Russia is looking to China, India, Iran and Turkey to plug the gap created by an exodus of western retail companies, an industry body has said, as Moscow grapples to find ways to combat its growing isolation in the face of sanctions.

The Russian Council of Shopping Centres (RCSC), an organisation representing developers, shopping centre owners and retail chain operators, said it was negotiating with its corresponding representatives in the four countries about finding alternatives to western brands.

“A list of foreign companies that have temporarily ceased operations in Russia was sent to them so that appropriate equivalents can be found,” a statement on the RCSC website read.

“Over time this will help supplement or completely replace goods of the defunct brands with ones of a similar quality and design.”

Also on AF: Chinese Trade With Russia Feels Sting of Ukraine, Sanctions

Dozens of big brands have temporarily shuttered operations or exited the country since Russia sent tens of thousands of troops into Ukraine on February 24 in what it calls a ‘special operation’.

Sanctions have hampered supply chains and fuelled panic buying among some Russians, with medicine and sugar shortages reported, and accelerating inflation is set to send prices higher.

During an RCSC meeting of more than 100 market participants, the challenges facing Russian retailers were discussed.

RCSC cited Igor Maltinsky, director of development at Melon Fashion Group, as saying that the main challenge facing domestic retail firms was the uncontrollable growth of production costs, due to huge increases in procurement and logistics costs, as well as many other related factors.

Melon owns four, mainly women’s, fashion brands – Zarina, Befree, Love Republic and Sela – and had 846 stores across Russia and CIS at the end of 2021. It had been planning to hold an initial public offering (IPO) this year.

On Thursday, Swedish real estate firm Eastnine, a minority shareholder in Melon, said the planned IPO had been postponed. It said western sanctions had negatively affected the company, making valuing it very difficult.

• Reuters with additional editing by Jim Pollard

ALSO on AF:

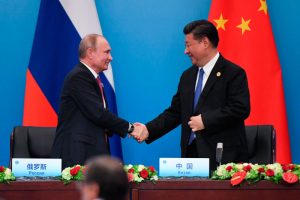

US Warns China Against Helping Russia as Sanctions Mount

Sanctions Limiting China’s Access to Russian Oil, Says Yellen

Russia’s Economy Seen Crumbling Over Time Under Sanctions