A push from the world’s biggest artificial intelligence companies to offset their increasing emissions has triggered a huge surge in demand for high quality carbon removal credits, leading to a shortage in their availability, credit experts say.

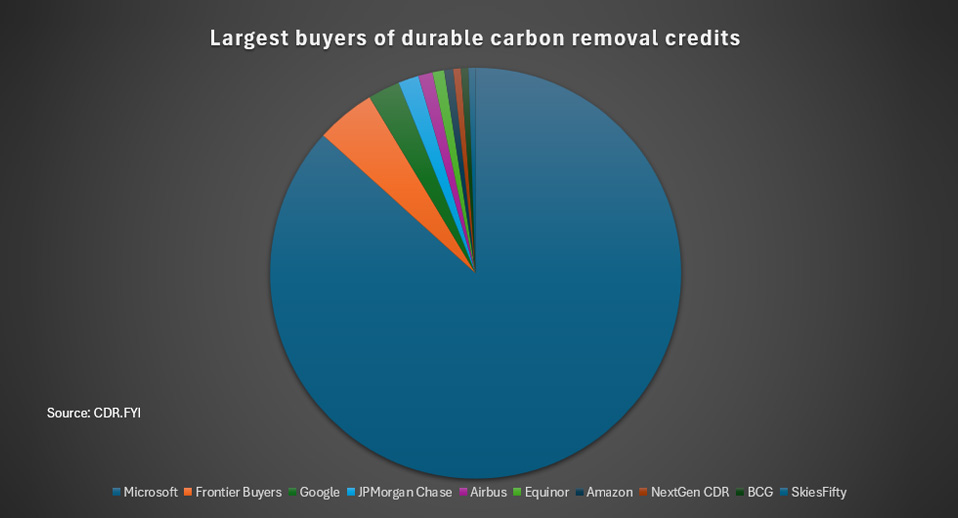

Big Tech has collectively spent $10 billion since 2019 on durable carbon dioxide removals (CDR), meaning projects that capture and store carbon dioxide for an extended period, according to market tracker CDR.fyi. Much of their spending has been in the last two years.

Scientists say carbon-removal projects are essential for the world to slow global warming by offsetting emissions from industries, such as power generation, that continue to use fossil fuels.

Also on AF: EU To Reject India Demand For Carbon Tax Exemption

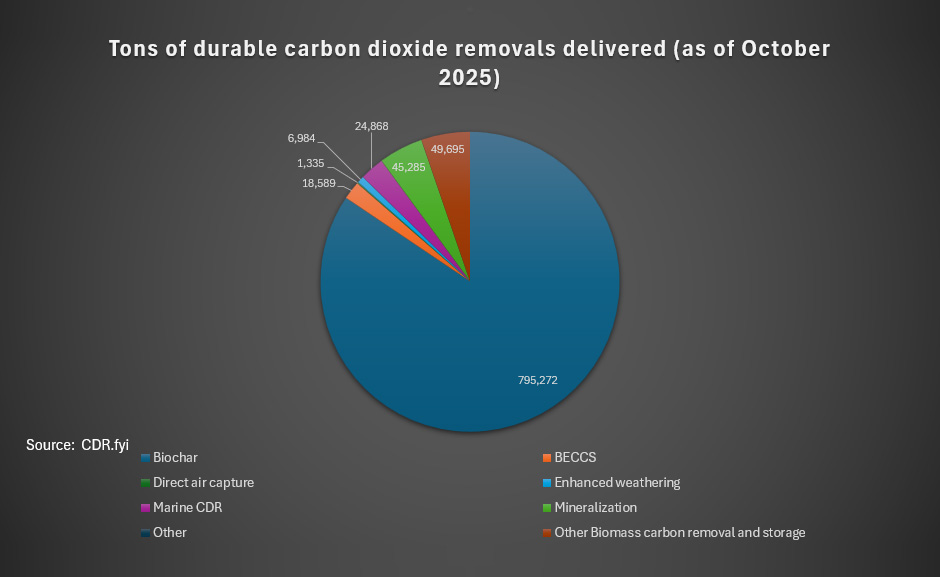

Credits linked to projects such as biochar, in which biomass is converted into a charcoal-like substance that locks in carbon, or direct air capture, are seen as providing more secure, long-term removal of carbon. Those linked to restoring degraded land are also valued highly.

Meanwhile, as tech companies expand data centres to power artificial intelligence, often using fossil fuels, their profits and greenhouse gas emissions are rising, underpinning demand for credits.

But the supply of high-quality carbon removal credits has not kept pace with demand.

A third of requests to buy credits through the climate tech firm platform Patch were for biochar, yet it ultimately made up less than 20% of sales because of tight supply, Patch said.

Reforestation credits were requested 25% of the time, but sold 12% of the time.

“The desire for high quality is very real, and you can see it in the numbers. In 2024, there were 8 million tons of durable carbon removal purchased, and so far this year, it’s 25 million,” said Lukas May, chief commercial officer at carbon registry Isometric.

“That is certainly being driven a lot by the big tech companies.”

Exactly what’s needed

Many other companies were also leveraging AI to expand their businesses and using some of the returns to buy credits, Brennan Spellacy, chief executive of Patch, said.

“The companies that are performing well are investing heavily, and the reason why these companies are performing well is AI. So AI’s driving profit and profit’s driving investment,” Spellacy said on the sidelines of the COP30 climate talks in Brazil.

Meanwhile, experts say the shortage triggered by surging demand is exactly what is needed to further drive up investment in the nascent market.

Heavy buying over the last two years by companies such as Microsoft and Google made the credits nearly four times more expensive in 2024 than lower-priced credits pegged to forest-preservation projects.

The higher prices, coupled with greater demand, are necessary to drive the confidence needed for the development of more CDR projects. Carbon removal projects can often require higher initial investments and can take longer to deliver the carbon offsets they promise, which can hurt potential interest in developing them.

To date, less than 1 million tons’ worth of durable carbon removal credits have been issued, CDR.fyi data shows, mostly from biochar projects.

But the changing market dynamics should help expand supply by giving certainty of sales to developers, Isometric’s May said.

“At the end of the day, extra demand will drive extra supply.”

Asia’s billion-dollar carbon potential

Demand for carbon removal credits is likely to continue to expand as tech giants have pledged to eventually eliminate their emissions on a net basis. The latest data from credit rating agencies also shows that companies are actually choosing to pay premium amounts for high-quality credits, instead of opting for the cheapest available offsets — a practice that has been a key driver of ‘greenwashing’ in the past.

“We send strong demand signals through long-term offtakes to unlock a virtuous cycle of innovation, financing and deployment,” a Microsoft spokesperson told Reuters. “By anchoring large-scale projects, we both drive new supply while leaving headroom for other corporate buyers to enter,” the spokesperson added.

Research shows that major Asian countries are uniquely placed to meet the growing demand for carbon removal credits.

The continent’s vast natural resources, high population density and massive share in emissions create an outsized scope for development of projects that are known to generate ‘high-integrity’ or high-quality credits.

For instance, many Asian nations still rely on landfilling to manage their waste. Projects to tackle methane emissions from improperly managed sites or those aiming to use the waste to create biochar can create high-integrity offsets.

Emerging economies like India, Indonesia, Thailand, Malaysia, and Vietnam also have abundant potential for forestry and agricultural projects. According to the World Economic Forum, these economies can become some of the biggest suppliers of carbon credits globally by leveraging their natural assets for nature-based projects such as afforestation and reforestation. A high dependence on farming in these countries also makes them well-suited for credits generated from sustainable agriculture.

Those factors have driven greater interest in Asia’s CDR potential. In January, Google said it would purchase 100,000 tons of carbon dioxide removal credits from Indian startup Varaha. It was the world’s largest deal for biochar purchases.

Meanwhile, last week, Indian climate tech startup Alt Carbon announced a multi-year deal with Japan’s shipping giant Mitsui OSK Lines to remove 10,000 tonnes of carbon from the atmosphere using the enhanced rock weathering method. The company did not reveal the timeline or commercial value of the project but said it aims to enable “gigaton scale carbon removal in South Asia”.

“Globally, we need to remove 10 billion tons of CO₂ every year by 2050. We’re nowhere close to these targets. While the world is debating carbon markets at COP, we are proving it at scale here in India,” Alt Carbon said in a statement.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

Asia’s Billion-Dollar Carbon Boom?

India’s Green Transition In A Chokehold

As Typhoons Lash Southeast Asia, COP30 Hunts Adaptation Finance

Firms Underestimating Risks From Carbon-Fuelled Climate Change

Study Says Biochar Can Solve Asia’s Fertiliser Shortages

Biochar Can Cut Cement Use In Construction, Researchers Say

Oil and Gas Firms, Governments Silent on Methane Leaks, UN Says

Global Disaster Losses Soar to $80 Billion in First Half: Swiss Re

Carbon Removals Not Growing Fast Enough For Climate Goals

Carbon Removal Could Rake in $100 Billion Annually From 2030

A European Push Could Help India Fill Carbon Removal Gaps

Bill Gates Backs Effort to Boost Credibility of Carbon Removal

Firms May Abandon Net-Zero Plans Amid Carbon Offset Uncertainty