(ATF) Ukraine said on March 11 that it would nationalise an aircraft engine manufacturer majority-owned by Chinese companies.

The move to reclaim Motor Sich will raise tensions with Beijing as Kyiv has backed the US, which recently blacklisted the main Chinese investor, Skyrizon Aviation.

“The decision has been taken to return Motor Sich to the Ukrainian people,” Oleksiy Danylov, head of Ukraine’s national security and defence council, said.

Several Chinese companies, including Skyrizon, have accumulated a 75% stake in Motor Sich, which makes engines for cruise missiles and drones as well as helicopters and aircraft.

Beijing considers Motor Sich a strategic foreign investment as the company has the know-how to make engines for large commercial planes that China cannot make domestically.

INVESTMENT CONCERNS

The US and Ukraine have formed a close bond since Russia backed uprisings in the east of the country since the pro-Western president Volodymyr Zelensky took office in 2019.

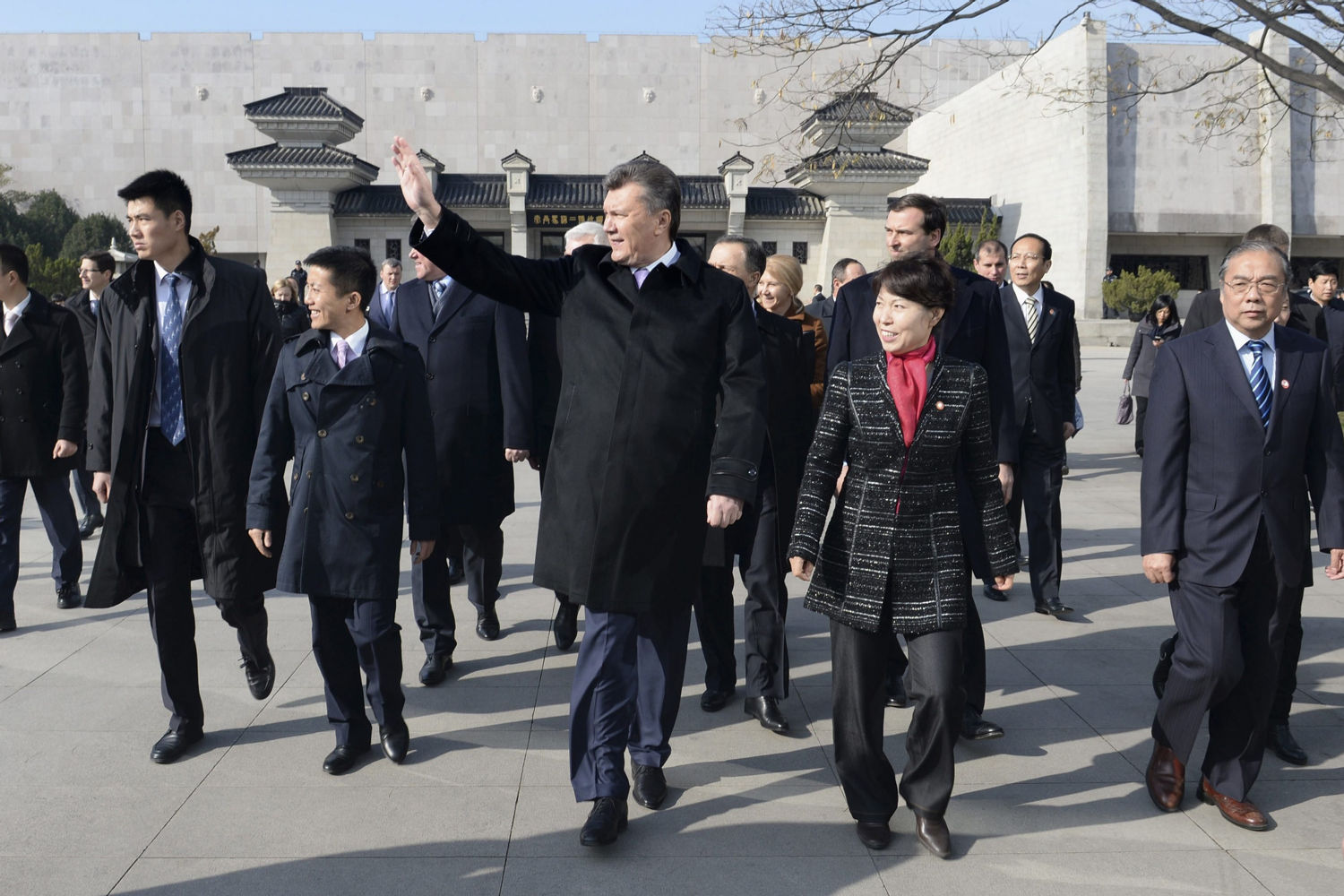

Ukraine and China had closer ties under deposed leader Viktor Yanukovych, who served until 2014.

Both the Trump and Biden administrations have raised concerns over Chinese investment in Motor Sich.

Ukraine imposed sanctions against Skyrizon in January following the US blacklisting of the company, which prompted a protest from Beijing.

The US Commerce department included Skyrizon, formally known as Beijing Tianjiao Aviation Industry Investment Co because it has military end-users, on the grounds that the company “has the ability to develop, produce or maintain military items, such as military aircraft engines.”

With reporting by Agence France-Presse