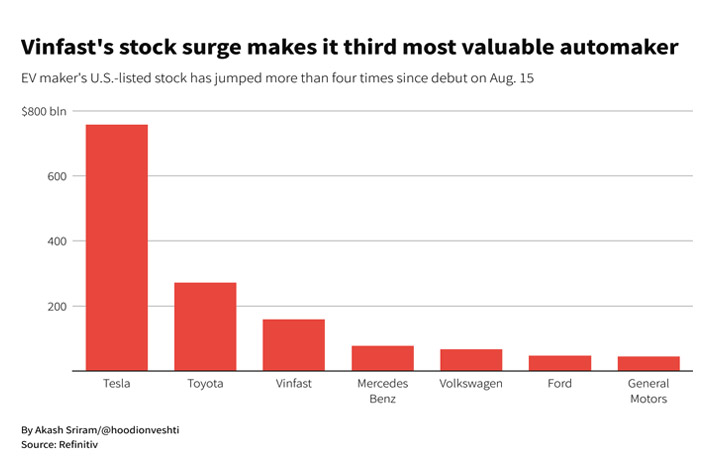

An eye-popping rally in shares of VinFast has made the Vietnamese electric vehicle (EV) maker the world’s third-most valuable car company after Tesla and Toyota.

Shares of the still loss-making automaker have rallied more than 333% over the past five trading sessions, largely as its small float made VinFast stock vulnerable to speculation and volatility.

VinFast’s Nasdaq-listed shares have jumped or slumped more than 14% in 11 of the past 12 sessions. On Monday, they rallied close to 20% to end the day at a price of $82.35 per share and a valuation of roughly $190 billion.

Also on AF: Loss-Making VinFast Needs Revamp to Live Up to its Valuation

The EV-maker made a blowout debut on Wall Street just two weeks ago following a merger with SPAC partner Black Spade Acquisition. Its valuation, as part of the merger, was just $23 billion.

Vinfast is almost entirely controlled by Pham Nhat Vuong, Vietnam’s richest man and founder of parent conglomerate Vingroup, with a stake of about 99.7%, according to a filing.

‘No one getting rich’

Vinfast’s shares were among the most actively watched on Stocktwits, a popular website with retail investors.

But despite the market enthusiasm, it was unlikely that any retail investor was getting rich off the stock, Barron’s reported.

Of the hundreds of billions added to the automaker’s value, wealth created from trades was only around $1 billion, the Barron’s report said. Most investors have held VinFast stock for roughly 1.5 days, the report added, making it unlikely that any investor has benefitted from the entirety of the past five sessions.

VinFast insiders are the likely beneficiaries of the majority of the rally, but their winnings are mere “paper wealth” as they can’t yet sell their shares, the report added.

Furthermore, given the track record of earlier SPAC-based listings like Lucid and Nikola, it is likely that VinFast share price will eventually cool as the frenzy wears off.

Long way to go

Vinfast faces a long road before it can start competing meaningfully with Tesla and legacy automakers that are pouring billions of dollars into grabbing a share of the EV market.

Only 137 Vinfast EVs were registered in the United States through June, according to S&P Global Mobility.

The firm is also entering the US and European markets at a time when EV demand is slowing and Tesla has waged a price war to defend its dominance.

Vinfast expects to sell as many as 50,000 electric vehicles this year, compared with Tesla’s projection to deliver 1.8 million cars.

To drive sales, Vinfast is breaking away from the direct-to-consumer approach used by Tesla and turning to dealers. The company is also building a $4 billion factory in North Carolina.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

VinFast Recalls First Batch of EVs in US Over Dashboard Risk

VinFast Expecting 7-Fold Bump in EV Sales With US Expansion

Vietnam’s VinFast Finally Rolls Out VF9 Electric SUV

Vietnam’s VinFast Taps Banks for $4 Billion for US EV Plant

Hyundai, Honda Partner EV Rivals to Take on Tesla Supercharger

Chinese EV ‘Invasion’ Forces Western Rivals to Slash Costs