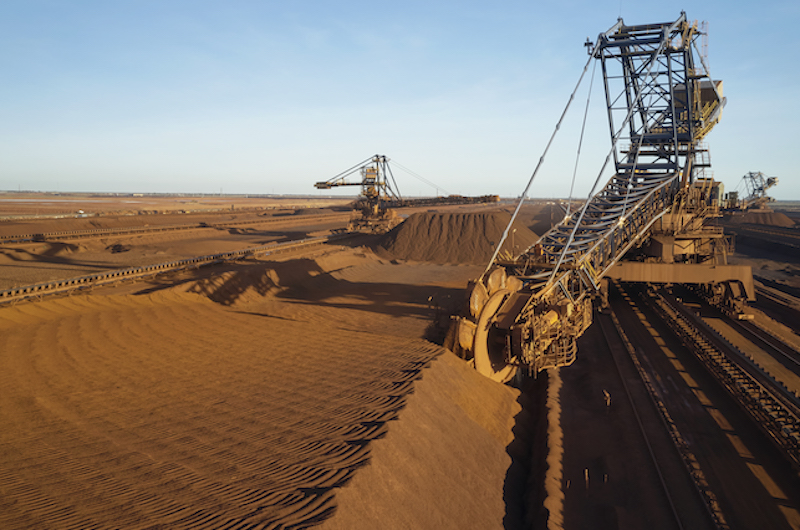

Second-half results from the Australian mining triumvirate of Rio Tinto, BHP and Fortescue are likely to draw a grim picture of a sharp drop in iron ore prices and demand from top metals consumer China.

Half-year 2021 earnings at Fortescue, a pure-play iron ore miner, will likely drop by roughly a third, while six-month profit growth at more diversified, larger rivals Rio Tinto and BHP is expected to be knocked down.

Prices of the steel-making commodity halved from record levels over the December-half as China’s push to curb emissions and easing construction activity in its debt-laden property sector curtailed demand, and analysts contend they will remain way off last year’s peak for some time.

BHP, which scrapped its dual-listing structure in favour of a main listing in Sydney, is expected to report a 53% rise in profit, compared with a whopping 185% gain in the June-half when prices hit a record.

BHP “could provide a new net debt target range (ex-petroleum), or a new capital management strategy to distribute BHP’s large franking balance,” Morgan Stanley analysts wrote last week.

They also estimated Fortescue’s investments in its green energy unit could lead to a more conservative interim dividend.

Rio Tinto’s second-half profit growth will slow to 23.5%, according to consensus estimates, from a more than 150% surge in the first six months of 2021.

Still, the world’s biggest iron ore producer is set to log record annual earnings, owing to all-time high profits in its first half and a more diverse product mix.

Labour And Culture

Investors will also likely keep tabs on issues that could affect the bottom line as well as reputation.

An acute shortage of workers in Australia has been a challenge for months. The mining trio has already warned of hits from the labour crunch, with Rio and BHP forced to cut their annual output forecast.

“We need to keep an eye on potential disruptions in the Pilbara as Covid cases are unfortunately rising in the region. Labour shortages in Western Australia are an issue as well, in part due to Covid-related border closures,” Jefferies warned.

However, with the country set to reopen its borders to all vaccinated visa holders next week, any signals on easing labour pressure will be well received.

Workplace behaviour across the industry is also on the top of investors’ minds after an 85-page report released by Rio outlined a culture of bullying, harassment and racism.

- Reuters with additional editing by Jim Pollard

ALSO READ:

Miners Say Western Australia Border Curb To Hit Labour, Output

Australia Accuses China Of Undermining World Trade

Perenti Eyes Mining Tie-Up with Sumitomo – West Australian