China is experiencing a boom in the manufacturing of energy storage batteries, thanks to a revamp of the country’s electricity market and the massive surge in international demand for renewable energy sources.

Chinese firms have exported more than $65 billion worth of storage and electric-vehicle batteries this year. By one estimate, they are on track for a 75% jump in global shipments of lithium-ion battery cells for energy storage, which is a sector that Chinese companies already dominate globally.

These manufacturers are cementing their dominance in a sector vital to backing up wind and solar and keeping power coursing through artificial-intelligence data centres.

ALSO SEE: China’s Big Tech Secret: Lab Copied Dutch Chipmaking Machine

The surge in sales is driven by data centres and renewables domestically, as well as by Chinese reforms and subsidies that are boosting general demand for energy storage.

International demand is rising in tandem with the surging growth in data centres, a need to back up Europe’s ageing grid and China’s burgeoning renewable energy business in the Middle East, analysts say.

‘Double shifts to meet demand’

“These leading energy storage cell makers, they have full orders. Many of them are basically working double shifts now to try and meet demand,” analyst Cosimo Ries at policy research firm Trivium China said. The boom “is one of the biggest surprises of the year, I think, in China’s energy space.”

UBS last month raised its 2026 forecast for global battery-energy storage installations by 25%.

The International Energy Agency forecasts global investment in battery storage facilities will rise 16% this year to $66 billion. Much of that is set to be captured by Chinese firms because, while Tesla is number one in energy storage systems, China dominates production of the tiny cells inside them.

All of the six top global cell suppliers – Contemporary Amperex Technology Ltd (CATL), HiTHIUM, EVE Energy, BYD, CALB and REPT BATTERO – are Chinese, according to a January-to-September ranking by consultancy Infolink. Of the top 10, only Japan’s AESC is not from China.

EVE’s energy storage sales volumes rose 35.5% in the first three quarters from the same period last year. REPT BATTERO’s third-quarter shipments of all batteries set a record high.

Top EV players CATL and BYD did not break out energy storage shipments through the third quarter. Storage has historically made up less of their revenue than automotive batteries and EVs, although the proportion is growing.

“Pairing solar with storage has effectively become the only solution for meeting US AI data-centre power needs,” UBS analyst Yishu Yan told a media briefing. “US AI data centre power demand is very robust, but power is the biggest bottleneck, and US baseload power – gas, nuclear, thermal – they won’t grow much in the next five years.”

However, Yan said, Chinese manufacturers face risks from US restrictions on projects receiving investment tax credits that involve designated “foreign entities of concern”, which include China.

‘China leading global energy transformation’

A report by the energy think tank Ember in September said battery storage investment in China rose 69% from the first half of 2024 to the first half of 2025, while grid investment rose 22%. It noted that China now accounts for 31% of global clean energy investment.

There was a realisation within China, it said, “that the old development paradigm centred on fossil fuels has run its course, and is not fit for 21st century realities.”

But China’s clean energy transition was affecting far more than its domestic economy – it “is fundamentally reshaping the economics of energy across the world,” Ember’s researchers said.

“Accelerating deployment of renewables, grids and storage in China, combined with electrification of transport, buildings and industry, are rapidly bringing China itself towards a peak in energy-related fossil fuel use, while also reducing costs and accelerating uptake of clean electro-technologies in other countries.”

These trends were creating the conditions for the global use of fossil fuels “to peak and decline,” it said.

“Cheap Chinese tech has enabled 25% of emerging markets to leapfrog the US in end-use electrification. [And some] 63% have leapfrogged it on solar generation share.”

Battery exports top $66.7bn, solar PV

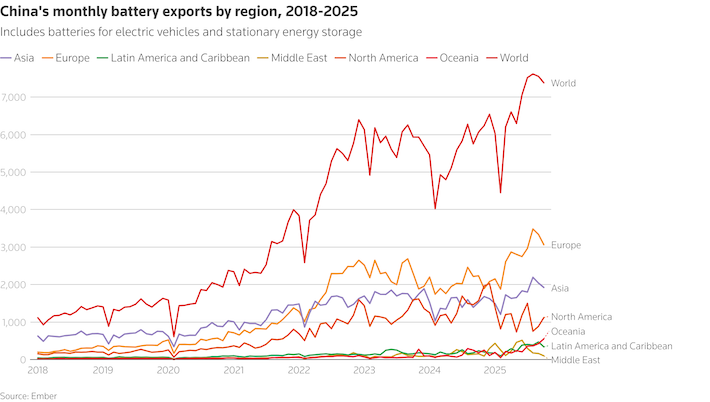

Reuters said China’s battery exports, including for EVs and energy storage, hit a record $66.761 billion in the first 10 months of the year, according to data from Ember. Batteries have been China’s most lucrative clean-technology export since 2022, surpassing solar photovoltaics.

That is likely to grow again next year, as consultancy Infolink anticipates global energy storage cell shipments could rise to 800 gigawatt-hours, a 33% to 43% increase from this year’s forecasts.

China’s exports of energy storage and other non-automotive batteries rose 51.4% in the first 11 months from the same period last year, faster than the 40.6% growth in EV battery exports, according to the China Electric Vehicle Industry Technology Innovation Strategic Alliance.

China already has the world’s largest battery energy storage fleet – some 40% of the global total – driven in part by local government mandates for developers to add storage to wind and solar projects.

China’s battery storage this year overtook its capacity of conventional pumped hydro, a geographically more limited technology that uses water stored behind dams to generate electricity when needed.

However, much of that battery storage capacity has sat idle because it was not profitable to operate. Although the model is changing, with reforms in June that require newly built projects to sell their power through market-based auctions, instead of at a fixed rate. As a result, it has become more profitable to run a storage plant that profits by recharging when prices are low and discharging when prices are high.

Energy storage plants ran longer in the third quarter, after the reforms passed, hitting an average 3.08 hours per day, up 0.78 hours from a year earlier and up 0.23 hours from the previous three months, according to the China Electricity Council.

This is happening against the backdrop of a new $35 billion government plan to nearly double battery storage by 2027, as well as new provincial-level subsidies.

Since late 2024, 10 Chinese provinces have rolled out capacity tariffs – special payments for providers to keep capacity on standby – in addition to other subsidies, according to Jefferies.

It is “the most decisive policy shift for energy storage in over a decade”, Jefferies analyst Johnson Wan wrote in a note.

- Reuters with additional input (Ember report) and editing by Jim Pollard

NOTE: Links and other details were added to this report, which was published early by mistake on Dec 22, 2025.

ALSO SEE:

China Aiming to Double Battery Storage, Holds First Solar Auction

Shares of Korean Battery Firms Sink Amid Global EV Uncertainty

US Says Hidden Radios Found in Solar Highway Tech From China

Rogue Communication Devices Found in Chinese Solar Inverters

Solar Power Boom Surging in Indonesia, Australia, Africa

China Lays Down Law to Solar Panel Makers: End Overproduction

Chinese Solar Firms Shed 87,000 Workers, And More Will Go

China Polysilicon Firms Seek $7bn to Shut a Third of Solar Sector

Solar Overcapacity Kills Projects, Fuels Bankruptcies In China

Spending on Global Energy Transition Well Under What’s Needed