China’s BYD may lose its crown as the world’s biggest electric vehicle (EV) seller after just one quarter, as slow sales in the first three months of 2024 put a dampener on its win over US rival Tesla.

The Warren Buffett-backed carmaker sold 300,114 EVs in the first quarter of this year, according to its filing to the Shenzhen Stock Exchange late on Monday.

In comparison, Tesla is projected to have sold 458,500 vehicles in the quarter, according to analysts polled by Visible Alpha. The Elon Musk-led carmaker will report first-quarter sales on Wednesday.

Also on AF: In Battle for China EV Market, Xiaomi’s ‘Thor’ Takes on Elon

BYD overtook Tesla as world’s biggest EV seller in the final quarter of 2023, reporting delivery of 526,409 units – a record quarterly high. But its sales for Q1 2024 were 43% lower than that figure.

The slump was largely due to a sharp drop in China’s EV demand in January and February, likely due to Lunar New Year celebrations.

While Chinese customers have traditionally snapped up luxury products like EVs during the period, a slow economy, wage cuts, youth unemployment and spillover from the property crisis are likely to have weighed on buyer sentiment.

Even so, BYD’s first-quarter sales were up 13.4% from a year ago. The carmaker sold 626,263 units of all vehicle types in the period. That number too was down 33.7% from a record quarterly high of 944,779 in the fourth quarter.

The drop in numbers comes despite steep discounts BYD has handed out on its vehicles, amid a price war with Tesla.

Tesla taking back the sales crown illustrates its global clout will not be easily challenged, especially as both companies expect a slowdown in Chinese EV sales growth this year.

It also demonstrates that BYD’s short-lived dominance followed from its domestic price cuts.

March sales, Tesla downturn may bring respite

Despite the gloomy numbers, March sales will come as a breather for BYD. The company sold 302,459 vehicles in the period – up 46% from a year earlier.

That was also its second-highest monthly sales tally, after an all-time monthly high of 341,043 units in December.

Sales of BYD’s purely electric models hit 139,902 in March, a 36.3% increase year-on-year, while sales of plug-in hybrids rose 56.4% to 161,729 units.

A larger downturn looming over its US competitor Tesla may also help boost BYD’s spirits, even if does end up falling short in Q1 sales.

At least five analysts cut Tesla’s target price last month, saying the automaker could post disappointing first-quarter delivery results. Tesla shares are down nearly 30% in the year-to-date.

“The EV slowdown is shaping up to be a Tesla slowdown,” Stephanie Valdez Streaty, analyst at researcher Cox Automotive, said during a conference call last week.

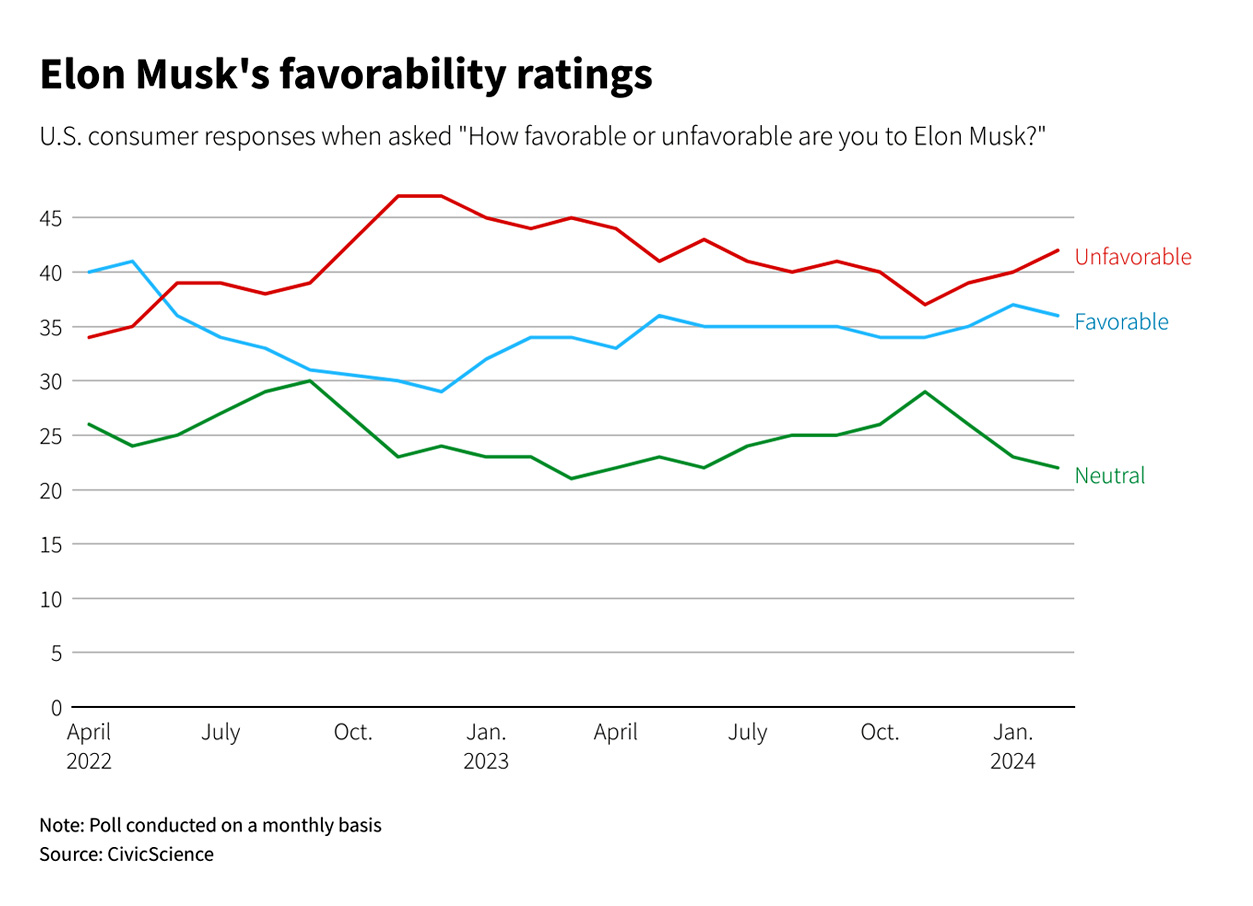

A survey by market intelligence firm Caliber also found that an increasing number of would-be Tesla buyers are now avoiding the company due to CEO Musk’s polarising persona.

Dan Ives, managing director at US advisory firm Wedbush Securities, told CNBC last week that Tesla was in a “code red situation.”

“They are going through some dark days in China,” Ives said.

BYD, meanwhile, is aiming to sell 3.6 million units this year – a 20% increase from its record-breaking sales last year.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

Smaller Profit Margins Help China’s BYD Steal Tesla’s EV Crown

BYD Forecasts Possible 86% Profit Surge on Overseas Sales

China’s BYD Delays EV Factory; Solid-State Batteries ‘Unsafe’

BYD to Use Nvidia’s Next-Gen Chips to Elevate Self-Driving Tech

Tesla-BYD Lock Horns in China With Deep Discounts, Incentives

China EV Firms Can Destroy Rivals Without Trade Barriers: Musk

China’s BYD Confirms Mexico Factory Plan But Rules Out Exports

BYD’s First Vehicle Charter Sets Sail Loaded With 5,000 EVs