Latest News: AF China Bond 50 Index

Foreign firms have been particularly concerned about stepping over the line while dealing with Chinese regulators, amid Beijing’s crackdowns on due diligence and consultancy firms

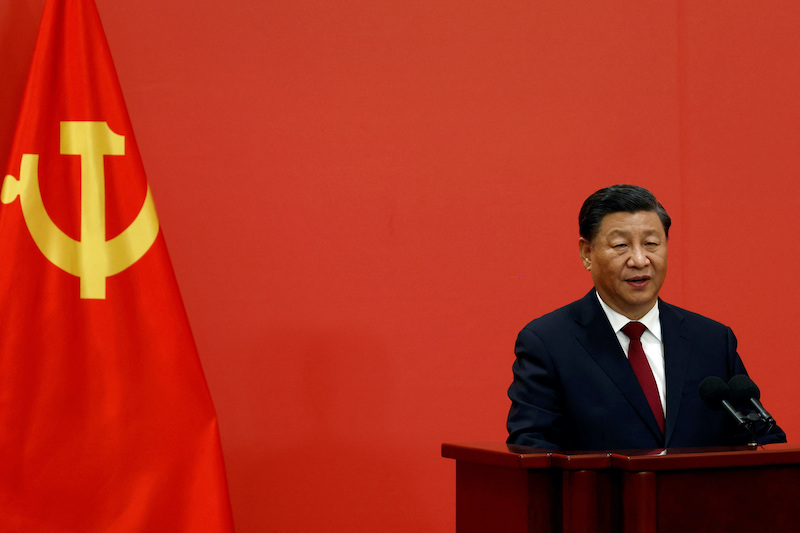

While the planned diplomatic exchanges are aimed, in part, at restoring ties, Xi is also said to be hoping they will slow down Washington’s trade and tech war targeting Beijing

The pledge comes amid Chinese president Xi Jinping's increased focus on national security risks within the party, government, and large industries

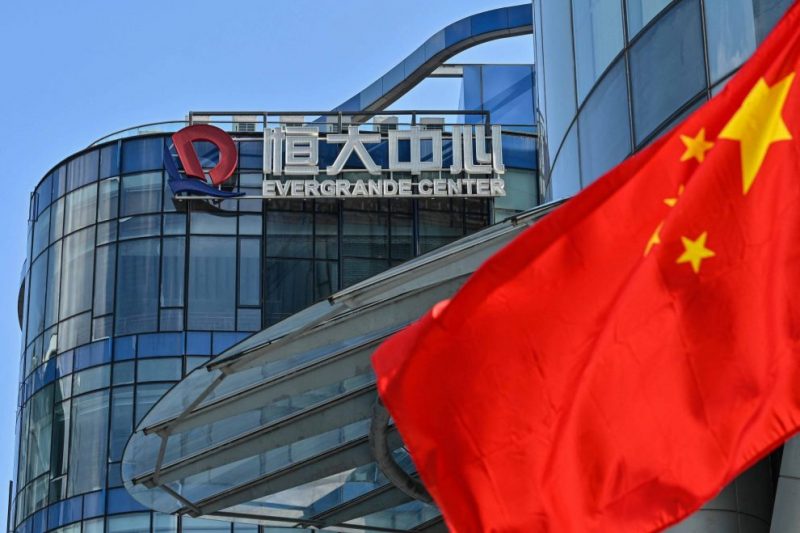

The developer's already battered Hong Kong-listed shares slipped more than 8% on Tuesday, taking the stock's losses to more than 27% in two days

The ban is reportedly connected to Beijing’s investigation into top tech dealmaker Bao Fan, whose disappearance early this year shook the business community in China.

Huawei’s planned event comes on the heels of Apple’s iPhone 15 launch event held on Tuesday, which received mixed reactions in China

Apple's globally anticipated event to launch its latest iPhone 15 saw mixed reactions in China - the company's third largest market

Eddie Wu, a long-time lieutenant of former Alibaba chief Jack Ma, takes charge of the company amid its biggest organisational restructure of its 24-year history

The cloud unit is Alibaba's second-biggest money spinner, valued at $41 billion to $60 billion ahead of an IPO planned for next year

The announcements come on the heels of a series of nationwide support measures announced by Beijing for the property sector

China's consumer prices returned to positive territory while factory-gate price declines slowed, pointing to signs of stabilisation in the economy

The development follows sanctions-hit Huawei's success in building an advanced 7-nanometer processor, in collaboration with state-backed SMIC

AF China Bond

- Popular