(ATF) Economic events

Financial markets will be edgy this week despite the progress on the vaccine front, after new US Covid-19 cases accelerated at a record pace and more European cities extended lockdowns to tackle the worsening coronavirus spread.

Optimism from Pfizer and BioNTech announcing promising results for their vaccine, has propelled US stocks to record highs with Wall Street quite satisfied with the corporate earnings posted so far.

Still there is caution in the air as US President Donald Trump remains unpredictable in his final days in office particularly in his dealings with China. Last week, Trump issued an executive order banning US people from transacting in securities of 31 companies that the Department of Defence (DoD) has identified as “Communist Chinese military companies” using an obscure law in his ongoing tirade against Beijing.

“The direct financial impact will be moderate – particularly given the phased-in implementation – but the ripple effects are large. The order would also apply to US investors in exchange traded or mutual funds that include securities from the listed Chinese firms. It would thus force index providers to drop these stocks – the most likely outcome – or force US investors sell their holdings in funds tracking the indices,” Michael Hirson and Allison Sherlock of the Eurasia Group said in a note.

On the economic data front in Asia, it will be a busy week. Central bank meetings are being held in China, Indonesia, Philippines and Thailand and third-quarter GDP data will be released in Japan, Singapore and Thailand. The barrage of October data will give an insight on what to expect in the fourth quarter.

“China’s industrial production growth should see some softening in October due to the National Day holiday, while retail sales should get an extra boost for the same reason. Hong Kong SAR is likely to see deeper negative CPI inflation as unemployment continued to grind higher,” ING Bank’s Senior Economist Prakash Sakpal said.

He said that Taiwan’s export order growth for October will serve as a leading indicator for the rest of Asia’s exports, as the electronics-led export recovery has gathered momentum. And Japanese and Singaporean exports will be tracked for the same reason. Australia’s labour report should reinforce an increase in activity amid an improved Covid-19 situation, he said.

Fund flows

Equity Funds, especially those dedicated to large cap plays were the big beneficiaries in the week to November 11 amid growing hope that President-elect Joe Biden will head the next US administration. This added momentum to a market which is increasingly factoring in a successful vaccine release in 2021.

US Equity Funds recorded their second largest inflow since fund tracker EPFR started tracking them two decades ago and Emerging Markets Equity Funds recorded their eighth consecutive inflow in that week, with overall flows hitting levels last seen in the first quarter of 2018. Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds received most of these inflows, which also reflected the biggest weekly influx of retail money since early 1Q13, according to EPFR.

“The prospect of a new president with more conventional views on foreign and trade policy and an inclination towards economic stimulus boosted flows into US Equity Funds, especially those investing in the large capitalisation plays expected to benefit from reduced trade friction and seen as better able to cope with additional regulatory costs,” Cameron Brandt, EPFR director of research, said.

In the past week Asia Pacific bond funds recorded their highest inflow since the first quarter of 2012 and EM bond funds recorded their sixth straight inflow and 18th since the beginning of 2Q20.

EM Asian equities (ex-China) saw foreign inflows of $6.3 billion last week, the largest weekly net buying since 2015, Goldman Sachs analysts said citing local exchange reports. India, Korea, Taiwan and Thailand saw net buying of $1-2 billion each.

“Foreign investors sold $62 billion from mid-January until late May and have been mostly cautious during the rally until recently, suggesting light foreign positioning overall. Over the past two weeks, FII have net bought $12 billion in Asian equities,” they said in a report while adding that on a global basis Equity funds saw record inflows of $44 billion, the largest weekly inflow since 2000.

The liquidity boost in emerging markets is also due to domestic factors.

“Domestic liquidity in Emerging Markets remains abundant and can help to support a strong growth recovery in combination with the vaccine. To capture the abundance of ‘free’ liquidity in EM, we calculate the year-on-year percentage growth of real M1 relative to the growth of PMIs, which basically captures how much liquidity is growing relative to the size of the economy; we aggregate the national numbers by the GDP weights,” BofA Securities analysts said in a note.

Their analysis showed this ‘free liquidity’ is currently growing at the fastest rate since the Global Financial Crisis.

Economic data calendar

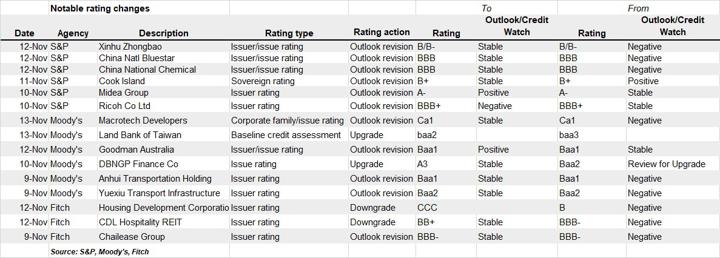

LAST WEEK’S RATING CHANGES