(ATF) With climate change emerging as a serious concern in Asia, the urgency to adopt effective responses would lead to greater opportunities for ESG investors, and could even hold potential for outperformance versus other asset classes, says Rong Ren Goh, Fixed Income Strategist, Eastspring Investments.

On why Asia offers the opportunity for ESG outperformance;

We expect “E” to take centerstage in ESG investing in Asia as climate impact is forecasted to hit the region the hardest. The urgency to undertake effective responses and strong government support will see rising issuances from Asia’s energy, transportation, banking and real estate sectors, creating numerous opportunities for bond investors.

The COVID outbreak was a lesson for policymakers who had ignored earlier warnings of how ill-prepared the world was for a global pandemic. At the same time, it served as a clarion call for investors to pay greater attention to the risks within their portfolios where traditional risk models have not been able to predict or assess.

On whether “E” will take centerstage in ESG investing in Asia;

While COVID brought much attention to social issues following the disruptions to work and education, we believe that climate concerns will take centerstage in ESG investing in Asia. According to McKinsey & Company, climate change is expected to hit Asia the hardest. For that very reason, the urgency to undertake effective responses suggests that there will be greater opportunities for investors, and for ESG outperformance.

According to the report, by 2050, parts of Asia may see increasing average temperatures, lethal heat waves, extreme precipitation events, severe hurricanes, drought, and water supply shortages. These extreme weather events are expected to hurt agricultural yields, infrastructure, supply chains and productivity. McKinsey & Company estimates that the Asian GDP that is at risk from these events accounts for more than two-thirds of the total annual global GDP impacted by climate change.

Against this sombre outlook, there is a silver lining. McKinsey’s report highlights that “Asia is well positioned to address these challenges and capture the opportunities that come from managing climate risk effectively”. With urbanisation levels still climbing in many parts of Asia, the region can build infrastructure and urban areas that are more resilient to climate effects. The Asian Development Bank estimates that Asia’s infrastructure needs from 2016 to 2030 will exceed $26 trillion, including $14.7 trillion and $8.4 trillion in the energy and transportation sectors respectively. There is clearly an opportunity for investors to participate in the “green infrastructure” push in Asia.

Korea and China are already world leaders in the areas of electric vehicles and renewable energy. In 2020, Korea overtook China to become the number one producer of the electric battery. Meanwhile, China manufactures 47% of all the electric cars in the world and is home to 99% of the world’s electric buses. These innovations can help to mitigate climate change risks.

With Asia Pacific expected to see up to $250 billion in new renewable investments in the lead up to 2025, we are likely to see more investment opportunities within the renewables energy sector. According to a new report by EY, seven Asian countries rank among the world’s most attractive markets for renewable energy sources such as wind power, hydropower and solar energy. EY’s Renewable Energy Country Attractiveness Index (RECAI) ranks China, India and Japan the highest in Asia for their investment and implementation opportunities in the renewables space.

We are already seeing a pick-up in bond issuances from the renewables energy sector, especially from China and India. Company metrics have been steadily improving as unit costs decline amid improving economies of scale. According to the Economist Intelligence Unit (EIU), green-labelled instruments have played a key role in funding renewable energy projects in Asia.

We also see opportunities in bond issuances from electric vehicle manufacturers, as their share of global vehicle output is expected to grow strongly in the coming years on the back of maturing technology and accelerating adoption.

We expect the banking, energy, transportation and real estate sectors to take the lead in Green Financing innovation in Asia.

China, currently the world’s largest carbon emitter has committed to turn carbon neutral by 2050. Chinese issuers, both State Owned Enterprises and Privately Owned Enterprises, are likely to rally behind the government’s goal and set equally ambitious environmental targets for their businesses, presenting significant opportunities for investors. In 2020, China was Asia’s largest green bond issuer ahead of Japan. It remains to be seen if China can continue to take the pole position in 2021. Meanwhile Singapore has also recently announced plans to issue up to $14 bn of infrastructure bonds to fund its ambitious Green Infrastructure programme.

On moving beyond negative screening;

As opportunities expand, we believe that ESG investors in Asia will look to do more than simply screen out companies that do not meet the inclusion thresholds of their ESG-focused portfolios.

Instead of diverting funds away from traditionally high-risk ESG sectors such as energy companies that are involved in fossil fuel extraction for example, asset owners and investors can catalyse change through engagement and helping companies adopt more sustainable practices. This transition would deliver ESG improvement in investment portfolios as well as the society at large, a win-win for both. This approach also helps us to differentiate companies that have high ESG ratings because of the “incidental” nature of the business they are in (e.g. technology) versus an intentional strategy to become more sustainable.

We believe that there are multiple approaches to address ESG issues and many ways to evaluate ESG risks. In a recent study of 300 respondents that included C-suite and institutional-investor organisations located in Asia, 48% of the respondents weighted ESG factors equally while 24% weighted E factors highest. Another 19% placed the greatest emphasis on S factors while 15% of respondents viewed G factors as most important. The metrics used to quantify the E, S and G factors also differed among respondents.

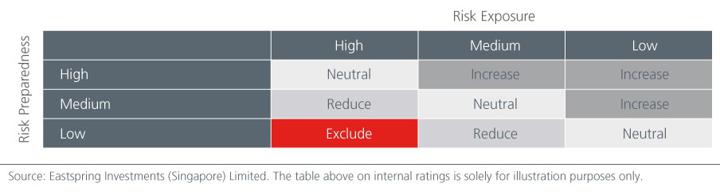

Our ESG approach does not focus only on Green, Social and Sustainability (“GSS”) labelled bonds. We are open to include bonds that are aligned to our internal ESG principles. As such, we would be willing to buy bonds of companies with medium ESG risk exposures if they demonstrate a heightened sense of preparedness to address those risks. However, we would not consider bonds even with low ESG risk exposures, if they are perceived to be ill-prepared to address such risks. See Fig. 1. To further illustrate, a power and gas transmission company may be susceptible to liabilities caused by wildfires but we would be comfortable to include it in our portfolio if we assess that such risks can be mitigated by the company’s bushfire mitigation plan and technology.

Fig. 1. Asian Fixed Income team’s ESG decision matrix

This approach places high demands on the quality and type of ESG data needed from companies, which may not always be available from third party providers. Therefore, we have developed our own proprietary ESG framework. In a sense, this is a natural extension of the credit analysis which we already perform on companies. We formally incorporated ESG analysis into our credit framework in 4Q17, but we continue to challenge and improve our thinking and processes around ESG issues. Besides leveraging on third party ESG rating providers, we believe that pro-active engagement with issuers is key to effect change and encourage best practices.

On Asia as the intersection of rapid wealth growth and rising ESG opportunities;

The COVID pandemic exposed the vulnerabilities within certain sectors while accentuating the resilience of others. As investors gravitated away from airlines bonds towards issuers within more resilient sectors such as technology, their awareness and appreciation of sustainability risks rose in the aftermath of the COVID outbreak. Many investors now see ESG risk assessment as key in helping to determine the sustainability of companies’ business models. In Asia, where ESG investing has historically lagged, assets in ESG funds reached $25.4 bn in 2020, up from only $810 m in 2019.

Asian governments are also increasingly aware that sound ESG practices go hand in hand with long term economic growth. Various Asian governments are promoting ESG as part of their agendas for economic growth either by supporting the development of regional green finance hubs (Singapore, Hong Kong), promoting green finance products (Indonesia, Taiwan) or nurturing a green bond market (India). Singapore’s recently unveiled Green Plan 2030 charts Singapore’s green targets over the next ten years as the country seeks to advance the national agenda on sustainable development. Meanwhile Bank Negara Malaysia is looking implement a green taxonomy later this year which can eventually be used to help differentiate financial institutions based on their support for climate goals.

With Asia’s unique mix of strong economic growth and policy support, we see the potential for ESG outperformance as rapid wealth accumulation and rising ESG investing opportunities intersect.

READ MORE:

Keeping sustainable investment real in a world of greenwashing