Undergraduate Travis Tan watched his parents’ gold investments appreciate over the past few decades and after deciding that he wanted a piece of the action, bought 5g from a jewellery shop in Chinatown in February last year for about $450. He is holding on to his purchase even as gold prices continue to climb, The Straits Times reported.

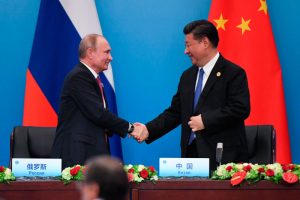

Tan is among many people around the world investing in the safe-haven asset amid rising inflation and market volatility due to factors such as Russia’s invasion of Ukraine and fears over the Omicron Covid variant.

Read the full report: The Straits Times.

ALSO READ:

Swiss Gold Exports to China Rise as Price Breaches $1,900

China’s Youth Boosts Gold Consumption – People’s Daily

Asian Stocks Sink, Oil And Gold Surge As Ukraine Invaded