LONDON: Rich governments scrambling to defend their economies from the coronavirus pandemic are being urged to coordinate to ward off a long-lasting global recession and future waves of infections from poorer nations.

The head of the OECD group of advanced economies said the coordination ought to exceed both the 1930s New Deal and the Marshall Plan, which rebuilt Europe after World War II.

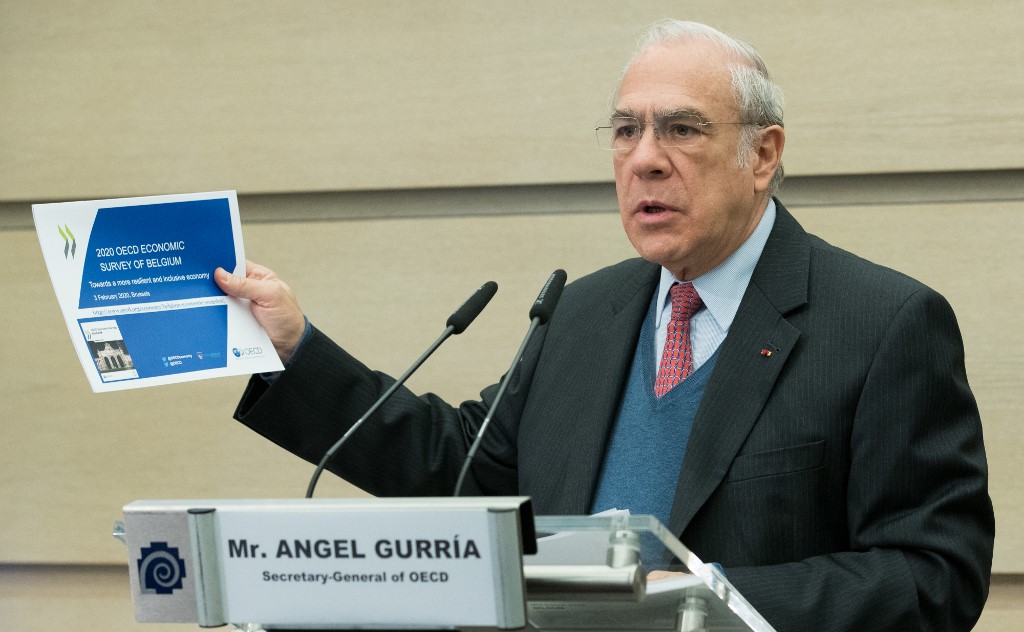

A global recession looks “increasingly likely” in the first half of this year, “and we must act now to avoid a protracted recession”, said Angel Gurria, secretary-general of the Organisation for Economic Co-operation and Development, itself a creation of America’s Marshall Plan.

“Only a sizeable, credible, internationally coordinated effort can deal with the immediate public health emergency, buffer the economic shock and develop a path towards recovery,” he said in a statement.

While many governments are unveiling titanic spending packages against the Covid-19 pandemic, exceeding even the 2008 financial crisis, there has so far been no collective action plan from groups such as the G7 or G20.

The G20’s Saudi presidency is preparing a virtual summit, and Allianz chief economist Ludovic Subran agreed concerted action is needed for poorer nations, especially in Africa.

“All the international measures have been taken without any coordination, it is quite unprecedented,” he said.

Gurria said governments had to work together to ensure progress on the scientific front including mass testing and vaccine research.

On the economic front, he said authorities should address areas such as direct cash help for the self-employed, who in some countries are not receiving the help being offered to those in full-time or salaried jobs.

Amid talk of bailouts for strategic companies, the OECD chief said governments should also extend aid to small and medium-sized companies, especially in services and tourism.

“Everything must be done to earn the confidence of citizens, who felt the weaknesses in our economies before all this began,” he said.

‘Wishful thinking’

Richer governments and their central banks are raising trillions of dollars to combat Covid-19, but concerns are mounting for poorer ones without access to capital markets and adequate health systems.

“If South Africa can’t afford to control the virus, it will spread again. No country can afford to keep every other country banned from travelling,” Charlie Robertson, global chief economist at Renaissance Capital in London, said.

“So I would argue there has to be a global financing solution to address this virus crisis,” he said, urging action from the G7 and G20 nations.

The G7 club of most advanced economies could borrow on behalf of the less developed at current rates of next to zero, Robertson suggested.

However, under the isolationist US presidency of Donald Trump, talk of global coordination has yet to resonate, and Washington is struggling to bridge its own fissures. US lawmakers have failed so far to agree on a trillion-dollar emergency package to shore up the crumbling American economy.

Democrats said the Republican plan failed to sufficiently protect millions of workers or protect the under-equipped healthcare system.

The global death toll from the virus has surged past 14,400, with nearly a billion people confined and non-essential businesses shut in dozens of countries.

In a BBC interview, Gurria said the belief of G20 policymakers a few weeks ago that the world could enjoy a V-shaped recovery from the pandemic was “wishful thinking”.

Countries would be dealing with the economic fallout “for years to come”, he said.

Neil Shearing, chief economist at Capital Economics, said it was possible that most economies would return to their pre-coronavirus trends for GDP within a couple of years.

But a permanently lower path of GDP was also possible, he cautioned.

“The risks are greatest in highly indebted countries in the eurozone and EMs (emerging markets) with fragile balance sheets.”

AFP