Renesas Electronics, one of Japan’s biggest semiconductor makers, plans to expand domestic production in Japan instead of building plants overseas.

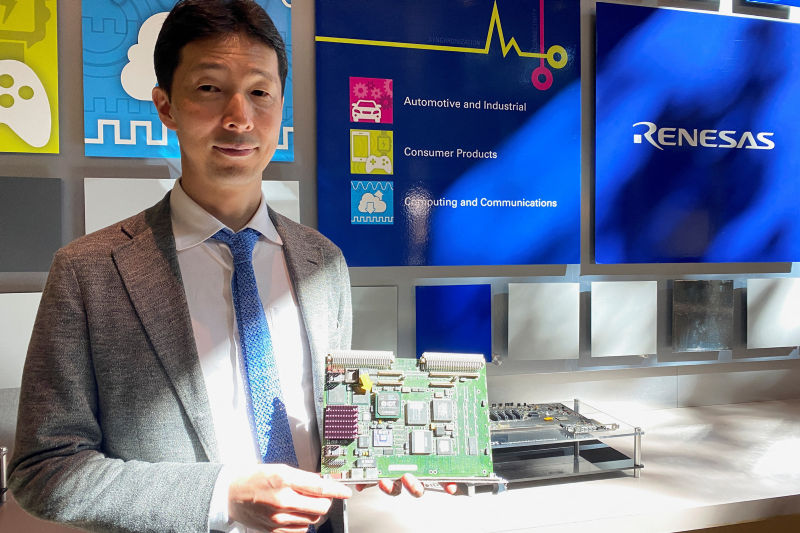

Chief executive Hidetoshi Shibata said a shortage of supplies of raw materials in Europe and North America was a greater risk than boosting production in Japan.

While manufacturing in Japan was susceptible to earthquakes, Shibata said Renesas was investing in technologies to cope with challenges from natural disasters.

“When it comes to front-end production, I don’t necessarily believe there are good supplies of ingredients in geographies like Europe or the US,” Shibata said.

He spoke in Silicon Valley after meeting with employees of US chip companies that Renesas acquired in recent years.

Front-end production is the process of creating chips on wafers – round shiny plates of silicon. They are then sent for packaging, often in black plastic casings.

Shibata said Renesas would keep a stock of chips that it could supply to customers in case of stoppages.

Renesas said in May it would invest 90 billion yen ($650 million) in its previously closed Kofu factory in Japan, revamping it to build power chips – semiconductors that manage electricity.

Major Supplier of Automotive Chips

Renesas, whose shareholders include Toyota and automotive component company Denso, is a major chip supplier for the automotive industry.

Shibata said that, while there was “sufficient capacity worldwide to cope with all the demand,” there were still areas of sharp shortages in power management chips and some analogue and mixed-signal (analogue and digital) chips with larger transistors.

Generally, the smaller the transistors, the faster and more powerful a semiconductor will be. While the latest smartphones have chips with 5 nanometre (nm) transistors, the automotive industry uses more mature technology, often 40nm or larger.

Shibata said Renesas’s manufacturing expansion would stick with 40nm or larger technology to meet that demand.

Still, the company continued to design chips that were close to the latest technologies, he said, and its automotive customers were “sampling” the 7nm chip Renesas has sold, although it is made by other chip manufacturers.

- Reuters, with additional editing by George Russell

READ MORE:

Japan’s Renesas, India’s Tata Elxsi Partner In EV Design Hub

Japan’s Renesas to buy Apple supplier Dialog for $6bn

Japan’s Nidec to Streamline Chip Purchases Amid Supply Woes