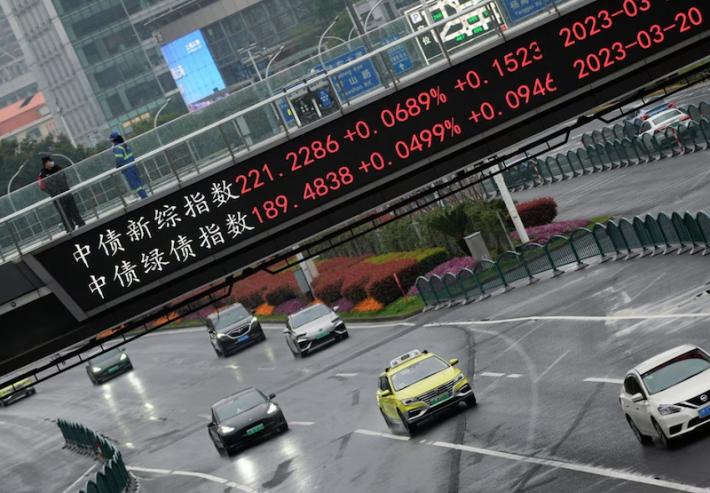

Latest News: AF China Bond 50 Index

Chinese foundries that would earlier use only a small amount of equipment from domestic firms, now want "as few foreign machines as feasible"

Analysts say BRI’s shift from investment intensive projects like dams to high-tech ones comes amid Xi's push to export Chinese ideas about governance

China's deepening property crisis has added to the pressure on local municipalities, with developers in no shape to buy new plots of land and provide some revenue

Liu Liange is the latest influential Chinese figure from the $57 trillion financial industry to face scrutiny amid Xi Jinping’s signature anti-graft campaign

The rules come after senior management of a Chinese automobile parts-maker was found to have lent shares to short-sellers on the first day of trading after its IPO

Chinese policymakers "seem to be ignoring everything they learned” from Japan's 15-year period of economic stagnation, one official warned

Sources say Wang is being investigated in relation to a probe into Zhu Congjiu, a former senior official at Chinese securities regulator CSRC

China's muted diplomatic stance - calling for de-escalation but stopping short of condemning Hamas - has also added to investors' nervousness

The move will likely be announced at a summit with the US, which had asked Brussels to move against Chinese steel producers

In order to meet the demands of the rapidly developing AI industry, Beijing also plans to improve computational infrastructure in western China

The Belgian security service is monitoring Alibaba’s operations, with scrutiny on software systems that collate sensitive data and the need for the group to share information with Chinese authorities

Police scrutiny of Evergrande, and now its chief, has complicated debt restructuring efforts by the world’s most debt-laden property developer

AF China Bond

- Popular