Latest News: Electric Vehicles

BYD’s sales abroad rose to a record 1.05 million units in 2025, a 150% jump from 2024, but its sales at home grew at its weakest pace in five years

Court denies key shareholders' move to block zinc refiner's plan to issue shares to help fund $7.4-billion smelter in the US, but they still support the US plan

Demand for renewables and data centres has caused a surge in shipments of lithium-ion storage batteries, with Chinese firms exporting more than $66 billion this year

Firms are now focusing on batteries for energy storage systems that are quickly becoming critical to the global data-centre build-out

This is the first indication from China that it is now seeing cars with L3 autonomous driving capabilities as legitimate products ready for mass adoption

Latest state data shows retail sales at their weakest in three years, while home prices continue to fall and even car sales slump

Beijing urges the Gulf Cooperation Council to conclude talks on a free-trade agreement, which first started over 20 years ago

Intense competition in China has hammered profitability for automakers, suppliers and dealers but regulators are now looking to penalise absurdly low pricing

Move will raise or impose new duties of up to 50% on goods such as autos, auto parts, textiles, clothing, plastics and steel from states without trade deals with Mexico

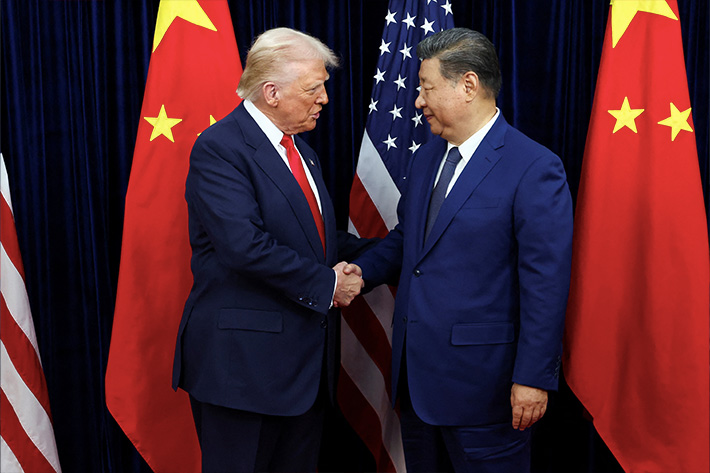

This is the first such indication from Beijing that it is taking concrete measures to reach a key promised outcome from a meeting between US President Donald Trump and Xi Jinping in October

Fossil-fuel vehicles made up 75% of Chinese auto exports since 2020, and annual shipments could top 6 million this year, amid huge overcapacity at home

Three auto suppliers have received "general licences" designed to ease demand pressure by allowing more exports under year-long permits for customers

AF China Bond

- Popular