Foreign investment into Australia will become more expensive as the recently elected Labor government looks to shore up finances.

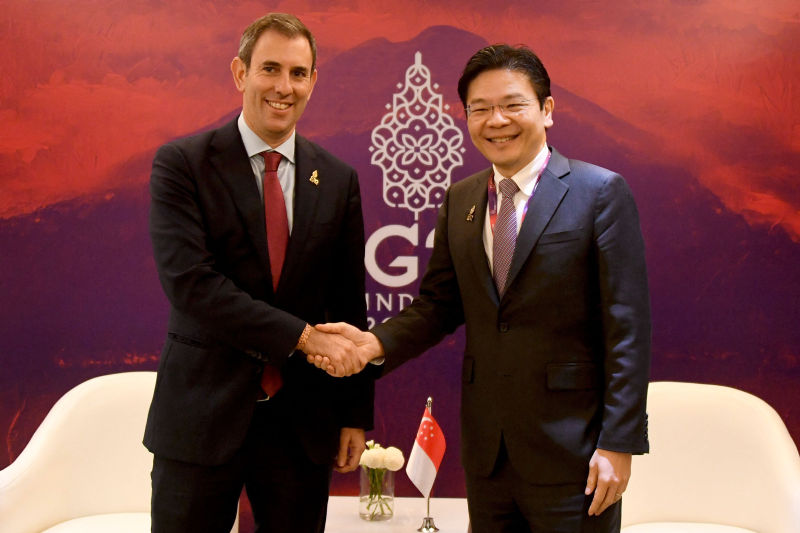

Treasurer Jim Chalmers said there would be an increase in fees and penalties for purchases of property, farms and businesses.

Chalmers said on Friday he is grappling with protracted budget deficits and needs to boost government revenue.

The higher fees are expected to generate an additional A$455 million ($315 million) in revenue over the next four years, Chalmers said.

The treasurer said he continued to back foreign investment in Australia but he had to make the decision due to “the state of the budget we have inherited from our predecessors”.

Chalmers earlier this week warned the country’s economic picture would be “confronting” as the government prepares to release updated economic forecasts to parliament on July 28 to account for faster inflation and rising interest rates.

“Foreign investment fees will continue to make up only a small proportion of total foreign direct investment,” he said in a statement. The new measures will take effect from July 29.

- Reuters, with additional editing by George Russell

READ MORE:

Australia’s BHP to Review Coal Mining After Royalties ‘Triple’

Acciona Plans $26bn Splurge on Australian Clean Energy – SMH

TikTok Says Australian Data Can Be Accessed in China