Vietnam is holding talks with chipmakers about the possibility of building its first plant to produce less advanced chips used in cars or electronics, executives have confirmed.

The Southeast Asian nation already does chip packaging and testing for US giant Intel, but wants to attract more chip investment, despite warnings from US officials about high costs.

Vietnam has become an electronics manufacturing hub – a role that is growing as more US firms relocate from China – and is home to several chip designing software firms.

It is working on a strategy to attract investment in foundries, which focus on manufacturing chips.

ALSO SEE: Top Memory Chipmaker Gets $2 Billion From China’s ‘Big Fund’

Meetings with half a dozen US chip firms took place in recent weeks, including with fab operators, Vu Tu Thanh, head of the Vietnam office of the US-ASEAN Business Council, said. He declined to identify the firms because talks were still at a preliminary stage.

Talks with GlobalFoundries, PSMC

A chip executive, who declined to be identified because he was not allowed to talk to media, said talks with potential investors have involved US contract manufacturer GlobalFoundries and Taiwan’s PSMC.

The aim was to build Vietnam’s first fab, most likely for less advanced chips used in cars or for telecoms applications, the executive added.

The meetings followed an historic upgrade of formal ties between Vietnam and the US in September, when President Joe Biden visited Hanoi and the White House described the former foe as potentially a “critical player” in semiconductor global supply chains.

GlobalFoundries attended a restricted business summit during Biden’s visit after an invitation from the president himself, the company said, but has since shown no immediate interest in investing in Vietnam, a person familiar with the matter said.

“We do not comment on market rumours,” a GlobalFoundries spokesperson said when asked about subsequent contacts. PSMC did not reply to a request for comment.

Industry officials said meetings at this stage were mostly to test interest and discuss potential incentives and subsidies, including on power supplies, infrastructure and the availability of trained workforce.

The Vietnamese government has said it wants its first fab by the end of this decade and said on Monday that chip companies would benefit from “the highest incentives available in Vietnam”.

It may also support local firms such as state-owned tech company Viettel to build fabs with imported equipment, Hung Nguyen, senior program manager on supply chains at Hanoi’s University Vietnam, said.

Viettel did not reply to a request for comment.

$50-billion bet

However, Robert Li, vice-president of US Synopsys, a leading chip design firm with operations in Vietnam, urged the government to “think twice” before doling out subsidies to build fabs.

Speaking at “Vietnam Semiconductor Summit” in Hanoi on Sunday, he said building a foundry could cost as much as $50 billion, and would entail competing on subsidies with China, the US, South Korea and the European Union which have announced spending plans on chips between $50 and $150 billion each.

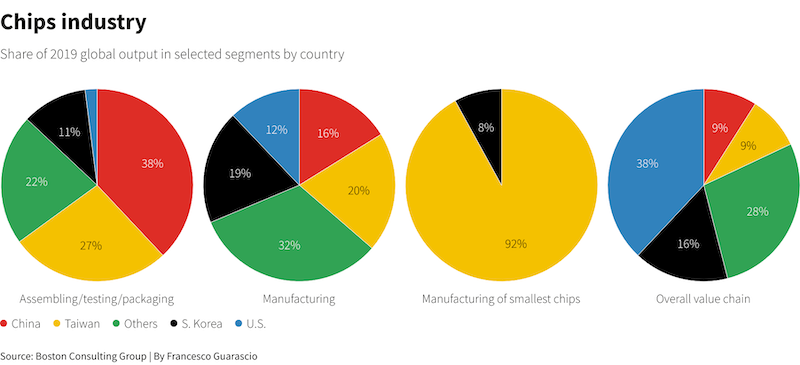

John Neuffer, president of the US Semiconductor Industry Association, at the same conference recommended the government focus on chip sectors where Vietnam was already strong, such as assembling, packaging and testing.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Vietnam Sees Foreign Investment Double in Factory Build Boom

Vietnam Tried to Hack US Lawmakers, CNN Reporters’ Phones – WP

China’s Trina Solar Eyeing Third Vietnam Plant After US Sanctions

Vietnam to Restart Giant Rare Earths Mine in Bid to Rival China

Seeking China Hedge, Top US Chip Firms to Join Biden in Vietnam