Stocks on Asian markets fell on Friday after US President Donald Trump announced sweeping new import tariffs – notably 100% duties on branded drugs, a 25% levy on heavy-duty trucks, and 30-50% tariffs on furniture items.

Trump said the levies, which aim to protect US manufacturers and national security, will be enforced from next Wednesday (October 1). But pharmaceutical companies already building plants in the US would be exempt.

He said the US would also start to charge a 50% tariff on kitchen cabinets and bathroom vanities, plus a 30% tariff on upholstered furniture. These fees follow a broad range of tariffs on trading partners of up to 50% and duties on products such as steel.

ALSO SEE: Trump Signs TikTok Order; Analysts Puzzled by App’s ‘$14bn Value’

Shares of pharmaceutical companies tumbled across Asia, with Indian benchmarks appearing to be hardest hit, while Japanese stocks staged a recovery after tariff negotiator Ryosei Akazawa said Tokyo had secured most-favoured-nation status for chip and pharma tariffs.

The tech-heavy Nikkei dropped 0.9% to finish at 45,354.99, after a record high on Thursday, while the Topix edged up to a record close of 3,205.63.

Chugai Pharmaceutical tumbled 4.8%, Sumitomo Pharma dropped 3.5% and Otsuka Holdings slid 2.9%, although Takeda finished just 0.1% lower and Shionogi gained 1%.

Long-touted tariffs, impacts limited

Trump has long touted pharma tariffs and analysts have said the impact on all companies would be limited, partly because many Asian companies, especially in China and India, focus on generic drugs, so tariffs on brands do not affect them.

Jefferies analyst Stephen Barker said while he thought it highly unlikely that Trump’s announcement would lead to “onerous” tariffs on Japan’s pharma sector, investors naturally could not ignore the risks.

In Australia, shares of Commonwealth Serum Laboratories (CSL), which develops biotherapies, vaccines, and therapies for life-threatening medical conditions, rare diseases, plus immune deficiencies and influenza, were down 1.9% to a six-year low, despite the fact it has plants in the US that employ 19,000 people.

Health Minister Mark Butler said Australia sold around $1.37 billion in medicines to the US last year. He said the government was working to understand the implications of the “unfair, unjustified tariffs after 20 years of free trade”.

Singapore could also be hit hard. Analysts told the Business Times that the tariff rate on shipments would rise to well over 30%, compared with 4% currently.

However, the country hosts nine of the top 10 global pharmaceutical firms, and some of these big firms have established or are expanding manufacturing operations in the US. Major companies such as Novartis, AstraZeneca and GSK had announced plans to invest in the US or started construction of new facilities, the paper said.

‘Biggest losers will be US citizens’

A source at a Taiwan-based pharmaceutical company that makes branded drugs told Reuters, on condition of anonymity, that it could take at least five years to build and certify a new US plant, without taking into account any supply chain or labour shortage issues.

But the source noted that, ultimately, the biggest losers would be people [in America] who need such medicine.

In India, the Nifty 50 and BSE Sensex were both down and on course for a sixth consecutive session of losses. The pharma index was the biggest loser, down 2.4% on uncertainty about impacts from Trump’s tariffs on the sector.

The US accounts for slightly more than a third of India’s pharmaceutical exports, which comprise mainly cheaper generic versions of popular drugs. Exports to the country rose 20% to about $10.5 billion in fiscal 2025.

There was uncertainty on whether complex generics and biosimilars would come under the tariff embargo in the future, ICICI Securities said.

Sun Pharmaceutical Industries declined 2%, and was the biggest Nifty 50 loser, while Natco Pharma fell 3.4%, losing the most on the pharma index.

In Europe, shares recovered from early losses amid uncertainty over how widely some of the duties might apply.

Trump’s announcement on Truth Social did not say whether the new levies would be on top of existing national tariffs. Recent trade deals with Japan, the EU, and Britain include provisions that cap tariffs for specific products like pharmaceuticals.

A non-binding preliminary trade deal between the EU and the US agreed to limit tariffs to 15%. But Trump has yet to sign an executive order confirming the agreement.

The European Commission said on Friday the agreement was “clear” that there was an all-inclusive 15% tariff ceiling, which represented “an insurance policy that no higher tariffs will emerge” for European companies.

Nathalie Moll, director general of the European Federation of Pharmaceutical Industries and Associations, said that urgent discussions were needed on “how to avoid any tariffs on medicines that harm patients in the EU and the US.”

Big drugmakers announced investments

Trump said the 100% tariff on branded drugs would only apply to producers that had not already broken ground on US manufacturing plants.

Many drugmakers have announced multibillion-dollar investments in the United States, and Switzerland’s Roche stressed on Friday that one of its US units recently started work on a new facility.

Rival Novartis, which has also made a large US investment pledge, did not reply to a request for comment.

Switzerland is still discussing a trade agreement with the US and its economy ministry said it was waiting for more details on Trump’s latest announcement.

The Pharmaceutical Research and Manufacturers of America, an industry group, said companies “continue to announce hundreds of billions in new US investments. Tariffs risk those plans.”

Trump had long threatened higher tariffs on drugmakers and Ireland, where mainly American-owned pharmaceutical factories employ about 2% of the workforce, has frontloaded much of its exports to the US in anticipation.

Exports of chemical and related products, including medicinal and pharmaceutical products, leapt 536% year-on-year to 23.9 billion euros ($27.9 billion) in the first seven months of 2025, according to Ireland’s Central Statistics Office.

‘Bringing back’ US furniture business

Trump also followed through on a pledge to “bring back” America’s furniture business, saying he would start charging a 50% tariff on imported kitchen cabinets and bathroom vanities and a 30% tariff on upholstered furniture.

The new actions are seen as part of the Trump administration’s shift to better-established legal authorities for its trade actions, given the risks associated with a case before the Supreme Court on the legality of his global tariffs.

The administration has opened a dozen probes into the national security ramifications of imports of wind turbines, airplanes, semiconductors, polysilicon, copper, timber and lumber and critical minerals to form the basis of new tariffs.

Trump this week announced new probes into personal protective equipment, medical items, robotics and industrial machinery. He previously imposed national security tariffs on steel and aluminum and derivatives, light-duty autos and parts, and copper.

Trump has made the levies a key foreign policy tool, using them to renegotiate trade deals, extract concessions and exert political pressure on other countries.

His administration has played down the impact on consumer prices and touted tariffs as a significant revenue source, with Treasury Secretary Scott Bessent saying Washington could collect $300 billion by the end of the year.

Tariffs risk inflation

More than half of the $85.6 billion in ingredients for medicines used in the US are manufactured domestically, with the remainder from Europe and other US allies, the US pharmaceutical trade group said earlier this year.

When it comes to furniture, imports to the US hit $25.5 billion in 2024, up 7% from the year prior. About 60% of those imports came from Vietnam and China, according to Furniture Today, a trade publication.

“Many of our members were shocked when we heard the news. I think the decision on the additional tariff is unfair,” said Nguyen Thi Thu Hoai from the Wood and Handicraft Association of Dong Nai province, one of Vietnam’s largest furniture clusters.

Furniture and wood products manufacturing employment in the US has halved since 2000 to around 340,000 today, according to government statistics.

Higher tariffs on commercial vehicles could put pressure on transportation costs just as Trump has vowed to reduce inflation, especially on consumer goods such as groceries.

Trump said the new heavy-duty truck tariffs would benefit companies such as Paccar-owned Peterbilt and Kenworth and Daimler Truck-owned Freightliner.

The US Chamber of Commerce earlier urged against imposing new truck tariffs, noting the top five import sources are Mexico, Canada, Japan, Germany, and Finland, which pose “no threat to US national security.”

- Jim Pollard with Reuters

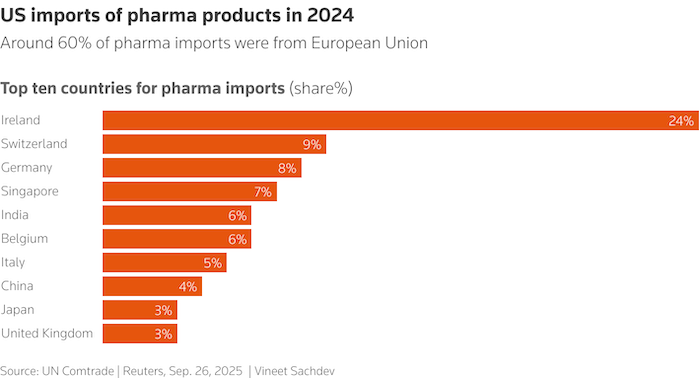

NOTE: A graphic was added to this report on Sept 26, 2025.

ALSO SEE:

Australian Critical Minerals Firms Look at Processing Plants in US

Trump’s H-1B Visa Chaos To Create ‘New World Order’ On Services

India To Get China Rare Earths As Trump Tariffs Bring Rivals Close

Trump Allows Tariff Exemption for ‘Partners’ on Metals, Pharma

Seoul Bids to Ease Anger Over Mass Arrests at US Hyundai Plant

US Lowers Japan Auto Tariffs But Some Carmakers Will Still Hurt

The West Needs a Better Attitude Toward Global South: EU Leader

India Now Aiming To Finalise Trade Deal With US By November

Trump Will Ask Supreme Court to Allow Tariffs After Legal Setback