Chip giant Taiwan proposed bigger tax breaks for technology companies’ research and development (R&D) on Thursday, with an aim to maintain its dominance in semiconductor manufacturing.

The Taiwanese economy ministry said it is imperative for the island to remain competitive as countries including the United States, Japan and South Korea offer billions to bolster their chip industries.

“For Taiwan, the global situation right now presents a critical moment, so Taiwan must continue to move forward, continue to research and develop,” Economy Minister Wang Mei-hua told reporters, adding some details for the tax break were still being worked out.

Also on AF: Taiwan Slams ‘Rumours’ on Risks in Investing in its Chips

Disruptions to global supply chains, triggered by the Covid-19 pandemic, have pushed countries across the world to step up tax breaks and subsidies for their chip industries.

Taiwan’s proposal comes in an amendment to a statute on industrial innovation put forward by the economy ministry, raising the corporate income tax break to 25% from 15%. The amendment requires parliamentary approval to be passed into law, which the government hopes will take effect from January 1.

The tax income hit would be well worth it, Wang said. “What’s very important is that the benefits it creates will far outweigh the tax reduction.”

Chip competition to get tougher

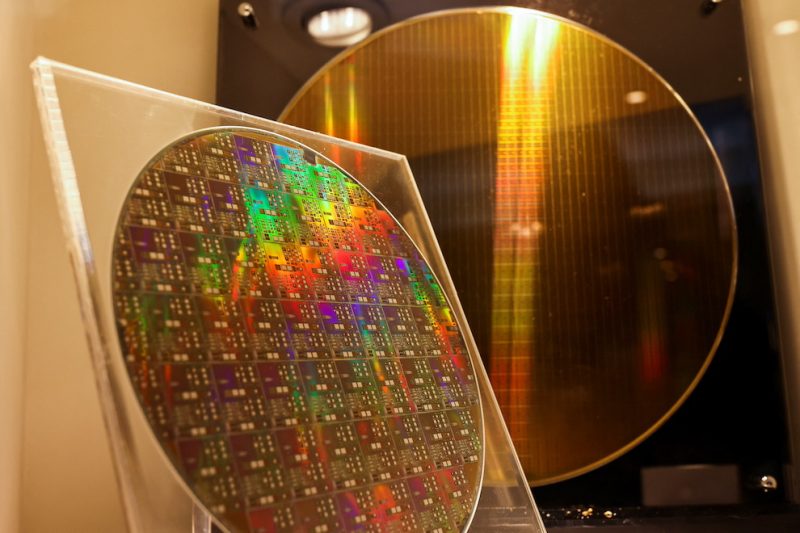

Taiwan is home to the world’s largest contract chipmaker Taiwan Semiconductor Manufacturing Co Ltd (TSMC). It also houses hundreds of other firms that make up a complex and long-established supply chain, from chip design houses to packaging and testing companies.

“Research and development and advanced technology are extremely important to Taiwan’s competitiveness and business opportunities for the next generation,” said Tien Wu, chief executive of ASE Technology Holding. ASE is one of the world’s largest semiconductor testing and packaging firms.

The next decade will bring “greater challenges” for the chip industry, with different countries’ large subsidies and controls making competition tougher, Wu said in a statement, welcoming the proposal.

To secure supplies of chips, governments around the world have been dangling incentives to bring chip production onshore.

In August, the United States passed a landmark $52.7 billion Chips and Science Act to increase its competitiveness with China and decrease its reliance on manufacturers in Taiwan and South Korea.

The law, which authorises subsidies for US semiconductor production and research, has already incentivised large investments on US soil.

The European Commission has also proposed a 45 billion euros ($46.6 billion) chip plan this year.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Nvidia Offers New Chip to China That Meets US Limits

China Chip Giant Hua Hong Set for $2.5bn IPO in Shanghai

ASML Plans $181 Million Chip Centre in South Korea – Nikkei

Taiwan Says China Attack ‘Worse Than Ukraine’ for Supply Chains