Alibaba shares shot up on Wednesday after the company revealed moves to double down on artificial intelligence, despite tough competition from local rivals such as DeepSeek and Tencent.

The Chinese tech giant, which is positioning AI as a core business alongside its traditional e-commerce operation, announced a partnership with Nvidia, along with global data centre expansion plans and new AI products.

There’s also an ‘x’ factor spicing up investors’ enthusiasm – the return of company founder and tech legend Jack Ma, which we’ll explain below.

ALSO SEE: Australia’s Central Bank Tells ASX to Fix Stock Settlement System

Hong Kong-listed shares of the company rose by nearly 10% to a four-year high, as investors welcomed the moves. And that was followed by Alibaba’s US-listed shares also jumping close to 10% in pre-market trading.

“The speed of AI industry development has far exceeded our expectations, and the industry’s demand for AI infrastructure has also far exceeded our expectations,” Alibaba CEO Eddie Wu said at its annual Apsara Conference on Wednesday.

Wu said Alibaba would increase spending further without specifying amounts. Earlier this year, the company announced plans to invest 380 billion yuan ($53 billion) in AI-related infrastructure over the next three years.

Data synthesis, 91 data centres

At the conference, Alibaba said it would partner with Nvidia to develop physical AI capabilities such as data synthesis, model training, environmental simulation and validation testing.

The company also announced plans to open its first data centres in Brazil, France and the Netherlands, with additional facilities planned for Mexico, Japan, South Korea, Malaysia and Dubai over the coming year. This will expand Alibaba’s current network of 91 data centres across 29 regions worldwide.

It did not say whether the new data centres would be powered by Nvidia chips – and that’s likely because China’s regulators began warning its tech giants last week against buying Nvidia’s AI chips.

Beijing is anxious to boost domestic chip production, particularly its AI chips, to reduce reliance on foreign tech and gain greater control over its supply chain.

“Alibaba’s 2025 Apsara Conference demonstrated strong results from years of AI investment,” Lian Jye Su, chief analyst at technology research firm Omdia, said.

“The overseas data centre investments will help expand Alibaba’s influence among international AI developers and enterprise users.”

Its expansion plan and the partnership with the US chipmaker come just days after Nvidia, whose must-have chips are powering a global AI boom, announced a deal to invest up to $100 billion in OpenAI and supply it with data centre chips.

Largest AI language model

Alibaba also unveiled on Wednesday its largest-ever AI language model, the Qwen3-Max.

The model contains more than 1 trillion parameters, or variables that determine how an AI system processes information, and shows particular strength in code generation and autonomous agent capabilities, Zhou Jingren, chief technology officer at Alibaba Cloud, said at the conference.

Autonomous agent capabilities mean the AI system requires fewer human prompts than a chatbot like ChatGPT, and can make decisions and take action independently towards a goal set by the human user.

Alibaba cited third-party benchmarks, such as Tau2-Bench, saying the model outperformed rival products, including Anthropic’s Claude and DeepSeek-V3.1 in certain metrics.

The company released the Qwen3 model in April.

Additional AI products unveiled on Wednesday included Qwen3-Omni, a multimodal, immersive system useful for virtual and augmented reality applications such as smart glasses and intelligent cockpits.

Last month, Alibaba reported strong quarterly results, driven by its cloud business, whose revenue surged 26%, highlighting the company’s progress in monetising AI services.

Jack’s back

The other important factor behind Alibaba’s stock rise is the return of its famous founder, Jack Ma.

As most people know, Alibaba hit rocky water after Ma gave a notorious speech in October 2020 that criticised Chinese regulators for having a ‘pawnshop mentality.’

That had an immediate and prolonged impact. It led to the cancellation of a massive IPO planned by its subsidiary Ant Group, a $2.75 billion fine for abuse of its market position, a major restructure of Ant’s business, and Ma stepping down to lie low in Japan.

Over the next few years, Chinese tech giants lost more than a trillion dollars in market value as China’s communist leadership undertook a dramatic crackdown to rein in many of the country’s most powerful private firms.

For Alibaba, that lasted till about September 2024, when Beijing finally said the e-commerce giant’s three-year period of “rectification” had ended.

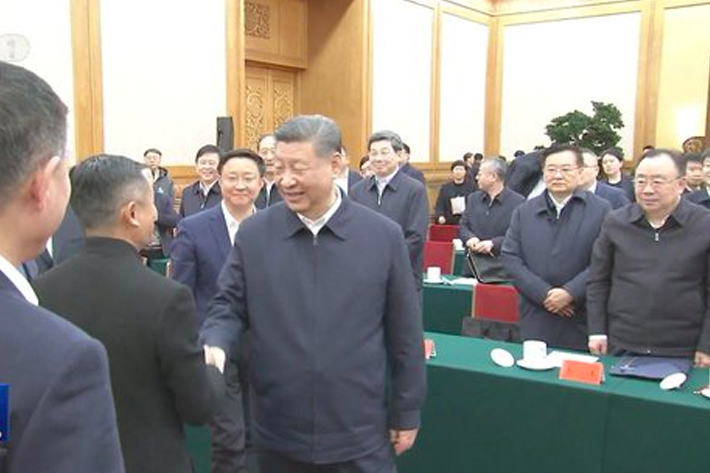

In February this year, Ma was among tech executives who met President Xi in Beijing, in a meeting that showed the regulatory crackdown was over and that the country wanted to move in a more business-friendly direction.

And over the past week, there have been reports that Jack Ma, China’s most famous tech leader – a multi-billionaire seen as having the golden touch – is making a comeback at Alibaba, giving speeches at its campuses and directly involved in strategic decisions.

His return is said to have lifted morale and encouraged speculation that he could help “make Alibaba great again.” So, that is clearly another reason why their shares have risen by such a healthy margin.

In late 2017, Alibaba was the sixth biggest company in the world, but last week its market cap was about 360 in the global ranking. But the company is reportedly back as the number-one stock, with the greatest weighting on the Hong Kong market.

He was a smart and popular man; little wonder that people are returning to get a slice of the action.

- Jim Pollard with Reuters

ALSO SEE:

China’s Meituan, Alibaba Enjoy a Boom in ‘Instant Retail’ Deliveries

Trump ‘Doesn’t Want’ Apple to Tie-Up With Alibaba AI in China

DeepSeek Sharing User Data With China Military, Intelligence: US

Nvidia to Build AI Supercomputer And New Office in Taiwan

DeepSeek Cut US-China AI Gap to Three Months, AI Expert Says

Curbing Chinese Access to US AI Models May be Hard: Analysts

Meta Set up ‘War Rooms’ to Study DeepSeek AI Model – Fortune

DeepSeek Breakthrough or Theft? US Probes ‘AI Data Breach’

Nvidia Looking Into How Its Chips Ended Up In China

China Tech Giants ‘Ordered $16 Billion of New Nvidia Chips’

SEC Adds Alibaba to List of Companies Facing Delisting

Beijing’s Crackdown Wiped $1.1 Trillion Off Chinese Big Tech