South Korea’s trade ministry said on Wednesday the United States’ proposed rules to prevent $52 billion in chip funding from being used by “countries of concern” will not force recipients to shut down their China factories.

The US Commerce Department on Tuesday proposed limits for recipients of US chip manufacturing and research funding, including limits on investing in expansion in countries such as China and Russia.

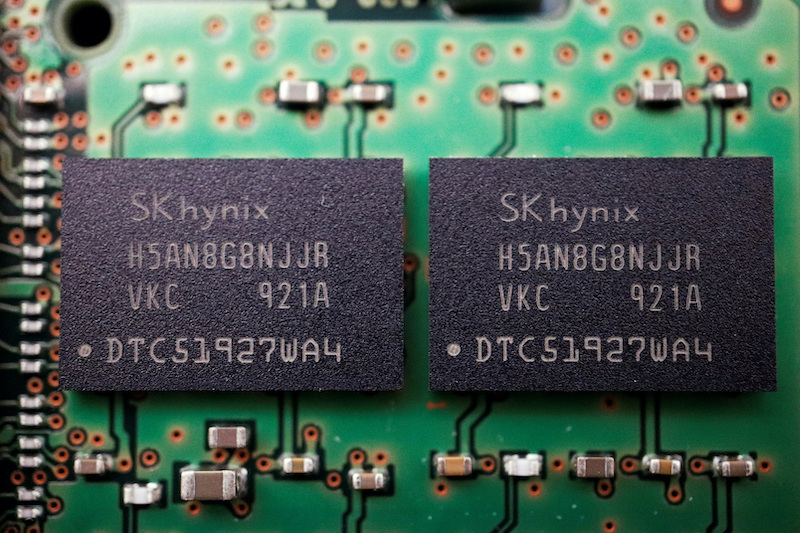

South Korea’s Samsung Electronics and SK Hynix — the world’s largest and second-largest memory-chip makers — have chip production facilities in China.

Also on AF: Nvidia Tweaks Another Flagship AI Chip for Export to China

Samsung is building a chip plant in Texas that could cost more than $25 billion, while SK Hynix parent SK Group announced last year plans to invest $15 billion in the US chip industry. Both may apply for funding.

“For production facilities our companies are operating in China, it is expected that maintenance and partial expansion as well as technology upgrades will continue to be possible,” the trade ministry said in a statement. “As technology is upgraded, chips per wafer can be increased… which could further expand production depending on corporate strategies.”

The proposed US rules for funding recipients limits chip production capacity growth in China to 5% over 10 years – as measured by wafers – and 10% for older legacy chips, the trade ministry said.

They do not restrict investments in technology and process upgrades, or equipment replacement necessary for the operation of existing facilities, the ministry added.

Persistent uncertainty

The South Korean government says it plans to communicate with the local industry, analyse proposed rules and consult with US counterparts within 60 days, the ministry said.

Uncertainties include what happens when the one-year waiver for Samsung and SK Hynix to receive chip equipment needed in China expires in October, said an industry source who declined to be named because of the sensitivity of the matter.

Samsung and SK Hynix said they would review the details of the announcement.

TSMC, the world’s largest contract chipmaker, which is investing $40 billion in a new chip plant in Arizona and also manufactures in China, declined to comment on the announcement.

The South Korean ministry noted that Samsung’s recent plan to invest $230 billion in South Korea over 20 years to develop a ‘the world’s largest chip-making base’ further reflected the uncertainties around investing in China or the United States.

US escalating chip war

The proposed US rules released on Tuesday also limit recipients of incentive funds from engaging in joint research or technology licensing efforts with a foreign entity of concern.

They also classify some semiconductors as critical to national security, which are therefore subject to tighter restrictions. This includes chips that are “current-generation and mature-node chips used for quantum computing, in radiation-intensive environments, and for other specialised military capabilities.”

Commerce Secretary Gina Raimondo said “these guardrails will help ensure we stay ahead of adversaries for decades to come.”

The US Commerce Department plans to begin accepting applications for a $39-billion semiconductor manufacturing subsidy program in late June. The law also creates a 25% investment tax credit for building chip plants, estimated to be worth $24 billion.

The chip fund is part of US efforts to cut China off from key semiconductor chips that contain US equipment, no matter where that are made in the world, in a bid to slow Beijing’s technological and military advances.

The Commerce Department on Tuesday said it would reinforce those controls by aligning prohibited technology thresholds for memory chips between export controls and CHIPS national security guardrails and include “a more restrictive threshold for logic chips than is used for export controls.”

- Reuters, with additional editing by Vishakha Saxena

Also read:

Samsung to Pump $230 Billion Into ‘World’s Largest Chip Base’

China to Ease Subsidy Access for Chipmakers Amid US Chip War

US Sanctions on China to Hit Dominance of Chips: TSMC Founder

Samsung to Keep Up Chip Spending Despite 8-Year Low Profits

US Would ‘Destroy Taiwan Chip Factories if China Invaded’ – BI