South Korea announced plans on Tuesday to offer tax incentives to chipmakers and other tech companies that would invest at home.

Companies making capital investment at home would be given up to a 35% tax deduction according to the proposed plan.

That would help companies save more than 3.6 trillion won ($2.82 billion) in tax payments in 2024, the finance ministry said in a statement.

Also on AF: ASML’s Taiwan Expansion Signals Chip Sector’s Next Big Leap

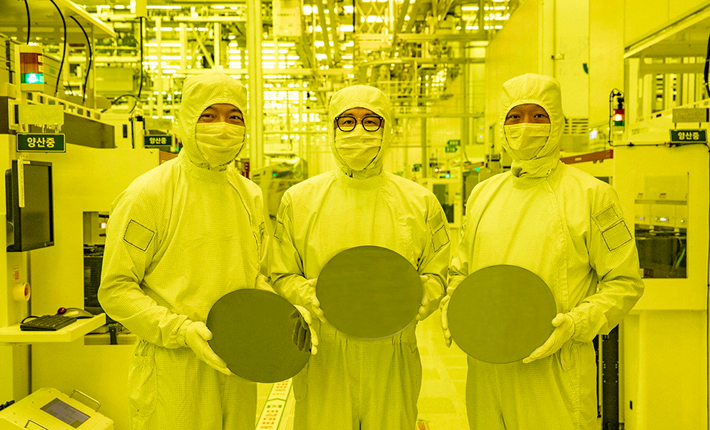

Home to Samsung, the world’s third-largest chipmaker, South Korea said the planned tax breaks would help the country cement the security of its supply-chain security while boosting the economy.

The move comes after other countries, such as Taiwan, home to the world’s largest contract chipmaker Taiwan Semiconductor Manufacturing Co Ltd (TSMC), and the United States announced plans to bring chip production on shore and bolster the domestic industry.

The South Korean finance ministry added that the tax break plans were subject to approval by the parliament, which is dominated by the opposition.

- Reuters, with additional editing by Vishakha Saxena

Also read:

China Pulls Off Chip Breakthrough in Sanctions Blow – Telegraph

Taiwan’s TSMC Starts Production of Its Most Advanced Chip Yet

Sanctioned Huawei Left With Zero Advanced Phone Chips – SCMP

US Fears China Flooding Global Market With Older Chips