In the latest development in Asia’s push for de-dollarisation, India and the United Arab Emirates have agreed to ditch the dollar in favour of settling their bilateral trade in rupees.

The move is part of India’s efforts to cut transaction costs by eliminating dollar conversions.

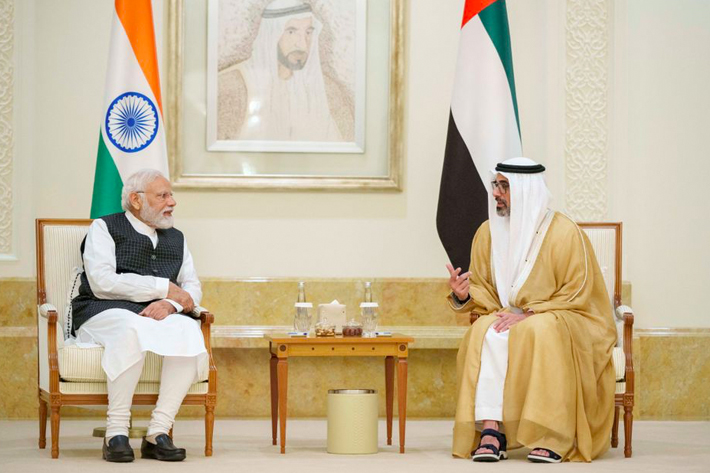

The two countries reached the agreement during Indian Prime Minister Narendra Modi’s visit to the UAE on Saturday, during which he met President Sheikh Mohamed bin Zayed Al Nahyan.

Also on AF: Global Economy Showing Signs of De-Dollarisation, Says JPMorgan

They also agreed to set up a real-time payment link to facilitate easier cross-border money transfers.

The agreements between India and the UAE will enable “seamless cross-border transactions and payments, and foster greater economic cooperation”, said a statement from India’s central bank, the Reserve Bank of India (RBI).

The RBI said the two central banks agreed to link India’s Unified Payments Interface (UPI) and UAE’s Instant Payment Platform (IPP).

India, the world’s third biggest oil importer and consumer, currently pays for UAE oil in dollars.

Last year, however, the RBI announced a framework for settling global trade in rupees amid the country’s increasing oil deals with sanctions-hit Russia.

Since Moscow began its invasion of Ukraine, India has paid for Russian commodities using several currencies including the dirham and yuan – a move that has already chipped away at the dollar’s dominance in international oil dealings.

Growing trade ties

An official with knowledge of the details of the agreement with UAE said India could make its first rupee payment for UAE oil to Abu Dhabi National Oil Co (ADNOC).

Bilateral trade between the two countries was valued at $84.5 billion between April 2022 to March 2023. The two countries have mutually agreed to raise non-petroleum bilateral trade to $100 billion by 2030, India’s trade minister said last month.

Sources say India would use the rupee settlement mechanism to pay for oil as well as other imports from the UAE, its fourth largest oil supplier in the year to March.

India is keen to push similar local currency arrangements with other countries, as it looks to boost exports amid slowing global trade.

Such arrangements, which are a growing trend in Asia, typically lower the cost of payments.

The BRICS nations, whose leading members include China and India, have been steering the push for ‘de-dollarisation’ as they aim to challenge the US currency’s “hegemony”.

Last month, the group said it was exploring alternative currencies to counter sanctions. It is also likely to discuss the creation of a new joint BRICS currency at an upcoming summit in August.

China, meanwhile, has already closed several deals with its yuan for commodities ranging from gas to metals.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

India-Russia Oil Deals Erode Dollar’s Currency Dominance

Private India Refiners ‘Now Paying for Russian Oil in Yuan’

Yuan Overtakes Dollar For 1st Time in China Cross-Border Trade

China’s Yuan is Now the Most Traded Currency in Russia

China Settles First LNG Trade in Yuan in Latest Hit to Dollar

Sanctioned Russia Pays Sakhalin Oil Dividends in Yuan – Nikkei