Australian biopharmaceutical firm CSL said its first-half profit fell as the Omicron Covid-19 outbreak stopped people giving blood plasma, the core of its treatments, but declared a return to pre-pandemic collections, sending its shares soaring.

The vaccine unit of Australia’s biggest biotech firm has benefitted from heightened demand for inoculations amid the pandemic, including for the AstraZeneca coronavirus vaccine it makes in Australia.

But most of its profit comes from selling blood plasma treatments for rare diseases.

“We anticipate a return to pre-pandemic collection levels,” CSL chief executive Paul Perreault told reporters on a call on Wednesday after the earnings were released.

“The underlying demand for these products is still quite robust. The problem is the raw material.”

The company’s shares were trading up 7% by mid-session, their biggest intraday gain since March 2020, helping push the broader market up 0.5%. The former Australian government laboratory is now the country’s fourth-largest company by market capitalisation.

The interim result “exceeded our forecasts and consensus expectations”, RBC Capital Markets analyst Craig Wong-Pan said in a client note.

Full-Year Profit

Jefferies analysts noted that CSL stuck to previous guidance of a full-year profit between $2.15 billion and $2.25 billion, down from the previous year’s $2.38 billion.

But it said the guidance now factored in $90 million to $110 million of costs to buy Swiss drugmaker Vifor Pharma AG, implying a 5% upgrade in earnings to offset those costs.

In the first half, net profit fell 5% to $1.72 billion on a constant currency basis, the company said, declaring an interim dividend of $1.04 cents per share, same as last year.

The pre-tax profit contribution from its plasma unit fell 22%, while profit from its vaccine division jumped 24%. Since the same period a year earlier, the profit contribution from the company’s vaccine unit has risen from 30% to 40%.

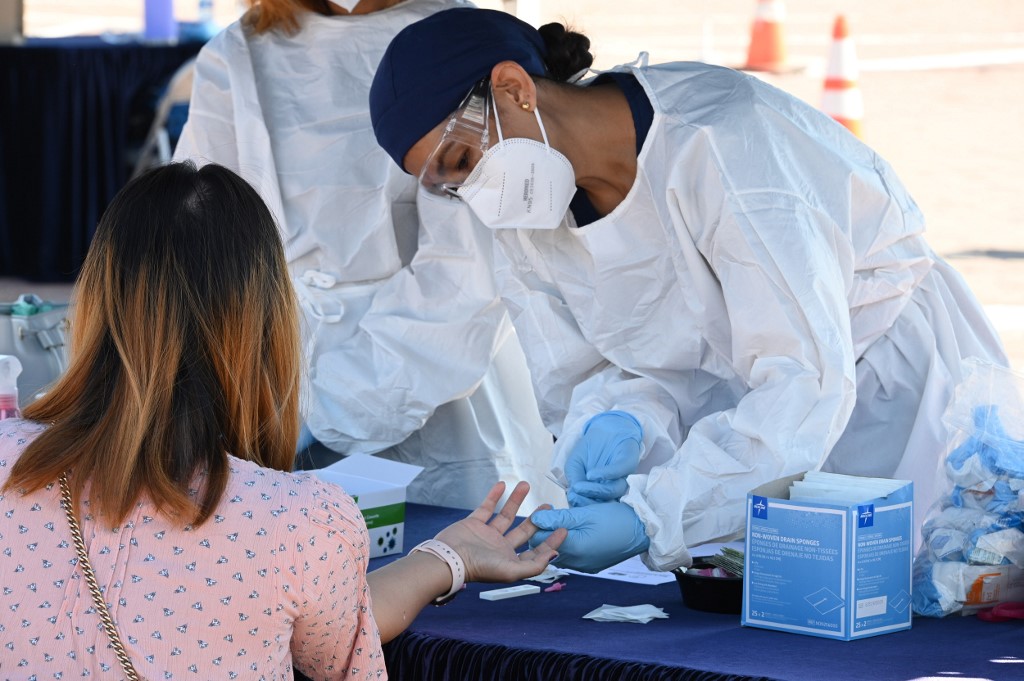

CSL has reported continuous disruption with plasma donations since the pandemic began. It said it had sought to offset the collection downturn by raising the fees it pays its donors – most of whom are in the United States – opening new centres and ramping up its marketing.

The turnaround in collection volumes had started since the company took a more assertive approach in April 2021 but would not immediately be reflected in profits because of the lengthy time to convert the plasma into treatments, CEO Perreault said.

- Reuters with additional editing by Jim Pollard

ALSO READ:

Vaccines to accelerate Asian economic recovery

Biotech M&A Tumbles to Lowest in a Decade – FT

China’s Walvax Biotech Withdraws Hong Kong IPO – Caixin