(ATF) German carmaker BMW is planning big investments in electric cars, as well as simplifying its vehicle portfolio, and raising its share in its joint venture in China from 50% to 75% in 2022.

BMW’s chief financial officer Nicolas Peter told Reuters that the moves should help push the iconic luxury automotive manufacturer back to its pre-pandemic operating margin target of 8% to 10%.

Peter said orders had fallen because of the latest pandemic-related lockdowns, but added: “If activity starts again after the middle of February, we should be able to deliver a reasonable first quarter.”

Escalating restrictions in Germany and other eurozone nations deciding to tackle the coronavirus pandemic have significantly slowed economic activity, fuelling fears that the bloc faces a double-dip recession, but Peter cited a Brexit deal between the European Union and the UK as one sign of improving market conditions.

“We’re not talking about far away in the future, but it is a goal that we’re looking at systematically in the short term,” Peter said during an interview at BMW’s Munich headquarters. The company will publish its 2021 margin target in March.

A surge in premium car sales in China, the world’s largest car market, provided much-needed help for BMW’s business and it should report a 2020 operating margin of between 2% and 3%, Peter said.

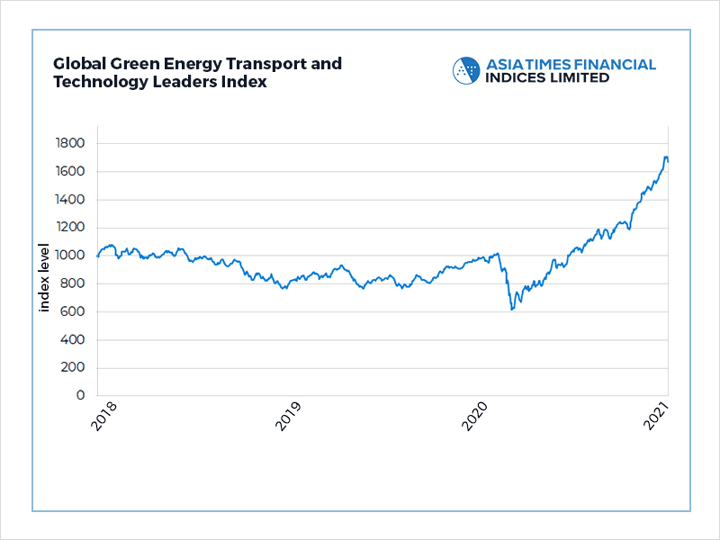

The Global Green Energy Transport and Technology Leaders Index created by Asia Times Financial in collaboration with ALLINDEX, is a benchmark that tracks shares of leaders in electric vehicle and renewable energy production and storage businesses.

Changing car line-ups from petrol and diesel to electric vehicles (EVs) to meet emissions targets in China and Europe and compete with US electric carmaker Tesla, is hugely expensive, and was a driving factor in the recent merger of PSA and Fiat Chrysler to form Stellantis, the world’s fourth-largest carmaker.

‘WE CAN MAKE IT ALONE’

Further consolidation is expected as carmakers struggle with electrification and investing in self-driving technology, but Peter said BMW could handle the transition. “We are very confident we can make it alone,” he said.

EVs are expensive to develop and still account for a small portion of sales, thus are less profitable for BMW, Peter said. “That’s why investment is so important,” he said. “We have to find ways to get to a different cost level, especially with cells and batteries.”

BMW is embarking on a push to cut complexity – reducing engine variants and options for different vehicles, scrapping features customers don’t use, plus overhauling software to focus on a simpler, more efficient way of building vehicles. In 2020, BMW’s global sales of EVs rose 31.8% over 2019 and says it plans to double its sales of fully-electric vehicles this year.

Traditionally, BMW has considered Germany’s other carmakers as its rivals, but Peter said increasingly it is looking to Tesla and companies like China’s Nio – with its focus on interaction between car and driver – for inspiration. He said two-thirds of Chinese consumers said in polls that they would switch to other brands and products if they provide a better digital experience.

With reporting by Reuters