ECONOMIC EVENTS

Financial markets will be on the edge at the start of the week as the resurgence in the pandemic in various parts of the world dims the economic optimism triggered by the $1.9 trillion US stimulus. The US Federal Reserve meets mid-week but that is unlikely to see any fireworks with the fiscal policy expected to provide most of the economic support going forward.

“The Federal Reserve’s mid-week policy decision won’t be affected at this juncture and is likely to be uneventful, but monetary policy may be sensitive to fiscal policy developments along the path toward tapering,” said Derek Holt, Vice-President, Scotiabank Economics.

“Global markets are unlikely to hear anything different from the Federal Reserve next week but that doesn’t mean that market participants shouldn’t already be bracing for a change in narrative to come.”

On the economic front, markets will be eyeing Q4 GDP reports from several major economies for leads as to the economic momentum. Asia will see GDP data from Taiwan, South Korea, Hong Kong and the Philippines.

“We expect GDP to show slower sequential growth, amid tighter social distancing rules. That said, exports and investment should provide a partial offset to weak private consumption,” said Rahul Bajoria, economist at Barclays about South Korea’s economy which he expects to have shown a 0.6% quarter on quarter growth down from the previous 2.1%.

“Like China, Taiwan continued to buck the region-wide negative GDP trend in the last quarter of 2020,” said Prakash Sakpal ING Bank’s Senior Economist in Asia.

“Not only staying in the positive territory, but growth also gained further traction to our house forecast of 4.2% year-on-year in 4Q from 3.9% in 3Q. Accelerating exports are driving the growth – a trend hinging on how the global semiconductor cycle pans out this year. As of now, it seems to be in full swing, given the strong electronics exports in December.”

FUND FLOW

In the week to January 20, growth and inflation sensitive funds saw inflows amid general optimism about the global economy, although the fresh bouts of infections and mutations continue to stoke economic worries creating volatility.

The week ending January 20 saw Global and Emerging Markets (GEM) Equity Funds pull in a combined $17 billion, taking their year-to-date total past the $44 billion mark, while Inflation Protected Bond Funds absorbed fresh money for the 34th time in the past 37 weeks, said funds data provider EPFR.

“The swearing in of Joseph Biden as the 46th President of the United States added to the tailwinds behind the global reflation and green investment stories,” said Cameron Brandt Director, Research at EPFR.

“Biden’s promise of another $1.9 trillion stimulus package heavily weighted towards climate change and clean energy goals is positive for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates.”

He said it is also being translated, to the benefit of Emerging Markets Equity and Bond Funds, into a weaker dollar and increased US demand for emerging markets exports.

Global EM debt funds posted their largest inflow last week since Feb 2019 with high yield funds continuing to enjoy strong inflows extending their streak of inflows to 11 last week as investors continue to chase yield, said BofA Securities in a note.

Recovery headwinds in Europe and ultra-low rates are forcing investors to chase yield in riskier pockets of the fixed income market, it said.

ECONOMIC DATA CALENDAR

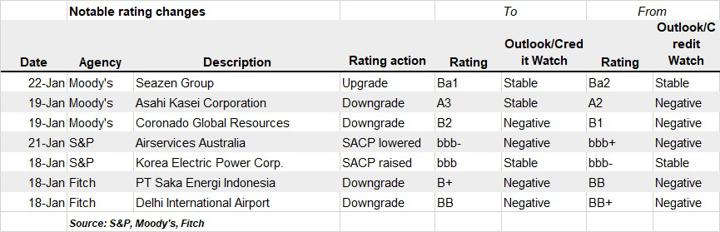

LAST WEEK’S RATING CHANGES

Also on ATF: