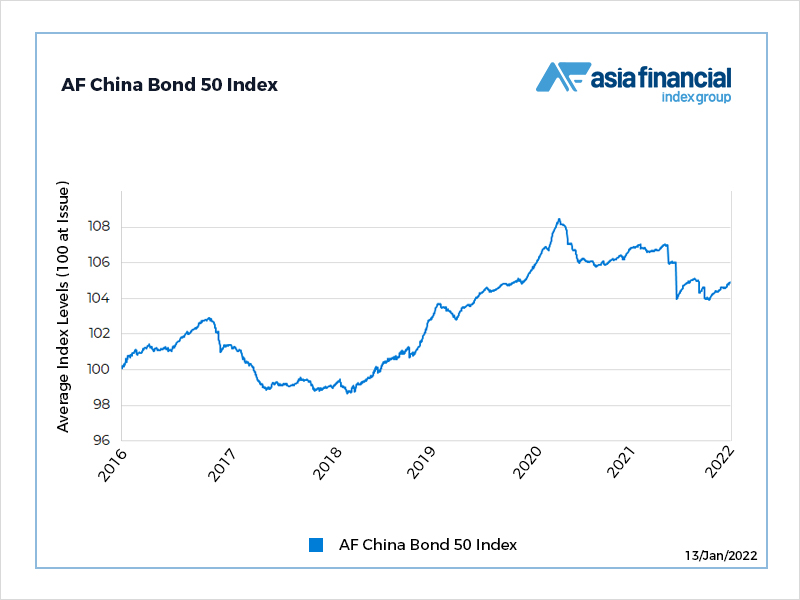

Chinese government bond yields fell across the curve on Wednesday after the central bank‘s vice governor said it would roll out more policy measures to stabilise the economy amid signs of weakening growth momentum.

China’s central bank “should hurry up, make our operations forward-looking, move ahead of the market curve, and respond to the general concerns of the market in a timely manner,” People’s Bank of China vice-governor Liu Guoqiang said on Tuesday, calling for policies conducive to economic stability.

Liu’s comments followed an unexpected cut to borrowing costs for medium-term loans on Monday, as fresh economic data showed signs of weakening consumption and a property downturn, despite a robust headline growth figure.

“The bond market rally will persist for a while as investors digest. I don’t really think the dovish comments [from Liu] were the trigger. In essence, it was the unexpected rate cut,” a trader at a Chinese bank said.

The benchmark 10-year yield fell as much as 5 basis points to a low of 2.71% in early trade on Wednesday, its lowest since June 2020. The drop narrowed the spread between Chinese and US 10-year yields to about 83 basis points, its narrowest since May 2019.

The five-year yield dipped 4 basis points to 2.42%.

“Don’t fight the central bank,” Qin Han, analyst at Guotai Junan Securities, said in a note. “Monetary loosening is the card on the table”

- Reuters with additional editing by Jim Pollard

ALSO READ:

Some China Bond Fund Losses Top 20% Amid Real Estate Crisis

Eastspring Survey Shows Bullish Appetite for China Bonds

Evergrande Sparks ‘Vortex of Fear’ In China Bond Market