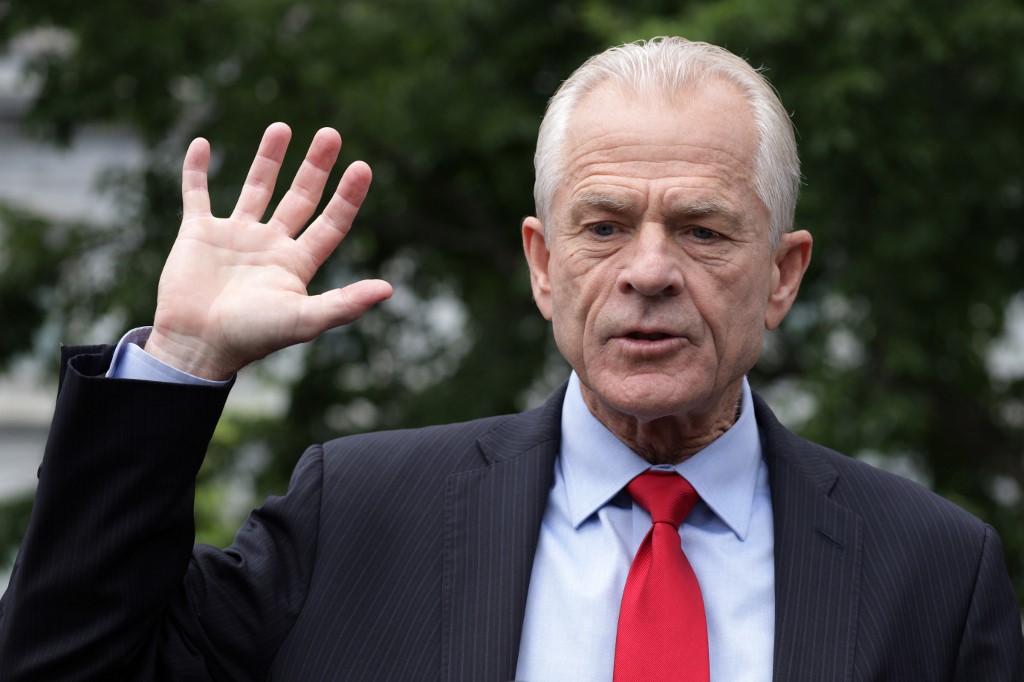

(ATF) Last night – New York time, White House trade adviser Peter Navarro told Fox’s ‘The Story’ host Martha MacCallum that US President Trump had decided to terminate the US-China trade deal.

Some time later that evening, the apparently somewhat unhinged senior official took it all back and said his comments were taken “wildly out of context.”

Which of the two (or are there more?) Navarros are we to believe? Global markets were mostly closed at the time. So, ultimately it mattered little (even more so than usual) what the “Death by China” author blurted out and then took back.

The matter was laid to rest (more or less) when Donald Trump took to Twitter and tweeted. “The China Trade Deal is fully intact. Hopefully, they will continue to live up to the terms of the Agreement.”

But while most stock markets were closed, currency markets never sleep and that’s where the White House confusion machine made its impact.

The offshore deliverable yuan (CNH) in an instant weakened from 7.0585 per USD to 7.0882 at 21:13 NY time. By 22:02, it had come back in to 7.0646.

As at this writing (19:00 HK time), CNH trades at a stronger 7.0606. The onshore yuan stands at 7.0672, unfazed by the White House antics.

But, of course, we cannot ignore the kerfuffle and unstable White House scene altogether. The sharp yuan move occurred because the basic views of Navarro are known and when he’s trotted out (or trotted out on his own) to tell the trusted Fox News network that the trade deal is over, it does have some credibility.

As I wrote a few days back, even as China is coming quite well out of the coronavirus crisis and recession, the Chinese currency is vulnerable to political risk from sudden unaccountable White House and US Congress policy moves.

What’s at greater risk of instability from economic fundamentals is the US dollar. As the US economy is slowly and haltingly coming out of deep economic downturn, it is now laden with enormous amounts of new debt piled on top of the already enormous pre-crisis level. The US Fed’s balance sheet has expanded from $4 trillion in mid-March to $7 trillion, and – according to former Federal Reserve Bank of New York President Bill Dudley – the size of the balance sheet could reach $10 trillion.

The only way any large open economy can deal with the combined burden of collapsing net national savings and a bulging current account deficit is to devalue its currency or deliberately let it slide.

Since end-May, with the worst of the coronavirus crisis over, the US dollar has experienced pronounced weakness and moved from above 100 on the DXY (dollar index) to 96.9200 at present.

Former Morgan Stanley Asia head Stephen Roach, now a senior lecturer at Yale, warns of a coming “dollar crash” and sees a 35% decline of the USD over the coming five years.

As I noted yesterday, I’m not quite as negative on the dollar’s prospects. But a 20% decline over a shorter period of time is entirely conceivable. The more the likes of Navarro and Trump play with fire, the closer we get to a dollar crisis.