South Korea’s trade minister will tell counterparts in Washington this week that it’s worried the US Chips Act could backfire on the States and harm its investment prospects.

During his trip, South Korea’s trade minister Ahn Duk-geun plans to meet with senior officials from the US Commerce Department and White House as well as officials from major think tanks to discuss the Chips Act.

The Biden administration last month said it would require companies winning $52.7 billion of available funds from the Chips Act to share excess profits and explain how they plan to provide affordable childcare.

The Chips Act plays a central role in the Biden administration’s effort to bring semiconductor manufacturing home, and its success is vital to US ambitions to keep ahead of China in global markets.

Also on AF: US Rate Hike Fears Spur Big Japanese Selloff of Foreign Stocks

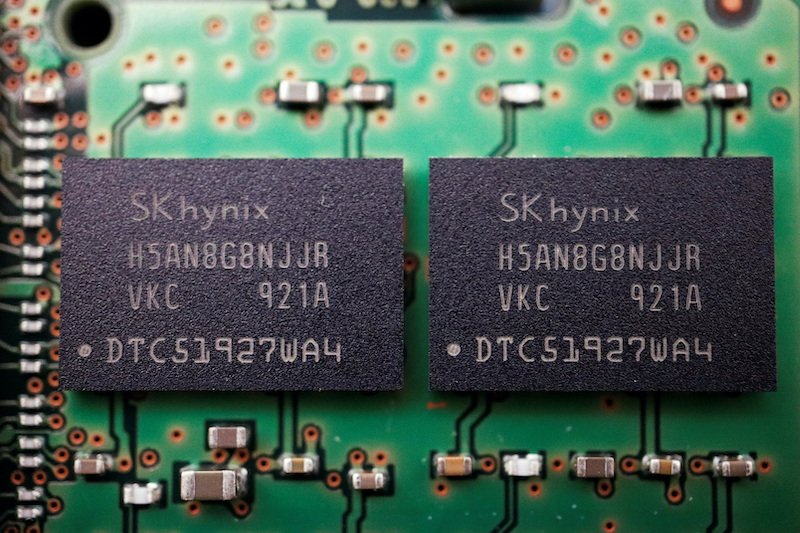

While the incentives are crucial for chipmakers’s investment decisions, some of the conditions for receiving the subsidies are putting South Korean chipmakers Samsung Electronics Co Ltd and SK Hynix Inc in a difficult position as they decide whether to apply for funding, South Korean government officials said.

“The South Korean government will make it clear that the conditions of the Chips Act could deepen business uncertainties, violate companies’ management and technology rights as well as make the United States less attractive as an investment option,” South Korea’s trade ministry said.

Under the Chips Act, companies that accept the incentives are required to share with the US government a portion of their profits that exceed initial projections by an agreed-upon threshold.

Companies winning chips subsidies would be barred from engaging in joint research and technology licensing efforts or expanding semiconductor manufacturing capacity in foreign countries of concern like China for 10 years. Both Samsung Electronics and SK Hynix operate chip factories in China.

Chipmakers are also concerned about requirements to turn over information about profit projections and operations, because they are considered trade secrets, analysts said.

- Reuters with additional editing by Sean O’Meara

Read more:

US Chips Act Fund Ban on China Expansion For 10 Years – FT

SK Group’s $22bn US Chips, Energy, Bioscience Investment Plan

Samsung Won’t Hand Over Sensitive Data To US Chips Probe