After quickly surging through the ranks of smartphone-makers in China, Huawei is starting to make its presence felt beyond the mainland.

In Hong Kong, an increasing number of smartphone shops have begun selling phones made by the tech giant — that was, just two years ago, on the verge of collapse.

“Everybody is stocking up on some Huawei right now. Some more, some less,” said Simon Lam, owner of a popular smartphone shop named Trinity Electronics in the city-state.

Also on AF: China Poised to Wreak Havoc with Major Cyberattack: UK, US

“People are willing to pay a lot of money for high-end Huawei, something other brands really can’t compare with.”

Reach beyond the mainland comes at a time when multiple new launches from Huawei have led to a 70% jump in sales for the smartphone giant in the first quarter of the year.

“Xiaomi, Oppo and Vivo are all being affected (by Huawei’s comeback),” said Toby Zhu, an analyst at research firm Canalys, referring to other Chinese smartphone makers.

“But for now, the biggest impact has been on Apple.”

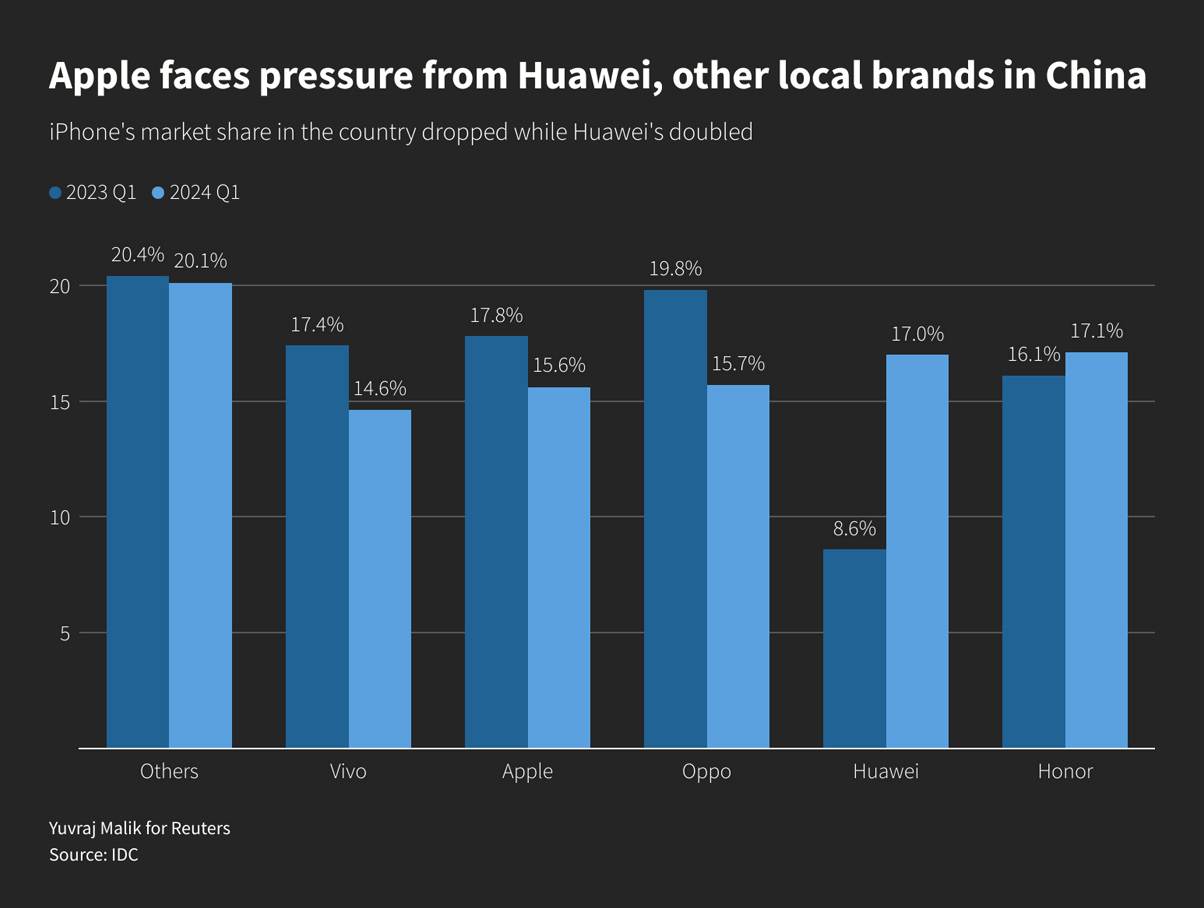

In the first quarter, while Apple saw a 6.6% plunge in iPhone sales in China, Huawei boosted its smartphone shipments by 110%, according to IDC data.

Effectively, Huawei overtook Apple as the second-biggest smartphone vendor in China.

The company is now stepping up a marketing blitz, mounting an even bigger challenge to Apple.

Flashy new stores

In Shanghai, Huawei recently renovated a shop spanning three floors of a famous heritage architecture building — situated directly across from Apple’s flagship store.

The store includes a coffee shop and a gym.

Huawei opened four such stores in major Chinese cities between December and February.

“The Huawei flagship store is very nice. It looks much brighter inside compared to the Apple Store across the street,” said Amy Chen, a 27-year-old physiotherapist who visited the Shanghai store this week to switch to Huawei’s top-end Pura 70 Ultra from the iPhone 15 Pro in hopes of better mobile reception.

Apple has 47 stores in mainland China. Huawei, which did not open a flagship store until 2019, now has 11 of them.

“I think they will open more than 20 of them. Then it will eventually catch up to Apple,” said Ethan Qi, associate director at research firm Counterpoint.

It marks a stark contrast to 2021 when the company’s licensed stores were shuttered across China due to product shortages caused by the US sanctions.

Huawei has since developed its own chips, introduced highly popular 5G-capable products and, according to sources, has started aggressively recruiting dealers in recent months.

Premium prices, products

Lucas Zhong, another analyst at Canalys, said Huawei had plans to build out its flagship stores since 2020 but the progress was slowed by the US sanctions, which led to a much slower iteration of its high-end products.

There are still supply-chain issues leading to shortages of specific models, but they are under much better control and the new phones are garnering good reviews. That means Huawei is now putting its focus squarely on selling premium products that compete with Apple, according to analysts.

Its latest Pura 70 Ultra smartphone, for example, starts at 9,999 yuan ($1,300), matching the price tag of the iPhone 15 Pro Max. In contrast, Samsung and Xiaomi are keeping prices for their premium models lower amid soft market demand.

Huawei’s luxurious flagship stores display premium products ranging from smartphones to tablets, smartwatches, televisions and even electric vehicles made in partnership with Chinese automakers.

“Huawei now has a long product line,” Counterpoint’s Qi said. “They need big demo areas… They will have to do it themselves because their distributors don’t have the capability to rent such a massive area.”

Distributor army

The push to build more of its own stores also underscores Huawei’s heavy reliance on offline sales.

Between 70% and 80% of Huawei’s sales come from physical stores, while Apple sees about 40% of its sales coming from online, Canalys’ Zhu said.

But those large sales come on the back of a long-line of distributors.

“As Huawei now manages to ship in large quantities, given the good profit margin they could provide, (distributors) have become willing to purchase Huawei devices again,” Counterpoint’s Qi said.

“Previously, many couldn’t get stock and their 4G devices didn’t sell well.”

Huawei has been actively bargaining with distributors, touting the above industry average profit margins of its phones and sometimes demanding exclusionary clauses to turn them into its exclusive partners, according to two industry sources.

More than 5,200 stores licensed to sell Huawei products sprang up through the first 10 months of 2023, with more than half of them in third and fourth-tier cities, according to market research firm GeoQ, helping Huawei expand its army of distribution partners nationwide.

- Reuters, with additional editing by Vishakha Saxena