Trade of the Day: European and US risk assets falter on rapidly expanding Covid-19 threat; US Treasuries and gold rally.

Quote of the Day: “After the largest fall in global stocks since 2008, a widening of credit spreads, and a rise in volatility, we think the market dislocation is creating opportunities for investors, and add exposure to US high yield credit, TIPS, and indirectly to US equities through options in our tactical asset allocation,” said UBS Global Wealth Management CIO in its latest commentary.

Stock of the Day: Meat products company WH Group rose as much as 5.9% after Morgan Stanley rated it an overweight target with a target of HK$10, implying an 18% upside from the current level.

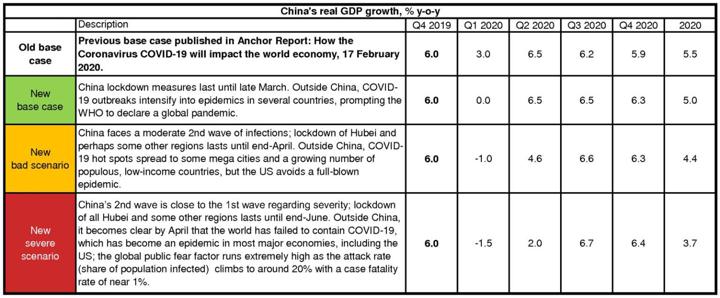

Number of the Day: -1.5% – Nomura’s renewed GDP forecast for China for Q1 in case the pandemic becomes a “severe scenario.” GDP for Q1 would contract -1% in a “bad scenario” and the base case scenario would be 0%.

Tip of the Day: “The Fed’s actions should make it easier for the ASEAN central banks to deliver on our expectations, especially for countries that also want to maintain currency stability. In this regard, we bring forward the timing of rate cuts in Indonesia (from April to March) and the Philippines (from May to March), while maintaining it for Malaysia (May) and Thailand (2Q). The odds of a downward re-centering move by MAS have also increased further, but this has more to do with the downshift in inflation trajectory than the Fed actions,” said Faiz Nagutha, BofA Securities analyst.

Mounting virus infections count in South Korea, Italy and Iran, with each country registering thousands of cases, rattled investors in Europe and ahead of Wall Street opening on Thursday, overshadowing Asia’s gains. Earlier MSCI Asia Pacific ex-Japan index rose 1.15%, Japan’s Nikkei 225 added 1.1%, Australia’s S&P ASX 200 climbed by an identical 1.1% and Hong Kong’s Hang Seng index surged 2.1% as consumer non-cyclicals, technology and insurance propelled the benchmark.

In contrast, European and US markets are showing marked weakness. The Stoxx Europe 600 Index tripped 1.4% and S&P Futures tumbled 1.9%, indicating a weak start on Wall Street. US Treasuries rallied across the curve with the 10-year yield plummeting to 0.97%.