Weak export orders are undermining China’s vast manufacturing sector, which suffered a drop in growth in March.

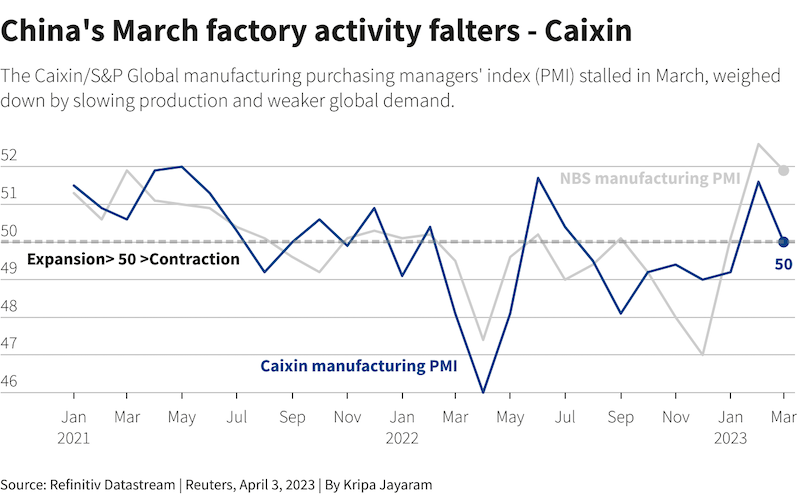

The Caixin/S&P Global manufacturing purchasing managers’ index (PMI) fell to 50.0 last month, after a reading of 51.6 in Feburary, which was the first monthly rise in activity in seven months.

Manufacturing accounts for a third of the world’s second-largest economy by value, but the survey results released on Monday were well below expectations of 51.7 in a Reuters poll, although they echoed slower growth in an official PMI announcement on Friday.

“The relatively modest and short-lived pick-up in the manufacturing PMIs in the first quarter suggests that the industrial sector has only received a limited boost from reopening,” Capital Economics wrote in a note.

“This is partly due to a weaker global backdrop, but it is also consistent with our view that most of the reopening recovery will come from the services sector which was hardest hit by the zero-Covid policy.”

ALSO SEE:

China’s Huawei Claims ‘Crisis is Over’ After Revenue Rise

Beijing has set a modest target for economic growth this year of around 5% after it grew just 3% last year, one of the weakest showings in nearly half a century.

China’s GDP is likely to have grown around 4.0% in the first quarter as consumption picked up and infrastructure investment maintained a high pace of growth, according to state-owned financial newspaper The Securities Times on Monday.

“The next few months are likely to see a weak external demand and a recovery in domestic demand,” said Nie Wen, a Shanghai-based economist at investment firm Hwabao Trust.

However, Nie expects first quarter GDP data to mostly reflect the strength seen in manufacturing and services at the start of the year and raised the GDP forecast to 3.7% from 3.5% previously.

Services sector buoyant, but global demand soft

The world’s second-largest economy showed a gradual recovery in the first two months of the year with a strong pickup in the services sector, boosted by the lifting of years of strict Covid-19 containment measures.

However, a property downturn, weaker global demand and financial uncertainty raised doubts about the strength of the rebound.

“The foundation for economic recovery is not yet solid. Looking forward, economic growth will still rely on a boost in domestic demand, especially an improvement in household consumption,” Wang Zhe, senior economist at Caixin Insight Group, said.

The factory activity was hit by slower growth in production and demand in March with sub-indexes falling from the previous month.

The new export orders sub-index fell to 49.0 after briefly swinging into growth in February, suggesting global demand remains weak.

Official data on Friday showed the services sector was stronger, with activity expanding at the fastest pace in nearly 12 years, raising hopes of an economic revival led by consumption as flagging global demand weakens exports.

Caixin/S&P Global services purchasing managers’ index (PMI), mostly tracks small and medium-sized private-owned enterprises, will be released on Thursday.

To prop up growth, China’s premier Li Qiang last week vowed to support consumption and investment. The central bank also lowered the reserve requirement ratio last month.

Chinese top officials in recent days have softened their stance toward the private sector, which cheered markets.

“The new economic team is officially taking over, we will likely see more pro-business policies going forward, even though our expectation for stimulus is low,” Citi in a research note said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Factory Growth Slows in China, Clouding Recovery Prospects

China Developer Sunac Posts $2 Billion 2022 Core Loss

Japan Joins US Chip War Against China With Export Restrictions