Officials say the Bank of Japan is likely to raise interest rates this month – the first since January – and the Takaichi government is expected to allow such a decision.

The BOJ looks set to proceed with a hike in its policy rate to 0.75% from 0.5%, three government sources said. The move was flagged by Governor Kazuo Ueda in a speech on Monday.

“If the BOJ wants to raise rates this month, please make your own decision. That’s the government’s stance,” said one of the sources, adding it was nearly certain the bank will proceed with a hike this month.

ALSO SEE: Chinese Firms Fare Worst As Study Finds AI Majors Fail Safety Test

The administration is prepared to tolerate a December hike, another source said. The sources spoke on condition of anonymity as they were not authorised to speak publicly.

The benchmark 10-year Japanese government bond (JGB) yield hit an 18-year high of 1.93% after the report.

Ueda said on Monday the BOJ will consider the “pros and cons” of raising rates this month, signalling a strong chance of a hike at the December 18-19 meeting.

The remarks led the market to price in a roughly 80% chance of a December rate hike, though some market players focused on how the administration of dovish Prime Minister Sanae Takaichi could react.

Finance Minister Satsuki Katayama said on Tuesday she saw no gap between the government and the BOJ on their assessment of the economy, when asked about Ueda’s remarks.

Even reflationist aides of Takaichi have not expressed opposition, including government panel member Toshihiro Nagahama, who told Reuters on Wednesday the premier may accept a December hike if the yen stayed weak.

The BOJ’s board is expected to make a final decision after scrutinising upcoming data on domestic wage developments, the US Federal Reserve’s policy decision next week and its impact on financial markets.

The market’s focus will likely shift to the central bank’s messaging on how far it will eventually raise interest rates, a topic Ueda remains ambiguous about.

Any clarity on the future rate-hike path will likely come from Ueda’s news conference after the December policy meeting.

Speaking in parliament on Thursday, Ueda said there was uncertainty on how far the BOJ should hike rates due to the difficulty of estimating the country’s neutral rate of interest, or the level that neither stimulates nor cools growth.

The BOJ has produced estimates suggesting Japan’s nominal neutral rate lies somewhere in a range of 1% to 2.5%.

0.75% a level not seen for three decades

Analysts said later it is less clear how the BOJ plans to communicate the longer-term rate hike path – a tougher task given a lack of consensus on where Japan’s neutral rate of interest lies.

The uneasy truce between the BOJ and administration will keep the bond market jittery, with investors already focusing on what Ueda would say on the pace of further rate hikes.

“I think the BOJ sees a December hike pretty much as a done deal. The more important question is what’s next,” Mari Iwashita, the executive rates strategist at Nomura Securities, said.

“The yen will fall if Ueda fails to assure markets the BOJ will keep hiking rates. But signaling steady hikes could make the administration nervous,” she said. “It’s a bit tricky.”

The finance minister’s comment on Tuesday that she saw no problem with Ueda’s remarks was a sign the government won’t get in the way of a rate hike this month.

The next hike would bring the BOJ’s policy rate to 0.75%, a level unseen in three decades, in another step by Ueda in removing remnants of his predecessor’s radical stimulus.

Clearing political opposition has been the biggest challenge to Ueda’s rate-hike plan since Takaichi took office on October 21, with the premier voicing displeasure over an early increase.

As with Ueda’s past two rate hikes, however, fears of unwelcome yen falls helped the BOJ convince politicians of the need to lift deeply negative real interest rates.

The breakthrough came in Ueda’s meeting with Takaichi on November 18, held at the premier’s office late afternoon rather than the customary one-hour talk over lunch.

Describing the meeting as “candid, good” talks, Ueda said Takaichi acknowledged the BOJ’s plan to make a smooth landing towards its price goal through gradual rate hikes.

“The premier is very sensitive to yen moves,” said an official with knowledge of the government’s deliberations. “Countering the weak yen became a priority as inflation would hit approval ratings,” another source said.

Analysts argue that wide “neutral” range prevents investors from buying long-term bonds due to uncertainty over future rate hikes. And Ueda, on Thursday, acknowledged uncertainty on how far the central bank could raise rates.

Swap rates show markets see the BOJ eventually raising rates up to around 1.5% by mid-2027. But Takuji Aida, an economic adviser to Takaichi, said after a hike to 0.75%, the BOJ should keep rates steady until 2027.

Nikkei at 3-week high, robot-makers surge

The Nikkei share average climbed 2.3% on Thursday to close at a three-week high, as robot makers led gains on bets that physical AI will fuel growth. The broader Topix closed at a record high, rising 1.9% to 3,398.21.

Robot maker Fanuc jumped close to 13% to top the Nikkei gainers, extending its 18.4% surge this week after announcing a partnership with US chip giant Nvidia to develop industrial robots powered by “physical AI”, which integrates artificial intelligence with robotic hardware.

“The market focus has shifted to robotics-related shares from chip stocks. This means investors keep looking for new themes,” said Kazuaki Shimada, chief strategist at IwaiCosmo Securities.

Fanuc’s peer Yaskawa Electric jumped 11.4%. Early this week, Yaskawa announced a tie-up in physical AI with SoftBank Group. SoftBank jumped 9.2%, while Nabtesco, another robot maker, jumped 11.3%.

Banks rebounded from the previous session’s declines, with Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group up 1.8% and 1.7%, respectively.

Foreign investors

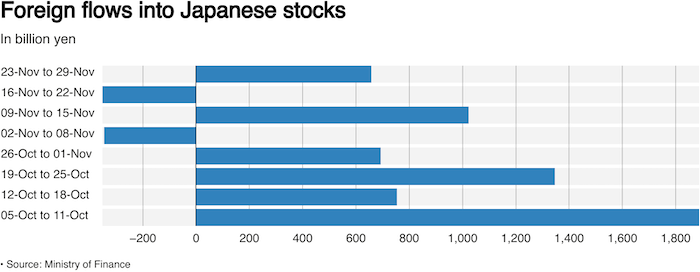

Foreign investors bought a significant amount of Japanese stocks in the week to November 29, snapping up tech stocks on bets of a Federal Reserve rate cut and banking shares on the expectations of a potential rate hike by the Bank of Japan.

They bought a net 655.6 billion yen ($4.22 billion) worth of local stocks during the week, reversing their 351.5 billion yen weekly net sales the prior week, Japan’s Ministry of Finance showed on Thursday.

Artificial intelligence-linked shares Advantest and Tokyo Electron gained 12.3% and 5.4%, while banking stocks Sumitomo Mitsui Financial Group and Yamaguchi Financial Group surged 5.6% and 13.4%, respectively, last week.

Japanese stocks have so far attracted approximately 7.22 trillion yen worth of foreign inflows this quarter as Prime Minister Sanae Takaichi’s government stimulus and robust corporate earnings boosted sentiment.

LSEG data for 742 large- and mid-cap companies showed that Japanese firms are expected to report net income growth of 15.2% next year, following an 8.5% growth for the current fiscal year, as per the mean of analyst estimates.

Foreigners, meanwhile, bought 1.06 trillion yen worth of Japanese long-term bonds in their fourth weekly net purchase in five weeks, although yield on 30-year Japanese government bonds (JGBs) rose to a record high on Thursday.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China’s Spat With Japan Derails Bid to Join CPTPP Trade Bloc

China Ramps up Trade Pressure on Japan Over Taiwan Remark

Japan’s Economy Contracts as Car Exports Sink in 3rd Quarter

Japan’s Megabanks Raise Profit Forecasts as Deflation Eases

Japan’s New PM Working on ‘Bold’ Stimulus Package, Draft Shows

Japan Signs Rare Earths, Nuclear Power Deal With Trump

Japan’s New PM to Meet Trump, ‘Will Buy US Soybeans, Pickups’

Nikkei Soars, Yen Sinks After Takaichi Picked as Japanese PM

Japan’s Topix Hits Record Peak, Yen Sinks as PM Ishiba Resigns