Another rare earth crisis may be looming as global supplies of the element yttrium have sunk due to China’s export restrictions.

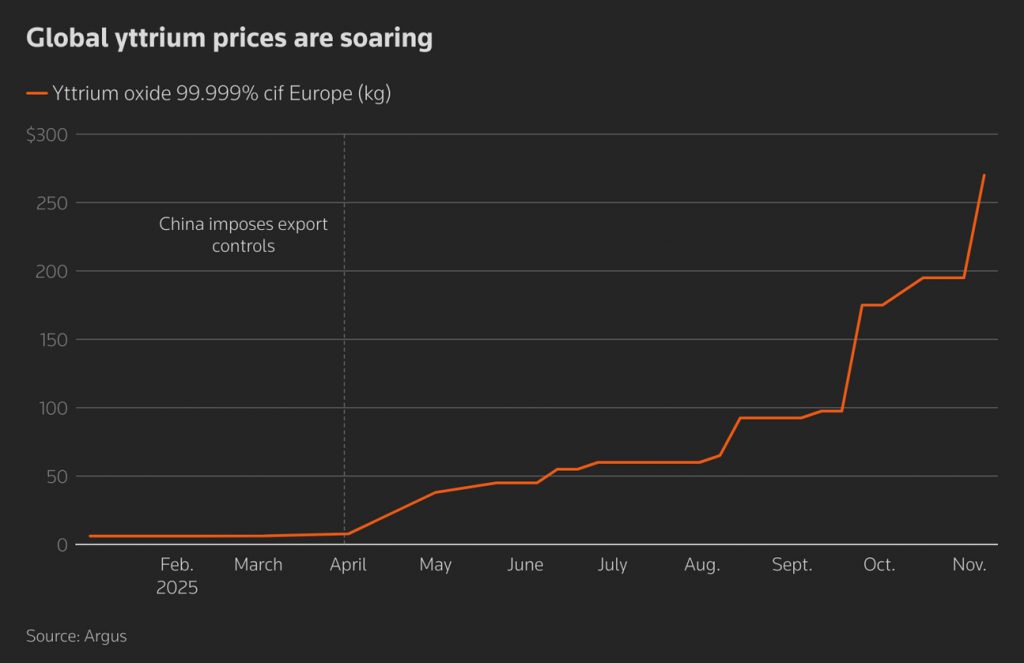

The price of yttrium has shot up by 4,400% since the start of this year, and there are now fears that the surge in costs and possible shortages could hit aerospace, energy and semiconductor production.

China, which is the main source of the element – used in speciality alloys found in engines, restricted exports along with six other rare earths in April in retaliation to tariffs imposed by the US.

ALSO SEE: US, Korea Reveal Details on Building Ships and Nuclear Subs

Rare earths dispute not fully resolved

While a high-stakes meeting last month between US President Donald Trump and Chinese President Xi Jinping had raised industry hopes for a more reliable flow of critical materials, the dispute has not been fully resolved.

So, while China has since paused some of its rare earth restrictions, its April controls remain in place, raising questions about access for US industry in the absence of a comprehensive deal between Washington and Beijing.

The controls, which require exporters to obtain licences from Beijing, have made it hard to get yttrium out of China, according to four rare earth traders and Argus analyst Ellie Saklatvla.

The licences issued thus far have been for small shipments and there are still long delays getting material delivered, Saklatvla said.

‘Scramble for yttrium’

“China’s export controls have undoubtedly prompted a scramble for yttrium that continues several months on,” Saklatvla said.

European prices for yttrium oxide, used to make heat-shield coatings, are up 4,400% since January at $270 a kilogram, Argus data showed. Chinese prices, around $7 per kilogram, are 16% higher over the period but falling, according to the data.

US trade group Aerospace Industries Association said yttrium was essential to the world’s most advanced jet engines and it was working with Washington to expand domestic supply.

“At present, our supply chain depends heavily on imports from China — a reliance that has contributed to rising costs amid growing shortages,” Dak Hardwick, AIA’s vice president of international affairs, said.

Shortages are also a major concern for the semiconductor industry, where yttrium is used as a protective coating and insulator, two industry sources said. One described it as a “9 out of 10” in severity.

Richard Thurston, CEO of Great Lakes Semiconductor, said yttrium shortages would lengthen production times, raise costs and make equipment less efficient, though immediate shutdowns were unlikely. Problems are likely to be worse for the larger producers, he added.

“Shortages will increasingly become a real chokepoint,” he said.

In addition to aircraft engines and semiconductors, yttrium coatings are used in gas plants to protect turbine blades from high temperatures.

Major producer Mitsubishi Heavy said its gas turbine business faced no issues at present from China’s expanded rare earth export controls.

Siemens Energy CEO Christian Bruch said the company was working to diversify itself away from Chinese rare earths in general, but it would take time to do that.

“So far, we have not seen any direct impact on our supply chains. We are monitoring the situation with concern, but it is still manageable for us at the moment.”

GE Vernova did not respond to questions.

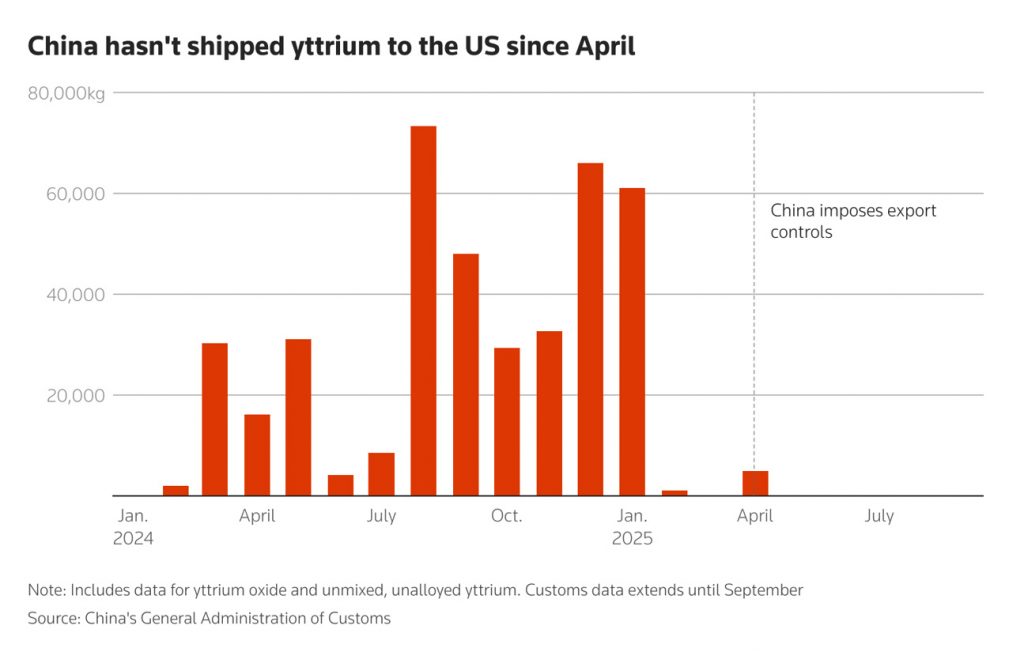

Exports to US stopped in April

China’s yttrium exports to the US began slowing early this year before stopping altogether after the April controls, customs data through September showed.

Exports to the rest of the world are down about 30% over the same period, but supplies are unlikely to flow to the US because companies or traders are concerned China could restrict their own shipments in retaliation, said a yttrium trader.

The yttrium market is opaque and information about stocks outside China varies. Six industry sources gave estimates ranging from one to 12 months of consumption. Several said reserves likely varied widely by company.

A rare earth trader, who declined to be named due to the sensitivity of the matter, told Reuters that their stocks had fallen to 5 tons from 200 tons. Another said they were out of stock.

Two aerospace industry sources said yttrium prices were rising, but the shortfall had not disrupted production.

Mark Burns, president of US Gulfstream Aerospace, told Reuters that the business jet maker had limited exposure to yttrium.

“I have heard the discussion, but only on the perimeter. Nothing that impacts our deliveries at this point,” he said.

‘Manipulating prices for decades’

The US imports all of its yttrium, with 93% coming directly from China and the remainder made from material that was first processed in China, the US Geological Survey said in a report in January.

That could soon change thanks to ReElement Technologies, based in Indiana, which plans to start producing yttrium oxide at a rate of 200 tons per year, or about 16 tons a month, by December, before rising to 400 tons per year by March, CEO Ryan Jensen told Reuters.

The US imported an estimated 470 tons of yttrium products in 2024, according to the USGS.

US lawmakers criticised China again last week, saying it had sought to manipulate critical minerals prices for decades, using its control as an economic weapon to expand its manufacturing sector and its geopolitical influence.

The allegations, in a 50-page report from the bipartisan US House Select Committee on China and reviewed by Reuters, add to a series of missives from Washington criticizing Beijing’s sway in critical minerals markets.

It alleges that China’s role as the world’s largest processor of many critical minerals has made it nearly impossible for the United States and allies to determine the true price of certain metals, including rare earths.

However, US Treasury Secretary Scott Bessent said on Sunday that a rare earths deal between the US and China will “hopefully” be done by late this month.

Bessent’s comments follow a framework agreement announced last month in which Washington agreed not to impose 100% tariffs on Chinese imports and China would hold off on an export licensing regime for crucial rare earths minerals and magnets.

“I am confident that post our meeting in Korea between the two leaders, President Trump, President Xi (Jinping), that China will honour their agreements,” Bessent told Fox News’s ‘Sunday Morning Futures’ programme.

- Reuters with additional input and editing by Jim Pollard

ALSO SEE:

Trump Cuts US Tariffs to 47%, Xi Vows to Ease Rare Earth Curbs

Trump Taps Southeast Asia For Rare Earths Amid China Uncertainty

US, Australia Sign $8.5bn Deal on Rare Earth, Gallium Projects

China Making Exports Of Rare Earth Magnets ‘Increasingly Difficult’

US May ‘Extend Tariff Truce’ If China Delays New Rare Earth Rule

China Stops Most Antimony Exports But Rare Earth Sales to US Soar

China Did Not Agree to Military Use of Rare Earths, US Says

Carmakers Stressed by China’s Curbs on Critical Mineral Exports

China Export Curbs on Rare Earth Magnets: a Trade War Weapon

China Sets up Tracking System to Trace Its Rare Earth Magnets

China’s Critical Minerals Blockade Risks Global Chip Shortage