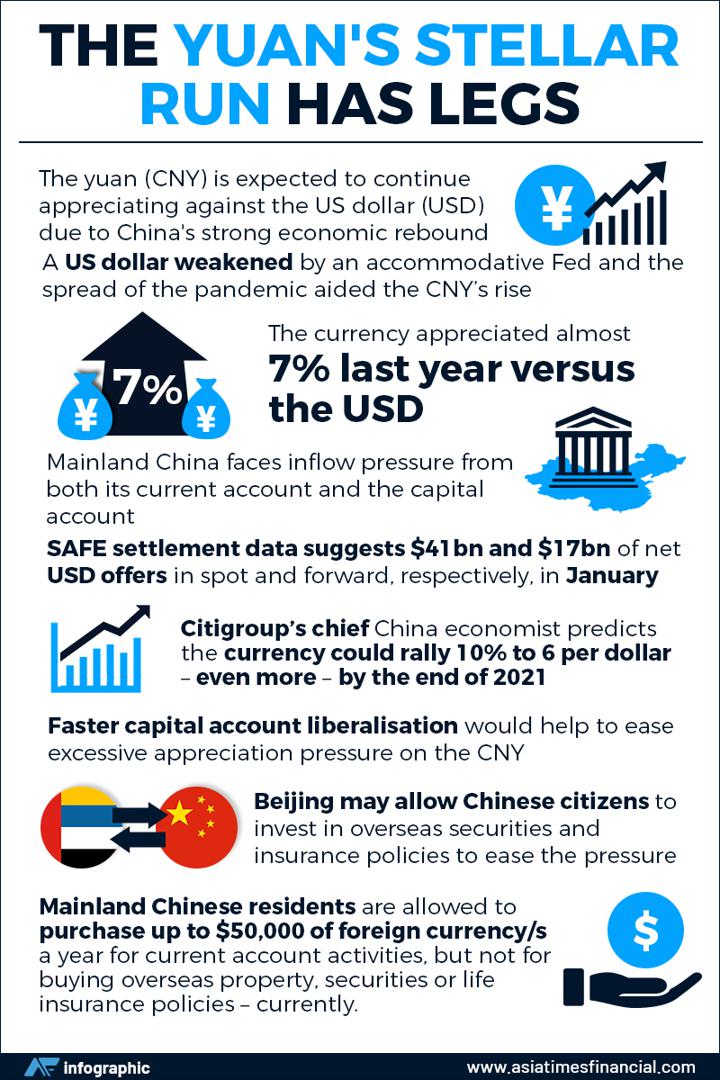

(ATF) The limit of US$50,000 in foreign exchange purchases by Chinese citizens may be lifted, and the ban on people taking or sending renminbi/yuan out of China looks set to be relaxed.

China’s Foreign Exchange Bureau has said that individuals may be allowed to spend more on overseas securities and insurance investments. The limit of $50,000 in foreign exchange purchases by Chinese citizens may be lifted, and the exit of yuan may be relaxed. A final decision on this has not been made yet, but there are indications suggesting this will happen soon.

Last Friday (Feb 19), Ye Haisheng, director of the State Administration of Foreign Exchange (SAFE)’s Capital Project Management Department, wrote that in 2021, studies will be conducted on the orderly relaxation of business restrictions on personal capital.

The main changes are as follows: The first is to amend the regulations governing the participation of ‘domestic individuals’ in the equity incentive plans of overseas listed companies – to remove the limit on annual foreign exchange purchases and payments, and “optimize the management process”.

The second is to study and demonstrate the feasibility of allowing citizens to invest in overseas securities and insurance within the annual facilitation quota of $50,000.

The third is to cooperate with the People’s Bank of China in piloting “QQ Music” in the Guangdong-Hong Kong-Macao Greater Bay Area, according to Tencent. QQ Music is an open platform a bit like a band camp.

Personal investment in Hong Kong and US stocks may become more convenient

Li Zongguang, chief economist of China Renaissance Capital, explained that overseas investment within the $50,000 quota is another major move in the opening of China’s capital account and an inevitable step toward internationalization of the yuan.

The introduction of reform measures at this time is related to the recovery of China’s economy over the past year, which has led to continuous rise of the yuan and an easing of the pressure on foreign exchange reserves. On the other hand, it also shows a determination and will to reform and open up the capital account, Li said.

Li Zongguang also noted that the short-term impact of the policy on markets will be limited. In fact, under the Shanghai-Shenzhen-Hong Kong Stock Connect set-up over the past year, the pressure for capital to go overseas has been obvious and the new policy will open the door even more. However, this policy will help the global allocation of residents’ assets, making it easier to invest in Hong Kong and the United States and other stock markets to obtain higher returns.

The chief research officer of CITIC Securities Bond Research pointed out that from the perspective of cross-border capital flows, an orderly relaxation of business restrictions on personal capital will make cross-border capital more volatile. While overseas cross-border funds can be “brought in”, the means for domestic personal capital to “go out” should be increased, so that cross-border capital flows can have a more balanced situation with both inflows and outflows. At the same time, an increase in the balance of cross-border capital flows also helps to maintain the basic stability of the yuan exchange rate at a reasonable and balanced level.

Impact on the yuan exchange rate

Li Zonguang also said that SAFE will strengthen its research. In response to the global economic downturn, the flooding of liquidity has created asset bubbles and other conditions during the epidemic. Li advise people to pay close attention to the financial/monetary policy trends of major economies, to regularly analyse changes in the international financial market; and to do in-depth research on the impact of unconventional foreign stimulus policies on China’s balance of payments, the yuan exchange rate, and the spillover effects of the financial market.

But adjustment measures via the personal capital account set-up would help internationalise the yuan.

Wen Bin, chief researcher of Minsheng Bank, said that the US dollar index has appreciated by 0.7% since the beginning of the year. Instead of devaluing the yuan against the US dollar, it has appreciated by 1%. The yuan exchange rate index, which is measured by a basket of currencies, has appreciated by 1.92% from the beginning of the year. The continued improvement of China’s economic fundamentals provides support for a stable yuan exchange rate.

Wen Bin also said that with the recovery of the global economy, demand for bulk commodities has increased, and inflationary trends have emerged. The CRB index, which reflects the price of bulk commodities, has risen 37.6% from its lowest point in April last year. Affected by expectations of inflation, although the Fed’s recent statement was still dovish, the bond yield on 10-year US Treasuries has exceeded 1.2%. Once the global monetary easing policy changes, it may lead to intensified global financial volatility.

“We should do a good job in researching the monetary policy trends of the world’s major economies and financial market trends – strengthen the monitoring of cross-border capital flows, and prepare risk management plans to ensure financial stability and financial security,” Wen said.

In addition, international financial expert Zhao Qingming believes that if the current policy is implemented, it will have little effect on the exchange rate because it is a liberalization of capital outflow, which will increase the demand for foreign exchange. The affect on the exchange rate will be short. But Zhao believes this will be a gradual process, and personal foreign exchange moves won’t be sudden. Therefore, the actual impact on the yuan exchange rate should be negligible, he said.