(ATF) Economic events: Financial markets this week will remain focused on the outcome of stimulus talks in the US even as House of Representatives Speaker Nancy Pelosi said there is a possibility the negotiations could get stretched to Christmas.

The undertone remains firm, despite US-China tensions, as vaccine-related news raises the likelihood of a speedy return to normality for many major economies.

Late on Friday, the US FDA issued the first emergency use authorisation allowing the Pfizer-BioNTech Covid-19 vaccine to be distributed in the country.

Read More on ATF

- China pulls EVs over standards failures

- Walmart commits billions more to India, in possible Flipkart IPO move

- Investors weigh blocked China companies as Sino-US chill deepens

But tensions between the world’s two largest economies remain elevated and further developments are worth tracking as outgoing President Donald Trump’s final weeks in office could see renewed political action.

At the weekend, Nasdaq said it will remove shares of four Chinese construction and manufacturing companies from indexes following a White House executive order last month that barred US investors from buying securities of blacklisted firms.

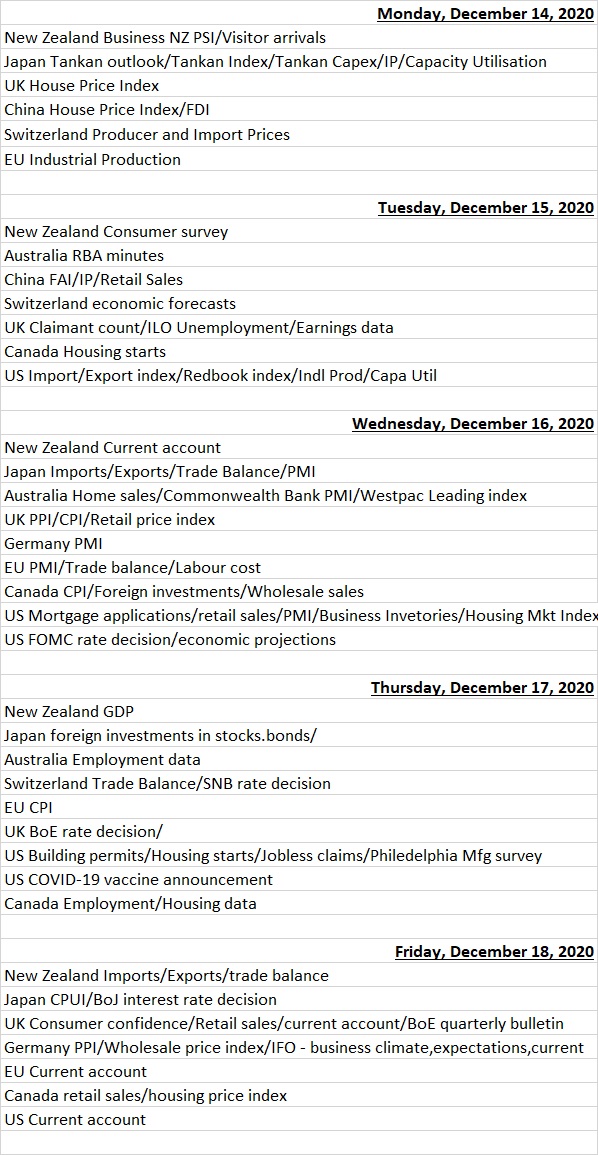

The week ahead sees several central banks announce interest-rate decisions with the US Federal Reserve, Bank of Japan and Bank of England being the biggest.

Brightening outlook

“Policymakers will be seeking to balance a brightening economic outlook following the development of Covid19 vaccines, which have raised prospects of life moving closer to normal over the course of 2021, against signs of further long-lasting damage from the pandemic,” said Chris Williamson, Chief Business Economist at IHS Markit.

“While rising price pressures will be largely ‘looked through’, markets will also be eager to assess just how much inflationary pressure is judged to be in the pipeline,” Williamson added.

Investors will also monitor key official releases such as industrial production and retail sales figures in China after Caixin PMI data showed that business activity grew during November at the fastest rate for more than 10 years.

The Fed is likely to ramp up its dovish rhetoric and emphasise the need for more fiscal support, after its meeting this week.

“With borrowing costs still close to record lows and credit markets functioning smoothly there is little they can seemingly do to boost the economy aside from emphasising they aren’t going to raise rates anytime soon,” said ING Bank’s economists James Knightley and Padhraic Garvey in a note.

“Policy tweaking to limit the steepening of the yield curve is possible, but will probably be deferred until next year.”

Fund flow

Investors put money into equity funds to leverage on the vaccine-fuelled rebound expected in global markets next year. Data from fund tracker EPFR showed flows into developed market equities posted their second-largest inflow ever and those into emerging market equities registered their 11th straight inflow, including new peaks for India and South Korea’s benchmark indexes.

“For the second week running global equity funds were the biggest money magnets among EPFR-tracked Developed Markets Equity Funds as investors began to close the book on 2020 and look forward to a more normal 2021 thanks to the growing number of credible Covid-19 vaccines,” said Cameron Brandt, EPFR’s Director of Research.

China Equity Funds posted record inflows, helped by the 21st straight week of positive retail flows, and Indonesia Equity Funds posted their biggest inflow since early June, EPFR said.

“Foreign investors extended their buying into India. They also resumed their acquisitions in Korea, Taiwan and Thailand. Meanwhile, Chinese equities witnessed firm ETF/mutual fund inflows as well as northbound buying again,” said Jefferies analysts in a note.

Investors put money to work in bond markets too committing $10.6 billion to EPFR-tracked Bond Funds – it took the year-to-date total to more than $400 billion – with emerging markets bond funds posting their 10th consecutive inflow.

Another noticeable trend has been the growing interest in Sovereign Bonds which saw inflows of $4 billion, away from credit where $1.5 billion of outflows were registered.

Economic data calendar

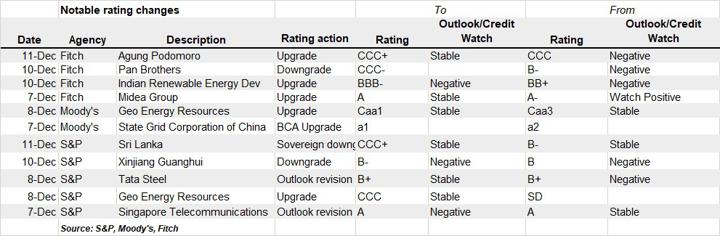

Last Week’s Rating Changes