Concerns mounted about a deepening liquidity crisis in the Chinese property sector on Wednesday ahead of a deadline for cash-strapped China Evergrande Group to make offshore bond coupon payments.

Evergrande, the world’s most indebted developer, has been stumbling from deadline to deadline in recent weeks as it grapples with more than $300 billion in liabilities, $19 billion of which are international market bonds.

The group has not defaulted on any of its offshore debt obligations, but a further $148 million in overdue bond payments had to be made on Wednesday. And it has coupon payments due on December 28 totalling more than $255 million on its June 2023 and 2025 bonds.

Beijing has been prodding government-owned firms and state-backed property developers to purchase some of Evergrande’s assets to try to control the fall.

Worries over the potential fallout from Evergrande roiled China’s property sector on Tuesday, slamming the bonds of real estate companies amid worries that the crisis could spread to other markets.

US Fed Warning

The slide in bond prices came just hours after the US Federal Reserve warned China’s troubled property sector could pose global risks.

Underlining the liquidity squeeze, some real estate firms disclosed plans to issue debt in the inter-bank market at a meeting with China’s inter-bank bond market regulator, the Securities Times reported on Wednesday.

China’s property woes rattled global markets in September and October. There was a brief lull in mid-October after Beijing tried to reassure markets the crisis would not be allowed to spiral out of control, but concerns have resurfaced.

Rising concern that the developers’ woes spreading to other sectors was visible on Wednesday as the spread, or risk premium, between lower risk, investment grade Chinese firms and US Treasuries widened to a more than five-month high.

Founded in Guangzhou in 1996, Evergrande epitomised a freewheeling era of borrowing and building. But that business model has been scuttled by hundreds of new rules designed to curb developers’ debt frenzy and promote affordable housing.

Any prospect of Evergrande’s demise raises questions over more than 1,300 real estate projects it has in some 280 cities. Bank exposure to developers is also extensive.

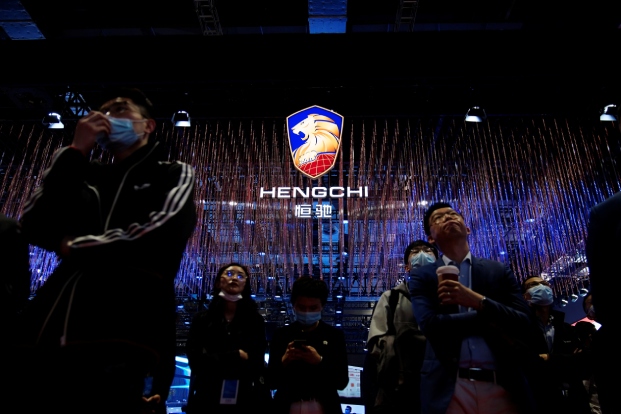

EV Unit Share Sale Plan

Despite the stifling debt woes of Evergrande, its electric vehicles (EV) unit is pushing ahead with its business plan. The unit is seeking Chinese regulatory approval to sell its inaugural Hengchi 5 sport-utility vehicles.

China Evergrande New Energy Vehicle Group Ltd plans to sell HK$500 million ($64 million) worth of shares to fund production of new energy cars.

The unit plans to sell 174.83 million new shares, or 1.76% of the enlarged share capital, at HK$2.86 per share in a top-up placement, it said in a filing to the Hong Kong bourse.

The new shares will be sold at HK$2.86 apiece, representing a 19.89% discount to Tuesday’s close of HK$3.57 each, to its controlling shareholder Evergrande Health Industry Holdings Ltd.

The controlling shareholder will buy the new shares on completion of the sale of the same amount of existing shares at the same price to third-party investors.

China Evergrande New Energy Vehicle said the move was aimed at paving the way for Hengchi new-energy vehicles to start production.

The electric-vehicles unit is seeking Chinese regulatory approval to sell its inaugural Hengchi 5 sport-utility vehicles (SUVs), as the embattled company vows to start making cars early next year. The directors had considered various options of raising funds, it said.

Shares in Evergrande were little changed from previous close on Wednesday morning, while the EV unit was up 1.4%.

- Reuters with additional editing by Jim Pollard

This report was updated on November 10.

ALSO READ:

Ailing Evergrande’s EV Unit Seeks Green Light for Model Launch

China Evergrande’s Auto Unit Offloads EV-maker Protean

China Evergrande EV Unit Shares Jump On Business Shift