South Korea has sought clarity from the United States on chip export curbs to China with waivers for its two biggest chipmakers set to expire next month.

South Korean Industry Minister Bang Moon-kyu met with US Deputy Secretary of Commerce Don Graves on Friday with an appeal to resolve uncertainties regarding chip export controls and subsidies for chip investment.

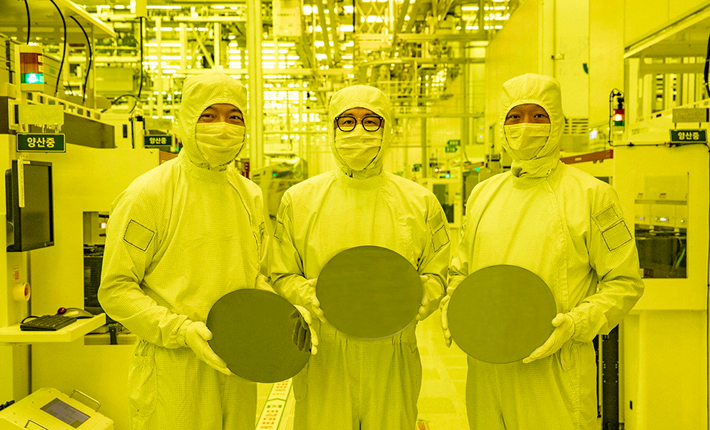

Top South Korean chipmakers Samsung Electronics and SK Hynix currently have permits to import US chip-making equipment into China, where they have extensive production facilities.

Also on AF: US Moves to Block China Benefitting From $52bn Chips Funds

Samsung has NAND flash memory production in China’s Xian, while SK Hynix has DRAM chip production in Wuxi and NAND Flash production in Dalian. The companies together control nearly 70% of global DRAM and 50% of NAND flash markets as at June-end, according to data from TrendForce.

A year-long US waiver has allowed the South Korean pair to supply equipment for their Chinese chip production facilities without additional licensing requirements.

Meanwhile, the US has not announced how or whether the waiver may be extended when it expires in October, or any conditions which would further affect the firms’ production plans in China.

In March, the US Department of Commerce also imposed guard rails for semiconductor firms applying for billions of dollars in subsidies under the CHIPS Act.

Those guard rails include limiting expansion of chip manufacturing in China for 10 years after winning funding.

Samsung, which is building a chip plant in Texas to begin shipping in late 2024, has completed the main application for US subsidies and could hear the result by year-end, people with knowledge of the matter said.

Bang has sought “active cooperation” from the US Department of Commerce to resolve issues relating to export controls, South Korea’s Ministry of Trade, Industry and Energy said in a statement without elaborating.

Analysts expect Washington to announce further details on the matter in the near future.

In June, the Wall Street Journal reported that the US Under Secretary of Commerce for Industry and Security, Alan Estevez, had informed members of the Semiconductor Industry Association that Washington planned to extend the previously granted waivers.

Estevez had told the powerful US chip trade and lobby group that the Joe Biden-government would also allow South Korean and Taiwanese chipmakers to operate and expand their current Chinese chip facilities ‘without worry of pushback’.

- Reuters with additional inputs from Vishakha Saxena

Also read:

South Korea Asks US to Review China Curbs in Chips Act Funding

Threat of More Chip Curbs Spurs Warnings on China Innovation

ASML to Ship Top Tech to China Even as Dutch Chip Ban Starts

China Curbs Mean Permanent Loss of Opportunities for US, Nvidia Says

Huawei’s Chip Breakthrough ‘May Spur Tougher US Tech Curbs’

China Plans $40bn Bonanza for Chips After Huawei Breakthrough

China Offering Millions to Foreign-Trained Chip, Tech Talents