Korean and Chinese equities logged some of their best gains in years in 2025 as booming global interest in artificial intelligence overcame American tariff concerns.

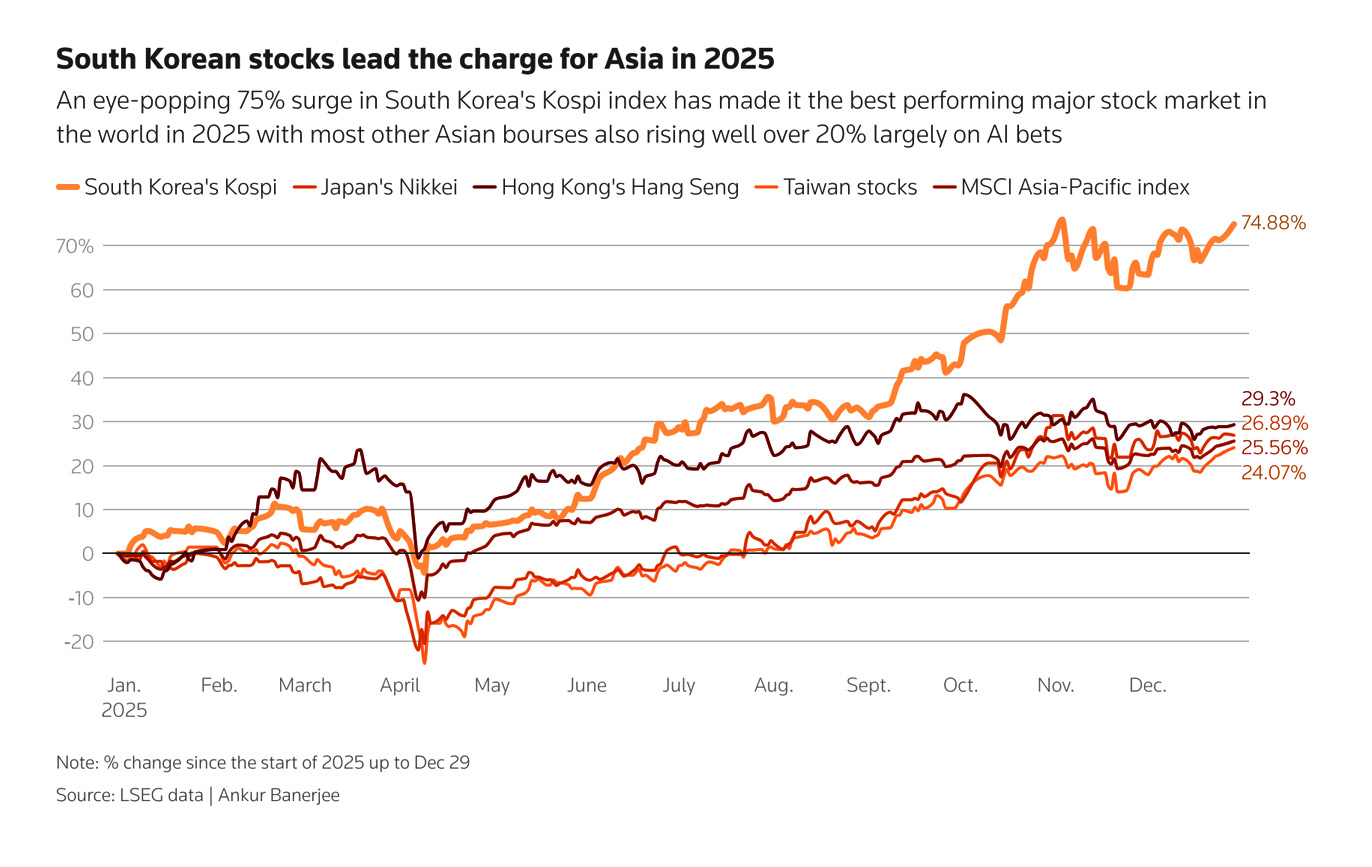

Korean shares fared the best in Asia, posting their biggest yearly gains in more than two decades. The benchmark KOSPI index ended the year near record highs, up 75.6% for the year — its biggest gain since 1999.

The KOSPI also emerged as the world’s best-performing major stock market in 2025, outstripping a 21% rise in global stocks and a 27% gain in broader Asian markets.

Also on AF: Meta to Buy Chinese-Founded AI Startup Seen as ‘Next DeepSeek’

The rally was largely driven by heavyweight chipmakers, with Samsung Electronics jumping 125% and SK Hynix surging 274% this year. Together, they account for more than 40% of the benchmark’s market capitalisation.

The interest in both chipmakers is driven primarily by their dominance in making high-bandwidth memory (HBM) chips, a critical component for AI accelerators and data centres. Analysts now expect AI demand to remain robust through next year.

Recent government measures to reform the markets have also aided the Korean rally.

Since taking office on June 4, President Lee Jae Myung’s administration has worked to narrow the so-called “Korea Discount” that has been driven by opaque governance and low dividend payouts.

The government has revised the Commercial Act to strengthen minority shareholder protections and is seeking an upgrade to developed-market status, with South Korea currently classified as an emerging market by Morgan Stanley Capital International (MSCI).

Among other sectors, financial groups rose 71% and securities firms doubled in 2025 on optimism around the government’s push to boost the stock market.

“We expect the KOSPI, still undervalued, to be on its own upward trend next year, as favourable external conditions, the semiconductor up-cycle, and the government’s policy drive make it even more attractive,” said Daishin Securities analyst Lee Kyoung-min, who set next year’s target at 5,300.

Meanwhile, the Korean won has strengthened 2.3% so far this year against the dollar and is set to snap four consecutive years of losses. It was hovering around 16-year lows until last week, when the government stepped up efforts to stabilise the currency.

Tech war boosts China shares

For China, artificial intelligence also helped equities overcome worries about a slowing economy.

Hong Kong stocks jumped nearly 30% in 2025 in their best showing since 2017, while the Shanghai market logged its best year in six thanks to investor excitement around Chinese artificial intelligence, specifically Beijing’s efforts to create a self-sufficient tech supply chain.

Hong Kong’s Hang Seng surged 28% for the year while The Shanghai Composite Index capped its best year since 2019 with a gain of 18%. China’s blue-chip CSI300 Index is also up 18% for the year.

Chinese markets have weathered a Sino-US trade war and rising geopolitical tensions in a volatile year, with share prices supported by government stimulus, rising confidence in Chinese technology, and an appreciating yuan.

China’s yuan breached the psychologically important 7-per-dollar level for the first time in 2-1/2 years this week, and is on track for its biggest annual rise since 2020.

Western Securities expects the market’s upward trend to continue in 2026, underpinned by the appreciating Chinese currency.

“Yuan appreciation is driving offshore capital flow back to China, solidifying the foundation of China’s bull market,” the brokerage said.

Guotai Haitong Securities also said in a report that a steadily rising yuan will “provide favourable conditions for loose monetary policies in early 2026,” and expected investor risk appetite to increase.

Japan also on the front foot

Japanese equities, meanwhile, were the second-best performers for Asia in 2025, with the technology sector becoming the key driver again for their massive gains.

Japan’s benchmark Nikkei surged 26% in 2025, a third consecutive yearly gain and the most since 2023. The Topix climbed 22%.

Japanese equities were on a roll this year, benefitting from a corporate governance push by the Tokyo Stock Exchange and more lately from euphoria over artificial intelligence investment.

The Nikkei got another leg up after Sanae Takaichi was elected prime minister on a campaign of huge fiscal stimulus.

“The first half of the year was weighed down by global economic instability, including rising prices, labour shortages, and U.S. tariffs,” Takaichi said at a ceremony at the exchange after the closing bell for the year’s last trading day on Wednesday.

“But in the latter half, the resilience of Japanese companies, together with policy support, propelled the Nikkei to a remarkable turnaround, rising past the 50,000 mark for the first time in history.”

Among the Nikkei’s biggest gainers for the year was Kioxia Holdings, a supplier of memory chips used in servers. The company’s stock surged 540% this year, according to Nikkei Asia.

A booming data centre demand — meant to train and run inference on AI — primarily fuelled the jump in Japanese shares, pumping up stocks of companies like Fujikura, Mitsui Mining & Smelting and Mitsubishi Heavy Industries.

Another major winner was Masayoshi Son-led SoftBank Group which surged 93% in 2025. On Tuesday the company said it completed a $41 billion investment in OpenAI, one of the largest-ever private funding rounds that would give the Japanese firm a stake of about 11% in the ChatGPT maker.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

Bumper IPO by Another China Chip Firm Raises Hype Worry

China Now Requires Chipmakers to Use At Least 50% Local Equipment

China Looks to Tackle Addiction, Self-Harm From AI Emulating Humans

Seoul Accuses Ex-Samsung Staff of Leaking DRAM Tech to China

Japan Set to Test Mining of ‘Rare Earth Mud’ From Deep Seabed

US Begins Reviewing Licences For Sale of H200 Chips to China

Shares of Korean Battery Firms Sink Amid Global EV Uncertainty

The Idea of AI Super-Intelligence is a ‘Fantasy’ – US Researcher

‘Big Short’ Wagers $1-Billion Bet That ‘AI Bubble’ Will Burst

Amid Fears Of An AI Bubble, Indian Equities Become Surprise Hedge