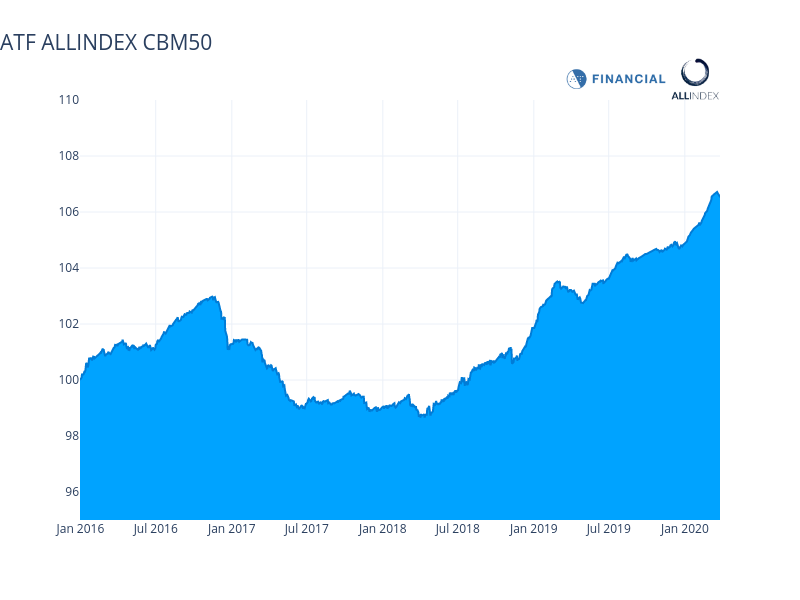

(ATF) – The ATF ALLINDEX CBM50 fell the most since mid-February on Friday, completing its first weekly decline in more than four months.

Equity markets traded firm during Asian hours after the G-20 offered a stimulus pledge but by the time European markets opened the rally had lost steam. The coronavirus infection count in the UK, France and Germany were reflected in their respective markets.

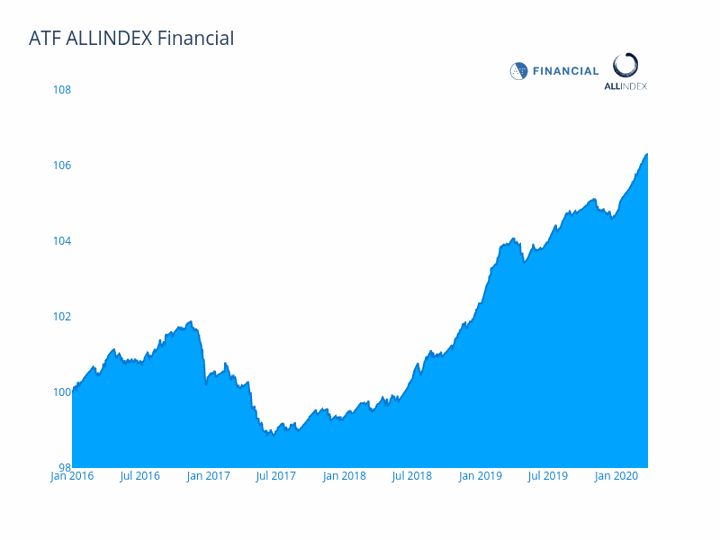

The ATF ALLINDEX CBM50 fell 0.05% on the day and o.14% in the week. Friday’s drop was due to a coupon payment by Shanghai Pudong Development Bank, which ended the day at 106.53. This led to a 0.07% fall in the Financial index to 106.29. The index fell the most this week since mid-December.

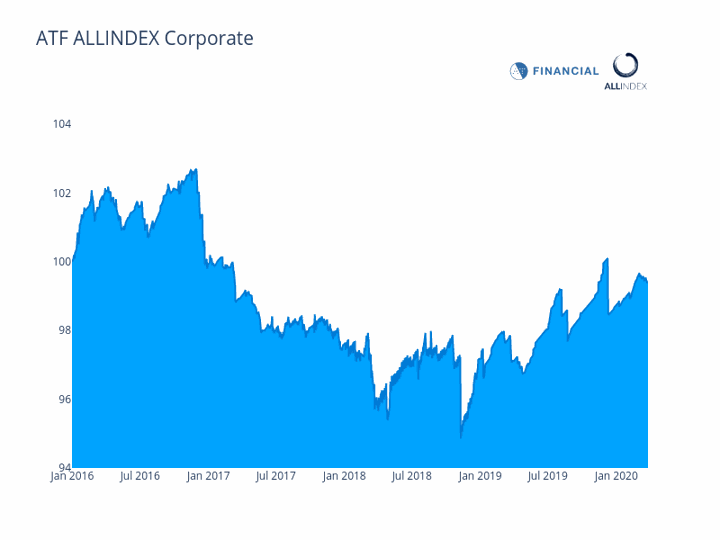

The Corporate index finished 0.03% lower at 99.39. The ATF ALLINDEX Enterprise index stayed firm and ended 0.02% higher, as did the Local Government bonds, which edged up 0.01%.

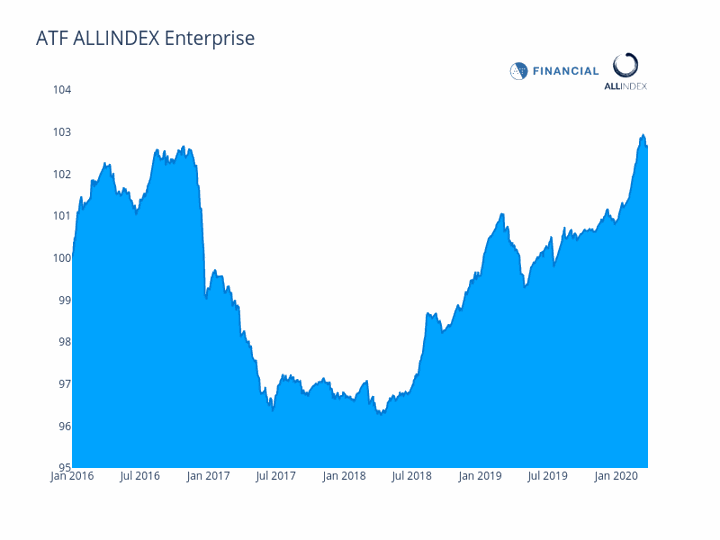

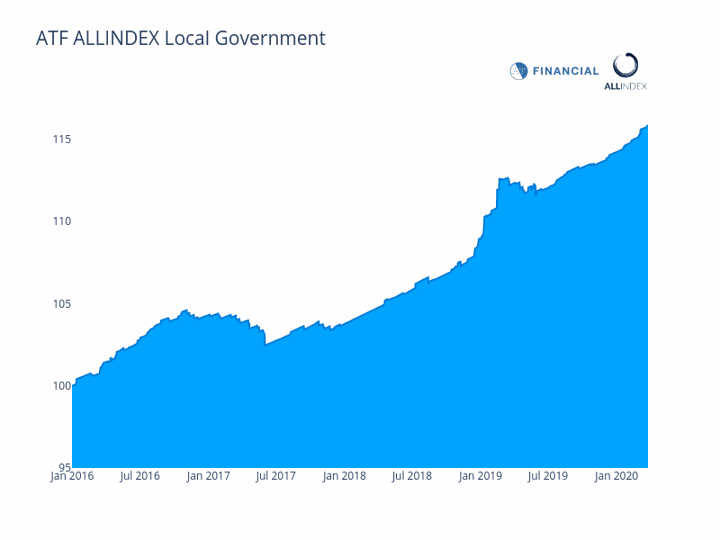

The ATF ALLINDEX Enterprise index stayed firm and ended 0.02% higher, as did the Local Government bonds, which edged up 0.01%.

In the year to date, the CBM50 has returned 1.58%, the Corporate index 0.67%, Enterprise 1.79%, Financials 1.45%, Local Government 1.43% respectively.

This contrasts with the US High Yield Corporate bonds (HYG) which is down by 17% in the year to date with most losses coinciding with the coronavirus-led bear market. US Investment Grade Corporates (LQD) are down 8.03% year to date.

-

![]()

The ATF ALLINDEX Corporates Index slipped 0.03%.

-

![]()

THE ATF ALLINDEX Enterprise Index rose 0.02%.

-

![]()

ATF ALLINDEX Local Government Index climbed 0.01%.

- ATF ALLINDEX Financials Index fell 0.07%.

ATF ALLINDEX CBM50 Bond Index: A 50-constituent index, updated daily and selected from across the entire Chinese onshore bond market, that provides a benchmark measure of the Chinese onshore fixed income market.

The CBM50 is taken from the ATF ALLINDEX Chinese Bond Market Index that tracks the price movements of Chinese CNY-denominated onshore bonds across the Corporate, Enterprise, Financial and Local Governments sectors.