(ATF) Returns on the bonds of Chinese private companies and banks fell Monday as coupon payments sapped liquidity from credit markets.

Those losses outweighed gains among Local Government debt, pushing the ATF benchmark China Bond 50 Index into it second lacklustre day. The gauge of AAA rated credits remained at 106.69. It ended the week higher on Friday for the fist time since mid-March after the International Monetary Fund (IMF) said China would be a key driver in global economic growth this year.

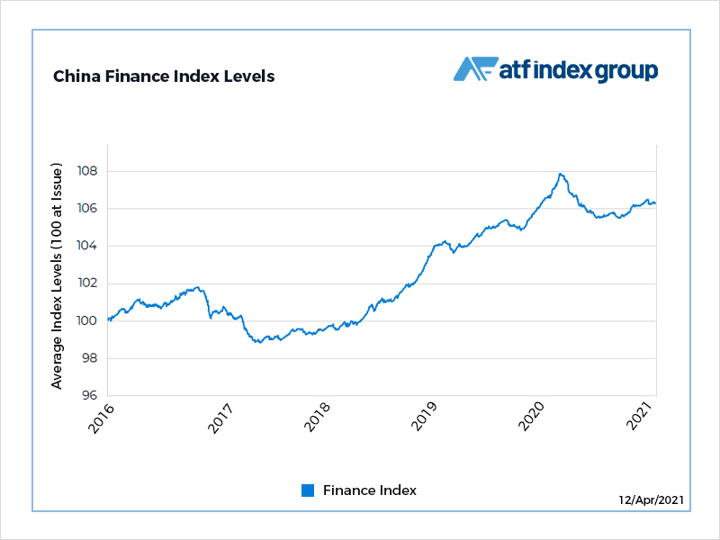

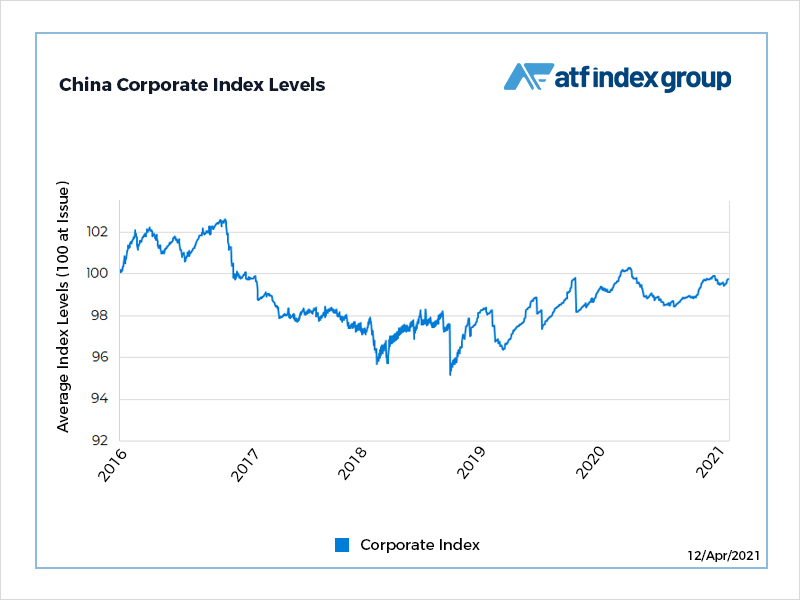

The Corporate sub-index fell 0.06% after Dalian Port Group Corporation made a coupon payment on its 4.95% bond due in March 2024. The Financials gauge fell 0.02% following a weekend payment by China Zheshang Bank on its 2.50% security maturing in March 2023.

Also on ATF

- Investors reset ahead of earnings

- China scolds reckless corporate borrowers: No more debt for you

- China no longer the US’ top trading partner

The measure dropped 0.32% in March, a month that was heavy on coupon payments but which was also subject to concern that inflation would rise after the global economy recovers from the pandemic downturn.

Coupon payments fall heavily in the first quarter, when borrowers tend to front-load their yearly debt sales early. They are usually concentrated in March and April, following the Lunar New Year celebration, which takes up much of February.