(ATF) The ATF China bonds indexes held broadly steady on Thursday as the People’s Bank of China (PBoC) injected 500 billion yuan ($74bn) via its medium-term lending facility (MLF), keeping the rate unchanged at 2.95% for the sixth consecutive month.

The move, which will amount to a net injection of 300bn yuan after 200bn yuan of MLF matures tomorrow, signals a concern about the rise in Chinese government bond yields and medium- to long-term rates, according to Ting Lu, Chief China Economist at Nomura.

“With a total net financing need of 1.8 trillion yuan in Q4, government bond yields would likely rise further if the PBoC does not accommodate this by adding more liquidity, especially longer-term liquidity,” Lu wrote in a research note.

He also added that the size of the injection lessened the probability of a reserve ratio rate cut this year.

ASIA MARKETS: Hong Kong stocks battered by US sanctions

“The PBoC clearly wants to use lower profile tools to add liquidity, and it also wants to put a lid on bank loan growth while maintaining its “wait and see” (policy easing) approach.”

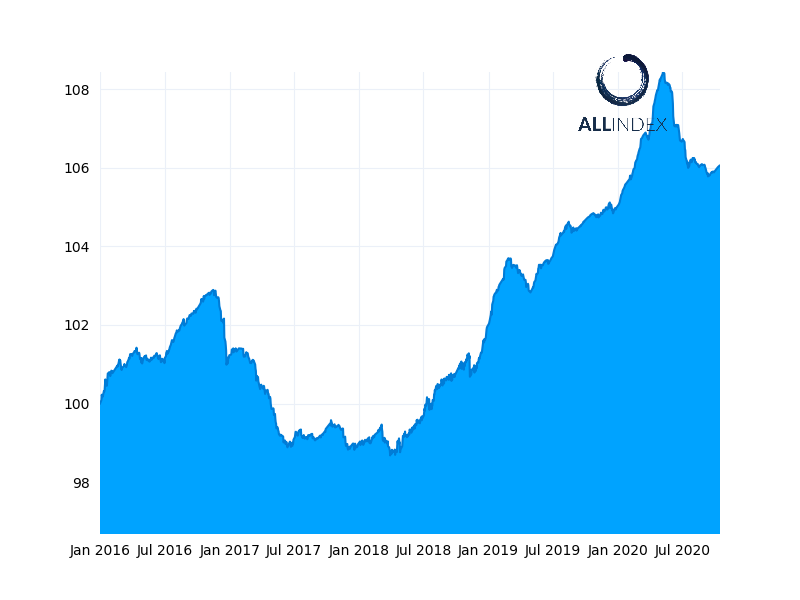

The flagship China Bond 50 index and the ATF ALLINDEX Enterprise didn’t move at all, the ATF ALLINDEX Corporates inched up 0.01%, while the ATF ALLINDEX Financial slipped just 0.02%.

Only the ATF ALLINDEX Local Government posted a significant move, falling 0.18% on the back of an announcement by Shanxi province that it had offered 3.32bn yuan of microloans this year. Accordingly, the bonds of the People’s Government of Shanxi dragged the index down, sinking 0.53% for a yield increase of 2.59%. The bonds were last traded on 24 September.

That aside, industrial and financial names posted the biggest moves of the day, with the prices of Nanjing Metro bonds rising 0.11% (for a yield decrease of 0.55%), while Urumqi City Construction bonds fell 0.51% (for a yield increase of 3.33%). The bonds, which are constituents of the ATF ALLINDEX Enterprise sub-gauge, were last traded on September 18 and July 27, respectively.

Meanwhile, the bond prices of Bank of Tianju fell 0.16%, for a yield rise of 2.19%. China Merchants rose 0.09%, for a yield decrease of 1.2%. The bonds, which are constituents of the ATF ALLINDEX Financial, were last traded on September 24 and 25, respectively.