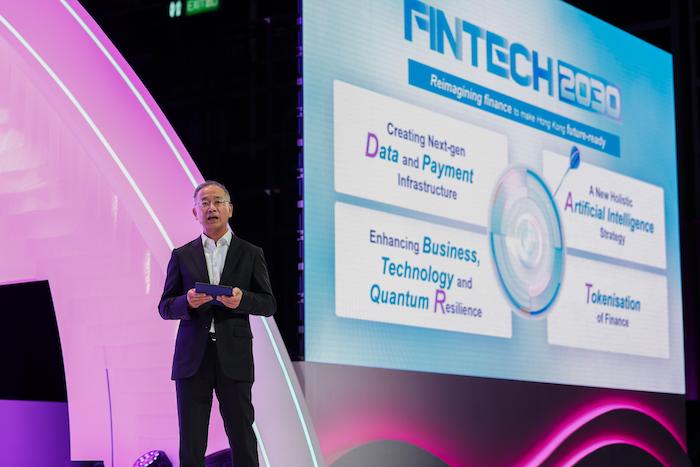

The Hong Kong Monetary Authority unveiled on Monday its “Fintech 2030” roadmap, focusing on data, artificial intelligence, resilience and tokenisation.

As part of the initiative, HKMA said it will advance its sandbox Ensemble to enable real-value transactions in tokenised deposits and digital assets.

“We will now begin incubating mature real-value use cases where tokenised deposits can offer significant advantages, starting with tokenised money market funds,” Eddie Yue, chief executive of HKMA, said at the same forum. The regulator did not disclose details of such real-value applications.

“The momentum behind this (digital) transformation is underscored by substantial technological investment with total spending projected to reach more than HK$100 billion ($12.9 billion) every year in the next three years,” Yue added.

Hong Kong has witnessed a flurry of launches of tokenised Hong Kong-dollar and US dollar money market funds this year, reflecting the global trend of digital-native capital seeking yield-generating investments.

Tokenised products are gaining in popularity, drawing sizable flows, with digitalised currency becoming mainstream, two executives of major global banks said on Monday.

HSBC’s CEO Georges Elhedery said during a panel discussion its tokenised gold product launched in Hong Kong has now become the third largest such product globally, with “mass adoption by retail customers”.

“Our belief, which I think is shared by the leadership of Hong Kong, is that pretty much all transactions will settle on blockchains eventually, and that all money will be digital,” said Bill Winters, chief executive of lender Standard Chartered, on the same panel.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Trump Cuts US Tariffs to 47%, Xi Vows to Ease Rare Earth Curbs

China’s EV Subsidy Era May End As Exports Boom, Priorities Shift

China Stocks Drop Off 10-Year High; HK Down Amid Trade Tension

First Half: Mainland Investors Pile $90bn Into Hong Kong Shares

Hong Kong Gives Green Light for Four More Crypto Exchanges

US to Review Ties With Hong Kong Banks, ‘City Now a Crime Hub’

Hong Kong Security Law Has Global Firms Racing to Shield Secrets

Hong Kong Battles to Boost Appeal, Business After Clampdown

Hong Kong Banks on China Links to Restore Global Status